Espirito Santo hit by parents’ debt troubles

TRADING on Banco Espirito Santo’s shares was suspended yesterday after its stock dived 17.89 per cent.

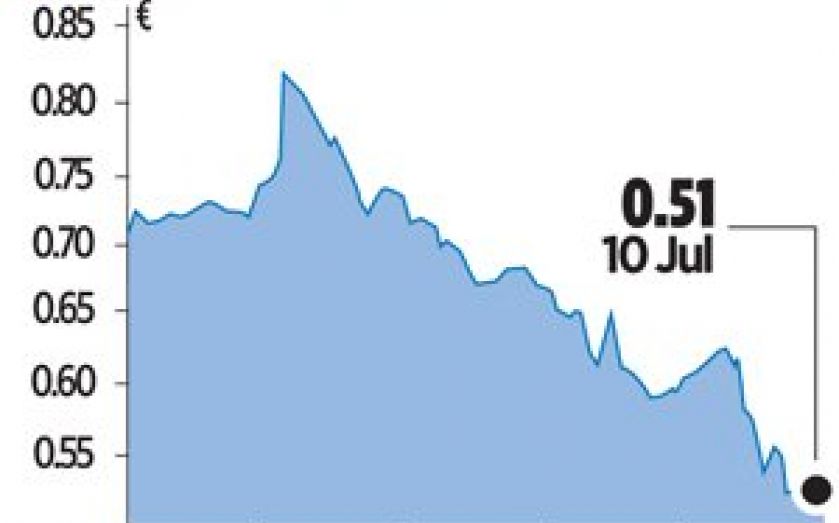

The shares were previously suspended on 20 June, after another precipitous fall. After a series of sharp drops its price now stands at €0.514, down 53 per cent in just one month.

The collapse in its stock represents a very sharp turnaround in the bank’s fortunes – in May it raised more than €1bn (£794m) from shareholders who were happy to back the bank.

Questions had been raised about the bank’s financial reporting late last year, and market concerns have grown rapidly since.

The latest warning sign is its parent, Espirito Santo Financial Group, failing to pay the interest on its debts.

The group is getting a new chairman, Vitor Bento, to replace Ricardo Espirito Santo Salgado who is leaving at an extraordinary general meeting at the end of this month.

The wider group was downgraded this week by credit ratings agency Moody’s. It had its rating cut from B2 to Caa2, a three-notch downgrade.

Analysts at the agency also complained the finance group is opaque and it is relatively difficult for Moody’s to obtain the information it needs to assess the firm’s financial health.

“Those concerns [over its investments] are magnified by the lack of transparency around the financial position of Espirito Santo International and the lack of information from the Espirito Santo group on the extent of intra-group linkages,” said Moody’s.