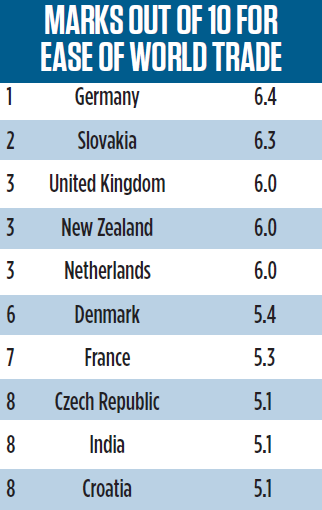

Bronze for UK in ranks of trade-friendly countries

THE BRITISH tax system is one of the most well-equipped in the world to benefit from further trade and globalisation, coming joint third in the ranks of 27 countries’ systems.

In UHY’s list of countries most prepared to capitalise from a boost to international trade, the UK is positioned behind only Slovakia and Germany, alongside New Zealand and the Netherlands with six marks out of 10.

The accounting firm has rated the range of countries based on their success in tax negotiations with trading partners, their export growth, the cost of labour and how hard the tax system hits businesses repatriating profits overseas. The index takes into account the country’s score in the World Bank’s doing business survey.

According to the authors, the UK did well across all measures, but benefited particularly because of its rules on taxing repatriated income.

“In addition to this, the UK has the highest number of double tax treaties, with agreements in place with 126 countries. It gives a big boost to trade when treaties are in place to minimise or avoid double taxation, so the UK’s successful diplomacy is to be applauded for helping make the country competitive globally,” according to UHY chairman Ladislav Hornan.

The US gets a particularly poor ranking in the index, coming only 25th, with only 3.7 marks out of 10. Japan comes last in 27th place.

Rick David, who works for UHY’s American arm, said: “American firms are household names around the world but actually our taxation system is very poorly geared towards encouraging US companies from growing overseas.”