Mortgage arrears rose by a quarter in a year as higher interest rates bite

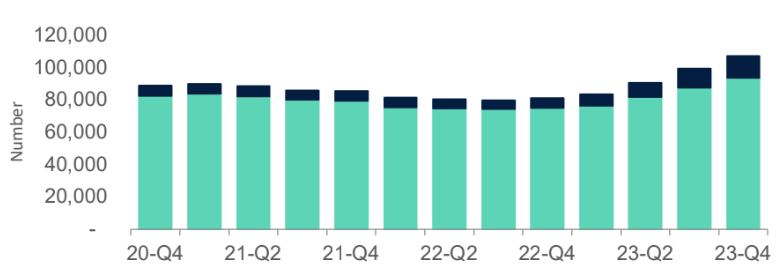

Mortgage arrears continued rising in the final quarter of last year, although remaining relatively low, as the pressure from higher interest rates continued to filter through into the economy.

According to the latest UK Finance figures, homeowner mortgages in arrears increased seven per cent on the previous quarter. This took the total figure in arrears to 93,680, 25 per cent higher than the year before.

Arrears among buy-to-let homeowners increased 18 per cent in the final quarter to 13,570. This was more than double the same period last year.

Arrears have increased as a result of the rapid rise in interest rates. The Bank of England has hiked interest rates from 0.1 per cent in late 2021 to a post-financial crisis high of 5.25 per cent, which has filtered through into higher mortgage rates.

According to recent research from the Bank, mortgage rates have increased by over four percentage points in the last two years. A three percentage point rate increase on a £300,000 mortgage would set borrowers back by roughly £500 per month, the Bank said.

“The number of mortgage holders in arrears, whilst still low, is continuing to rise as the cost-of-living and high interest rates take their toll on households,” Eric Leenders, managing director of personal finance at UK Finance, said.

Despite the increase, just 1.07 per cent of homeowner mortgages were in arrears. Only 0.69 per cent of buy-to-let homeowners were in arrears.

UK Finance noted that lender stress tests have helped ensure that borrowers are able to keep up with their payments.

Only 540 homeowner properties were taken into possession in the fourth quarter, down 14 per cent on the quarter before.