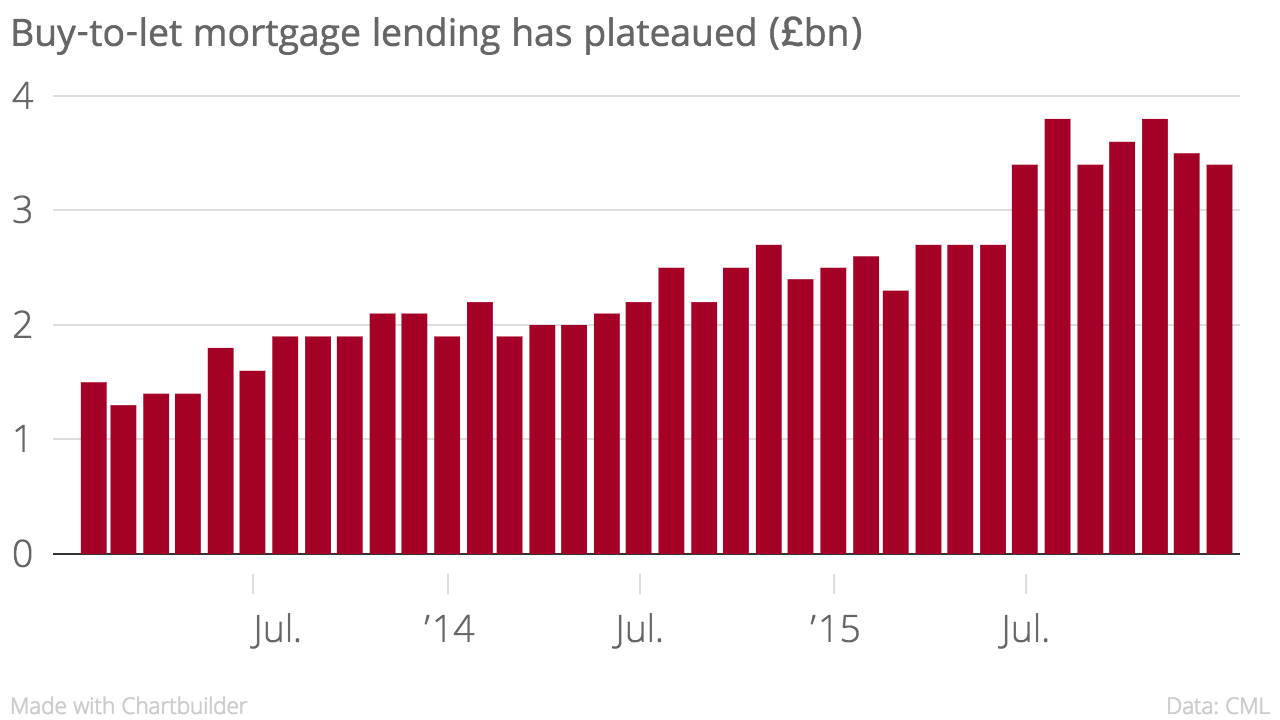

Buy-to-let mortgage boom runs out of steam as lending falls in December

The buy-to-let mortgage boom receded toward the end of last year, new figures show today.

The amount of cash loaned to buy-to-let investors dropped by three per cent in December compared with November, the Council of Mortgage Lenders said. It was also down one per cent in the three months from the three months to September.

Over the whole of 2015 buy-to-let lending rose 39 per cent in value terms. However, buy-to-let mortgage lending makes up less than a fifth of the total mortgage lending.

Other sectors of mortgage lending had a better month, with first-time buyer borrowing reaching £4.5bn in December, up seven per cent on the previous month. Lending to home movers rose two per cent. Both were up compared with last year.

"The government has introduced measures aimed at penalising buy-to-let investors, including the three per cent stamp duty surcharge and new tax on mortgage interest. In fact the perpetrator of the UK property market, driving up average house prices and the affordability problem, is the endemic shortage of property stock at all levels and not buy-to-let investors – an issue which must urgently be addressed by the government," said Stuart Law, chief executive at Assetz for Investors.

Buy-to-let activity is expected to slow this year due to policy changes which could weigh heavily on the London market.

"As we approach April and in the months beyond we will witness buy-to-let investors, who are not only looking to minimise the impact of the stamp duty levy on second homes but also looking to avoid inevitable increases in property prices in the Capital following the 40 per cent regional Help-to-Buy policy, move away from London," Law added.