FTSE 100 close: Bunzl and Rolls Royce help London index shrug off interest rate and inflation woes

London’s FTSE 100 opened the week in positive territory today as investors appeared to shrug off concerns about inflation and how forcefully central banks would respond to it.

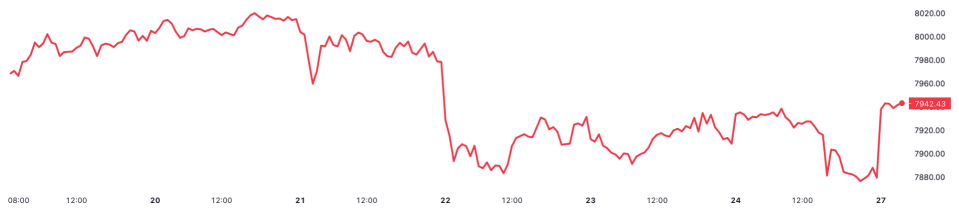

The capital’s premier index jumped 0.72 per cent to 7,935.12 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, gained around one per cent to close at 19,886.10 points.

Last week stock markets around the globe notched some of their worst performances of the year, as traders expressed concern that the US Federal Reserve and Bank of England would be forced to keep rates high to prevent inflation embedding into their respective economies.

“The FTSE 100 made a strong start to the week as investors shrugged off the inflation and interest rate concerns which bedevilled markets last week,” Russ Mould, investment director at broker AJ Bell, said.

But a string of decent corporate results today offset those concerns.

FTSE 100 has pared back some of last week’s losses

Outsourcer Bunzl rose to the top of the FTSE 100 during the morning session, adding nearly three per cent, after it reported a jump in profits this morning. It eventually finished up a shade under 2.5 per cent.

Aerospace giant Rolls-Royce topped the premier index as investors continued to pile into the stock after it released a decent set of earnings at the back end of last week. It advanced around six per cent today.

Ticket booking app Trainline helped the mid-cap FTSE 250 get off to a decent start to the week as well, climbing more than five per cent.

A slew of speeches from Bank of England officials will dominate the economic and market agenda this week, raising the risk of interest rate anxiety returning to spike stocks.

Governor Andrew Bailey delivers remarks on Wednesday, while chief economist Huw Pill is poised to provide an update on his thinking tomorrow.

The pound was broadly flat against the US dollar today.

Oil prices nudged around 0.3 per cent higher.