British Gas owner Centrica hands £250m to shareholders as profits surge

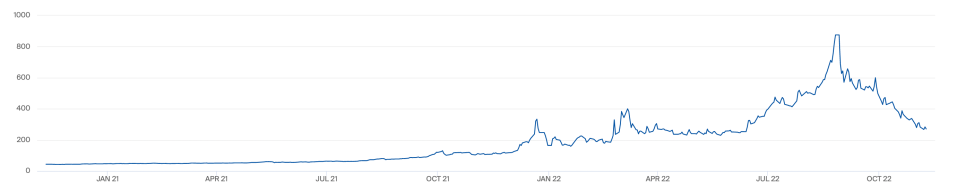

British Gas owner Centrica will hand £250m to shareholders in a new buyback scheme, as high wholesale prices put the firm on course for a six-fold increase in net profits compared to last year.

The energy giant revealed in a bullish and unexpected trading update that robust performance in its electricity generation assets alongside the gas Centrica sells from its North Sea fields meant full-year profits would be at the top end of estimates, with analysts forecasting earnings between 15.1-26p per share.

It said: “Centrica has continued to deliver strong operational performance from its balanced portfolio since its interim results in July and now expects full-year adjusted earnings per share to be towards the top end of the range of more recent sell-side analyst expectations.”

Centrica plans to repurchase up to five per cent of its issued share capital over the next three to four months at an expected cost of a quarter of a billion pounds.

The company first resumed dividend payments earlier this year, after scrapping them during the pandemic when commodities prices dropped amid collapsed demand.

Meanwhile, the unveiling of the full-year results is not expected until February 2023, with the company positing hefty half-year profits of £1.34bn in July earlier this year.

Centrica both produces electricity and gas and is the country’s biggest supplier through British Gas – home to over nine million customers.

The retail arm is not enjoying the same lucrative period of bumper earnings, with inflation and warmer weather eating into its profits, and causing Centrica to downgrade its earning.

However, the co-existence of British Gas alongside its production assets puts it in an awkward position when it comes to dividends and shareholder pay-outs.

Centrica challenged over dividends amid

Centrica faces a difficult balancing act as it looks to reward shareholders who have backed the company through pandemic headwinds, with proceeds from bumper trading this year amid sustained criticism energy producers are cashing in on soaring oil and gas prices fuelled by Russia’s invasion of Ukraine.

This includes calls from the Labour Party for the windfall tax to be toughened up.

In recent weeks, there have been multiple media reports suggesting Chancellor Jeremy Hunt will expand the Energy Profits Levy at the fiscal event next week in terms of both its timeframe and overall rates.

Sophie Lund-Yates, equity analyst at Hargreaves Lansdown said: “The recent performance will be used by some to argue that a windfall tax should be levied on energy companies. The situation is certainly a highly sensitive one, and any potential financial knocks brought about by new taxes would need to be carefully managed by Centrica, given what’s at stake for its customers.”

Households are suffering painful hikes in their energy bills as part of the biggest cost-of-living squeeze in a generation.

This is despite historic interventions from the Government such as the Energy Price Guarantee and the rebate schemes unveiled by Rishi Sunak when he was still Chancellor.

Wide-scale support is expected to taper off when the latest package concludes in April, and energy specialist Cornwall Insight is predicting the price cap will rise to £3,702 per year in April.

Centrica said it recognise the “difficult environment facing many people” as they struggled with high energy bills.

It said it would set aside another £25m to help customers this year, taking its overall support to £50m, a fifth of the size of its proposed shareholder pay-outs.

The company has also announced the reopening of Rough earlier this month – the UK’s single biggest gas storage site which was mothballed in 2017.

Centrica’s shares surged 9.1 per cent on the FTSE 100 following the latest update, reflecting investor approval of the decision.

However, Centrica warned there were still be “significant uncertainties that remain over the remaining two months of the year.”

The included weather, commodity price movements, asset performances, and the potential consequences of a recession on the commercial performance of its company.