China’s central bank governor plays down fears over currency regime

The governor of China’s central bank has downplayed fears over the country's dwindling level of foreign exchange reserves, saying there is no reason for them to fall to dangerously low levels.

Zhou Xiaochuan, governor of the People’s Bank of China, blamed “speculative forces” for attacking the value of the yuan.

China's stock market will open tomorrow after closing for a week-long holiday. Last week's global stock market rout may be felt on opening.

Read more: What a week: Over $1 trillion wiped off global stock markets

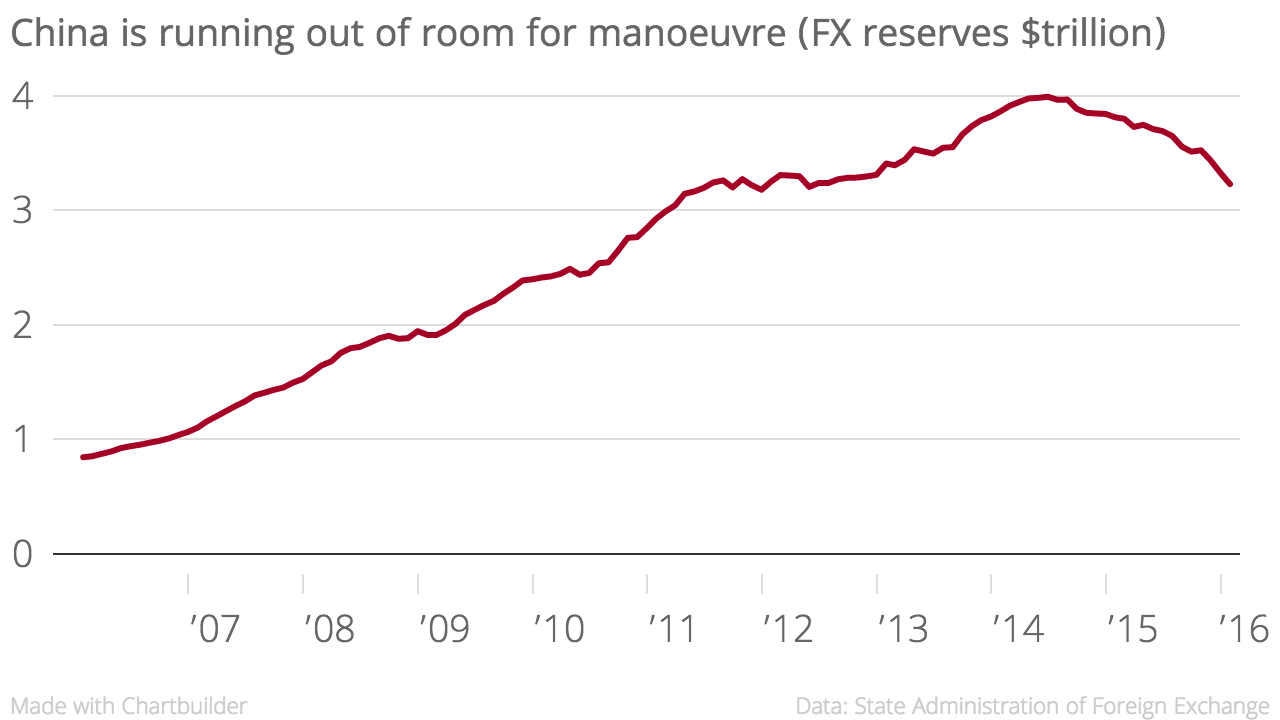

China is trying to prevent the yuan from falling sharply against the US dollar. It draws on a finite pool of dollars it holds in order to flood foreign exchange markets with dollars and mop up yuan, maintaining the yuan’s value.

China shelled out $99.5bn (£68.6bn) dollars in January, with its foreign exchange reserves falling to $3.23 trillion – the lowest since 2011. However, not all of the reserves are instantly accessible – around a third are tied up in illiquid assets, according to Lombard Street Research, a consultancy.

"International speculative forces have recently focused on shorting China," Zhou told the Caixin financial magazine.

“It is normal for foreign reserves to rise and fall as long as the fundamentals face no problems.”

“At the moment the level of cross-border capital flows is within the normal region.”

“We need to differentiate between capital outflow and capital flight,” he said, dismissing fears that the country would tighten capital controls.

The Chinese government fears a sharp devaluation of the yuan could destabilise the economy. Many business in China have borrowed in dollars, but with their earnings in yuan. This so called currency mismatch leaves them vulnerable to exchange rate movements. China's long term plan is to move to a system without any foreign exchange control.