Exclusive: Octopus Energy urges rival Centrica to work with them to protect consumers

Octopus Energy (Octopus) wants to work together with rival Centrica and market regulator Ofgem to protect households, as it continues to raise doubts over proposals to ringfence consumer credit balances.

The UK’s fifth-largest supplier, which is home to over three million customers, is wary of the industry being bounced into hasty decisions to reform the market following a historic crisis.

It has also repeated warnings that ringfencing the entirety of customer credit balances could add as much as £30 per year to household energy bills – which are already at record highs.

By contrast, Octopus argues its counter-proposals for a travel insurance model would only add £5 per year to energy bills.

An Octopus spokesperson told City A.M.: “We’re in an energy crisis and everyone should be focused on bringing bills down – so it seems crazy to propose a “fix” that costs six times more than the problem, which is why Octopus urge the regulator and industry to find a better value solution. We’d love to work together with British Gas to find a better way.”

Octopus’s suggestions are based on the Air Travel Organiser’s Licence (ATOL) scheme, a compensation programme for customers of travel organisers in the UK – which is managed by the Civil Aviation Authority.

The renewables-only supplier also pointed to a new survey from polling group YouGov, which revealed only 15 per cent of customers supported the idea of ringfencing credit balances in a separate account if it added costs to their energy bill.

Octopus’ call for a more collaborative process follows months of disagreement within the energy sector, with firms at loggerheads over ringfencing proposals.

Centrica, which owns British Gas, reignited calls for ringfencing last week, with the energy firm’s boss Chris O’Shea warning that regulations around ringfencing had to evolve, or the industry risked another market crisis.

He said: “Regulation on this needs to change or we run the risk of history repeating itself. Despite the many failures, wealthy private energy company owners are still using customer money as free working capital today. If they are successful, they become even wealthier, and if they lose, UK consumers picks up the tab.”

British Gas is the UK’s largest energy supplier, home to over nine million customers.

It has been ringfencing customer credit balances as a matter of company policy since March earlier this year.

Centrica warns another crisis could happen without reforms

Ringfencing refers to Ofgem proposals for energy firms to hold consumer credit balances in a special account, with the funds only spent on securing energy supplies rather than being used to fund commercial operations.

Customers typically overpay for their energy use in the summer months, and then that credit is used over the winter to keep direct debits consistent throughout the year.

However, the lethal combination of soaring wholesale costs, the constraints of the price cap, poor management and insufficient hedging has seen 30 energy firms collapse – directly affecting over four million customers.

Centrica has estimated, based on requests for information from Ofgem, that £400m of customer credit balances have been lost from collapsed suppliers during the current crisis.

O’Shea said: “We think this is wrong and as a responsible supplier we have already ringfenced our customers’ money. Customers tell us when they pay up front for their energy, they are trusting their supplier to look after their hard-earned money.”

As part of its submission to Ofgem, Centrica commissioned research from economic consultants Oxera into ringfencing and compared them to Octopus’ ATOL proposals.

Oxera determined that “compulsory co-insurance models, such as the ATOL in transport and the FSCS in financial services … would not be appropriate for dealing with the specific market failures of the UK energy supply market.”

Commenting on the findings, O’Shea said: “Economists have looked at Octopus’ idea of an ATOL style insurance type approach and it doesn’t solve any of the problems in the market. Their idea would allow companies to continue to operate risky business models and dip into customers deposits as a free overdraft facility.”

Consumer rights charity Citizens Advice has forecast that the market carnage will add £164 per year on to energy bills this winter, while the National Audit Office estimates households face a £2.7bn clean-up bill from the supplier of last resort process – which ferried 2.3m customers from fallen firms to surviving suppliers.

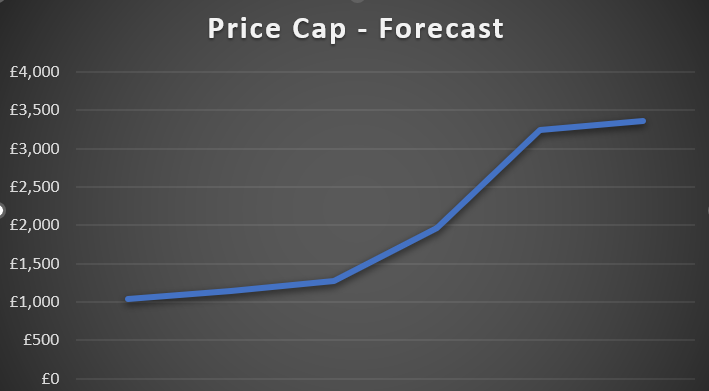

Meanwhile, energy specialist Cornwall Insight has forecast the price cap will peak at £3,363 per year this January, during the coldest month of the year when energy demand is at its highest.

Ofgem unveils plans to fix energy market

In recent months, Ofgem announced a bevy of reforms to clean up the energy sector, including financial stress tests and fit and proper person rules, alongside plans for a quarterly price cap.

It has also settled on a 30 per cent limit for ringfencing, and initiated a further industry consultation on the issue.

While Centrica backs ringfencing, the proposal has been contested by multiple energy firms, concerned it would drive up bills and stifle innovation.

Octopus has previously described Centrica’s proposals as “financially illiterate.”

The company’s chief executive Greg Jackson warned last month that ringfencing runs the risk of “handing the market back to turgid incumbents” through over-burdening the energy sector with regulations.

He urged the regulator not to give in to “pressure from archaic companies, whose proposals will only drive up bills and supplier profits.”

In his view, poor management and insufficient hedging were the key drivers of the market crisis, rather than ringfencing.

This outlook was shared by rival firms Good Energy and So Energy, while City A.M. understands Ovo Energy has raised concerns over ringfencing proposals.

| Ringfencing – In Favour | Ringfencing – Opposed |

| Ofgem | Octopus Energy |

| Centrica – British Gas owner | Good Energy |

| E.ON UK | So Energy |

| Utilita Energy | Ovo Energy (City A.M. understands) |

Earlier this year, Good Energy’s chief executive Nigel Pocklington, told City A.M. that Ofgem’s proposal to reform the energy market would benefit established players and hamper challenger firms with smaller reserves of revenue.

He said: “If we’re not careful, we’ll go back to a world of four large energy companies, which is where we came from 20-plus years ago.”

So Energy co-founder Simon Oscroft warned that higher costs to entry could stifle innovation.

Oscroft said: “I struggle to see how a new supplier could come in unless they have an extreme amount of funding and a huge parent above it. So, we will see less innovation as a result of many of these changes.”

By contrast, E.ON UK and Utilita Energy (Utilita) both support Centrica’s position and back ringfencing.

Utilita boss Bill Bullen described ringfencing as “the least worst option” while E.ON UK’s chief executive Michael Lewis considered ringfencing vital to cleaning up the energy sector.

He said: “Where we need to get to is a market that has well capitalised, well risk-managed companies that are there for the long run and aren’t going to leave a trail of destruction when they fail.”

However, Centrica and Octopus have been the most vocal suppliers over the proposals – with both making several public comments on the potential reform.

The two firms were also competing to buy Bulb Energy, however City A.M. understands Octopus is the last remaining bidder for the de-facto nationalised firm.

City A.M. has approached Ofgem for comment.