Ethereum exceeds $4,000 as Dencun day lands

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

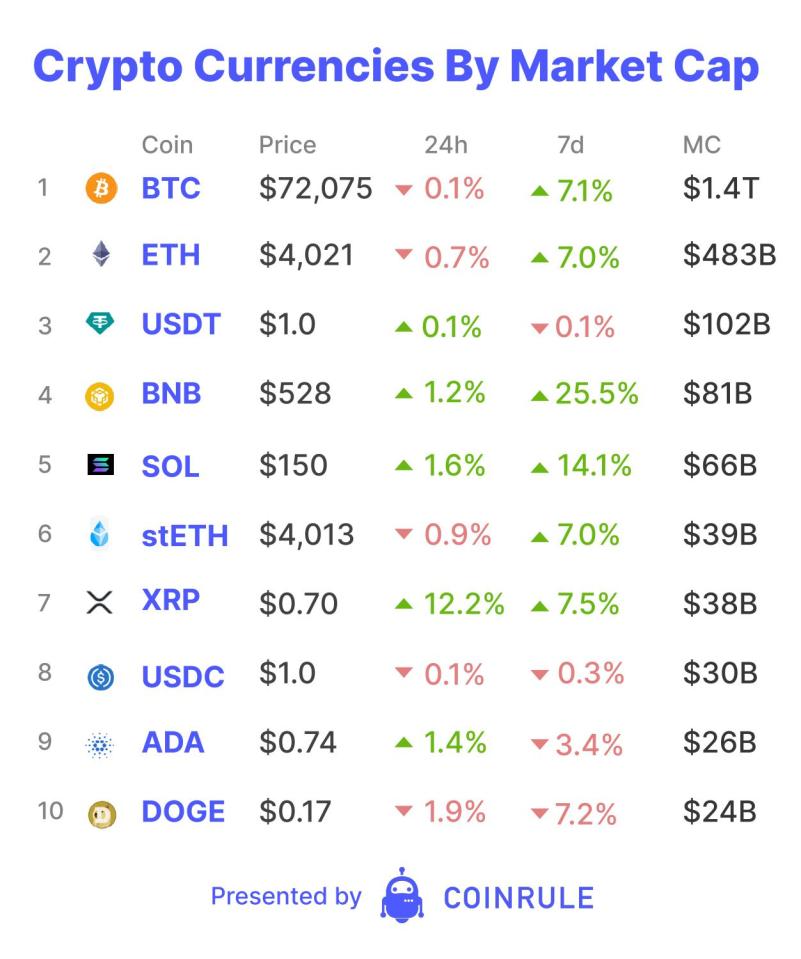

Today is the day of the long-awaited Ethereum Dencun upgrade. Dencun will reduce Layer 2 transaction fees and involve “blobs” and “Proto-dank sharding.” On Monday, Ethereum punched above $4,000 for the first time since December 2021. This new cycle high has happened even in the face of the perceived diminishing likelihood of an Ethereum spot exchange-traded fund (ETF) being approved by the SEC.

Over the past week, the probability of the Ethereum ETF being approved has been declining even as the asset has continued to soar. Eric Balchunas, Bloomberg’s senior ETF analyst, estimates the odds of the 23 May deadline being approved now stand at 30%. This is a decline from his 70% January estimate. Balchunas’s pessimism, he claims, stems from the lack of comments and interaction from the SEC regarding the filings so far. The Bitcoin ETFs took multiple edits and refilings along with meetings with the regulator to get the process over the finish line. In an attempt to aid the process, Coinbase met last week with the regulator to advocate for the spot ETF. They demonstrated the potential lack of manipulation and the strong correlation to the futures ETF. However, we are still 71 days away from the 23 May deadline. This is a lifetime in crypto, but maybe not in the traditional finance world where filings, regulatory bureaucracy and politics are involved.

Regardless of the ETF’s approval, Ethereum’s fundamentals are improving each day. According to The Block, active addresses have increased to over 500,000 – their highest since December 2022. Last week also saw Ethereum’s revenue breach $200 million for the first time since May 2022. Today’s Dencun Upgrade also aims to make layer 2s more usable. The Block also estimates the Dencun Upgrade will considerably lower DEX swap gas fees. Aribitrum’s fees will be reduced from $2.02 to $0.4 and Base’s will be reduced significantly from $0.58 to $0.01. The declining costs will potentially drive more cost-conscious participants onto Ethereum Layer 2s and away from Ethereum’s arch-nemesis – Solana. With both the overall crypto market outlook and Ethereum fundamentals improving, maybe denial of the Ethereum ETF wouldn’t be the end of the world for the asset. 71 sleeps to go.