Bottom Line: Perks help to sweeten investment case

ROLLERCOASTER fanatics listen up. Buy a stake in Merlin’s planned flotation, and you could be riding Nemesis on the cheap by qualifying for 30 per cent off an annual theme park season ticket.

But is the discount worth it? A standard adult season ticket – which shareholders would be entitled to two of – costs £119.25. That means a combined saving of £71.55 per year on the two tickets, or a yield of 7.15 per cent on the £1,000 minimum investment required.

So there’s the upside. But what about the risks? Merlin attempted to come to market three years ago, but backed out at the last minute, citing market volatility. This time round there’s less chance of that, yet the investment case is still open to debate due to the quirks of running an entertainment business.

Tourist attractions can be a perfect storm of consumer risk – bad weather, squeezed spending and passing trends can all throw profits off track very quickly. At the same time they’re expensive to run, with high staff and security costs and constant upgrades to fund – 14-loop rollercoasters and Katy Perry waxworks don’t come cheap.

On the other hand Merlin’s portfolio of brands is strong, and well-diversified across the world with assets everywhere from New Zealand to California.

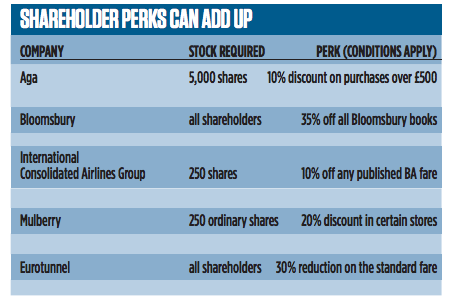

Investors are unlikely to pile in solely on the basis of a £70 theme park discount, but for some it will be an attractive sweetener.

For the rest of the pack, investing in Merlin could offer something of a rollercoaster ride.