EDF in fresh talks over £12bn BE bid

French power giant EDF is edging closer to a deal to buy British Energy, the nuclear generator, in the wake of fresh talks with some of the UK firm’s largest investors.

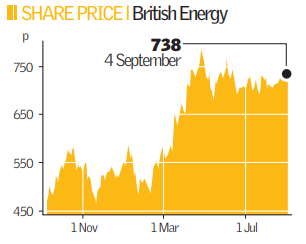

The French utility, whose £12bn bid was rejected by British Energy’s shareholders in July, has been in productive talks with among others Invesco Perpetual, the second-biggest shareholder with 15 per cent of British Energy.

One source close to the talks described them as having more “momentum” than at any time since the first set of negotiations collapsed over price earlier in the summer.

However, another source added talks were at a delicate stage and could fail.

EDF is understood to be offering essentially the same deal, but since the recent sharp fall in the oil price appears to have convinced some shareholders to be more flexible in their demands on price. Brent crude at $104 (£52) is 25 per cent down on when the original deal fell through at the end of July. Unlike Invesco, M&G, British Energy’s third-largest investor with 7 per cent of the firm’s shares, remains adamant that it has had no conversations with EDF. M&G is understood to favour a merger with British Gasowner Centrica.

This option remains unlikely as the British government, which owns 32.5 per cent of the nuclear generator has repeatedly said it favours a sale to EDF which has a lot of experience of building reactors in France. The government wants British Energy to lead the country’s new nuclear building programme.

EDF appears to be hoping to clinch a deal in the next two weeks, ahead of a board meeting on 17 September.