Buy-to-let repossessions jump 56 per cent as higher interest rates bite

According to new data released by UK Finance, the buy-to-let market has been hammered by higher interest rates, with lending plummeting and arrears rising.

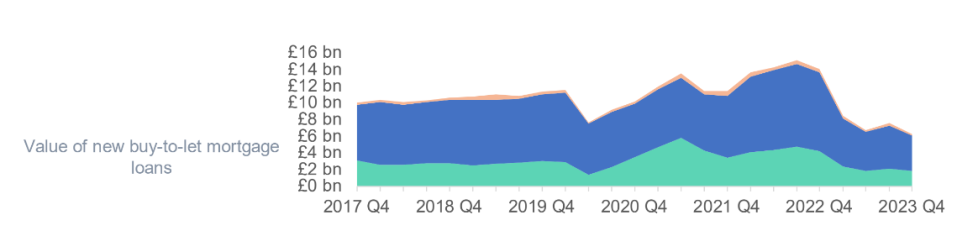

The value of new buy-to-let lending more halved in the final quarter of last year compared to a year earlier, dropping to £6.3bn as demand for new loans dried up.

Excluding the pandemic, this was the lowest level of activity in the buy-to-let market since 2013.

Higher interest rates also piled pressure onto existing borrowers, with 13,570 buy-to-let properties in arrears of more than 2.5 per cent of the outstanding balance.

This was 123.9 per cent higher than in the same quarter a year earlier, although this made up just 0.68 per cent of the total stock of buy-to-let mortgages.

In addition, 500 buy-to-let mortgage repossessions occurred in the final quarter of 2023, up 56 per cent from the previous year, but still low by historical comparison.

The figures reveal the impact of higher interest rates on the sector. Interest rates have increased from 0.1 per cent in December 2021 to a post-financial crisis high of 5.25 per cent, which in turn has fed through into higher mortgage payments.

The interest cover ratio—rental income expressed as a proportion of mortgage interest payments—has fallen by 58 percentage points for landlords year over year.

Most landlords have interest-only mortgages, which means borrowers see a more significant impact than in the residential market.

Arrears and repossessions have increased partly because it is difficult for landlords, who tend to rely on fixed leases, to increase rents each time mortgage payments rise.

Analysts at UK Finance stressed that the buy-to-let sector remained strong. “Despite the current challenges facing the sector, rental demand remains strong, and most landlords are showing resilience,” analysts said in a blog accompanying the figures.