Coronavirus squeezes mutual funds causing record fund outflows

The coronavirus-induced market slump caused record fund outflows last month, with fixed income funds particularly badly hit.

Investors redeemed a record £3.1bn of their fund holdings in March, according to global funds network Calastone. It represents almost three times the outflows recorded in the previous worst month in June 2016 when the UK voted to leave the EU.

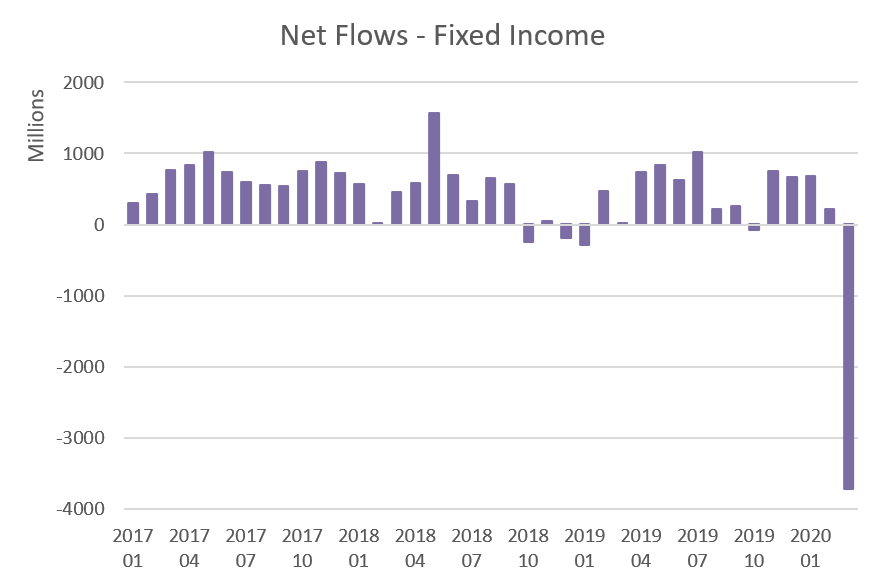

Investors flee fixed income funds

Fixed income funds were badly hit in March as the coronavirus crisis worsened. It faced an unprecedented £3.7bn of capital leaving the sector.

Redemptions were 13 times more than in January 2019, its previous worst month, wiping out accumulated inflows from the preceding eight months.

It came as investors reacted to widening yield spreads. A focus on credit quality highlighted risks that weak sovereign borrowers and corporates with overstated balance sheets may find debt unsustainable.

Calastone’s fund flow index on fixed income funds dropped to an unprecedented 30.4, meaning selling activity was more than twice as large as buying.

Edward Glyn, Calastone’s head of global markets, said: “The temporary loss of fixed income as a safe-haven asset class to counterbalance some of the huge losses in equity markets left investors with little option but to ride it out or park their money in cash or cash-equivalents like money market funds.”

Money market funds saw £854m of inflows.

Sign up to City A.M.’s Midday Update newsletter, delivered to your inbox every lunchtime

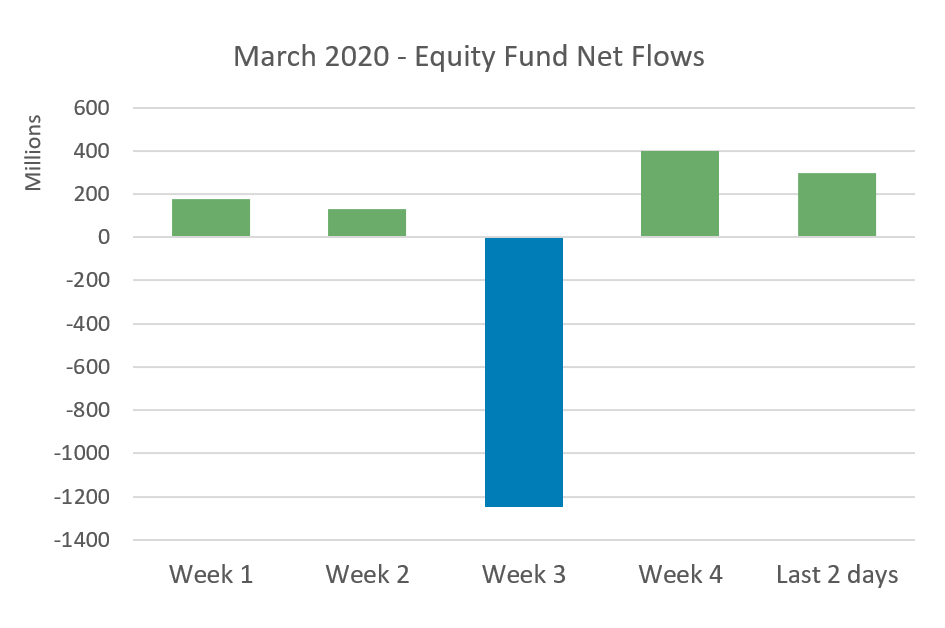

UK equity funds were the big winners

UK equity funds fared surprisingly well, with small outflows given the month of market turmoil.

Stocks were in free-fall for most of March, dropping 25 per cent to their lowest point before partially rebounding.

Given the coronavirus uncertainty, UK equity funds may have expected to bear the brunt, but they enjoyed the second-largest inflows in four years.

There was a huge divergence between passive and active funds. Passive funds saw record inflows of £1.4bn, in stark contrast to active funds which suffered their second-worst month on record, shedding £1.7bn.

The contrast can be partially explained by long-term trends driving the growth of index investing and the “hard anchor of monthly direct debits”. But Glyn said “these factors aren’t enough on their own to account for the huge disparity in March.”

“It seems investors attempting to catch market troughs may simply be focusing on timing and just relying on the index to do the rest. But in fact, active managers tend to do rather well in difficult times for stock markets so the big outflows from that segment at a time of such big inflows to passive funds are a little surprising.”

Real estate fund managers gate funds

Fund managers gated real estate funds two-thirds of the way through March after independent valuers said they could not reliably value assets.

The real estate funds shed £115m in March before being gated after valuers CBRE and Knight Frank introduced material valuation uncertainty.

Kames Capital was the first to suspend its property fund in March, and was quickly followed by Janus Henderson and Columbia Threadneedle.

Legal & General and Aviva Investors also gated their funds after their independent valuer, Knight Frank, cast uncertainty over their assets. Knight Frank also values M&G Investments, which suspended its fund in December.

BMO and Aberdeen Standard Investments also gated funds.

Get the news as it happens by following City A.M. on Twitter.