BoE’s Bailey and co are gloomiest central bank forecasters in history, according to Goldman Sachs

“No central bank has ever published as negative an economic forecast” as the Bank of England did last week, according to a top Wall Street bank.

Governor Andrew Bailey and co’s prediction that the UK will tip into the longest recession since the financial crisis at the end of this year is the gloomiest of any of the world’s top monetary authorities ever, Goldman Sachs said today.

A more than 13 per cent inflation peak driven by wild upward swings in gas prices leading to higher household energy bills is set to grind the economy into a protracted slump that will last at least five consecutive quarters, the Bank said last week.

Under the projections, households will suffer two straight years of falling spending power, amounting to the largest cumulative fall in living standards since records began in the 1960s.

Despite the softening economy, another 50 basis point interest rate hike will land next month, Goldman said, followed by two more 25 basis point moves in November and December, taking rates to nearly three per cent.

Bailey and the rest of the monetary policy committee last week signed off the biggest rate rise in the Bank’s 25 years of independence, taking borrowing costs to 1.75 per cent, the highest since December 2008.

Since last December, the Bank has raised rates 165 basis points as it scrambles to tame the largest inflation surge in 40 years.

Prices are up 9.4 per cent over the last year, the quickest acceleration since the early 1980s.

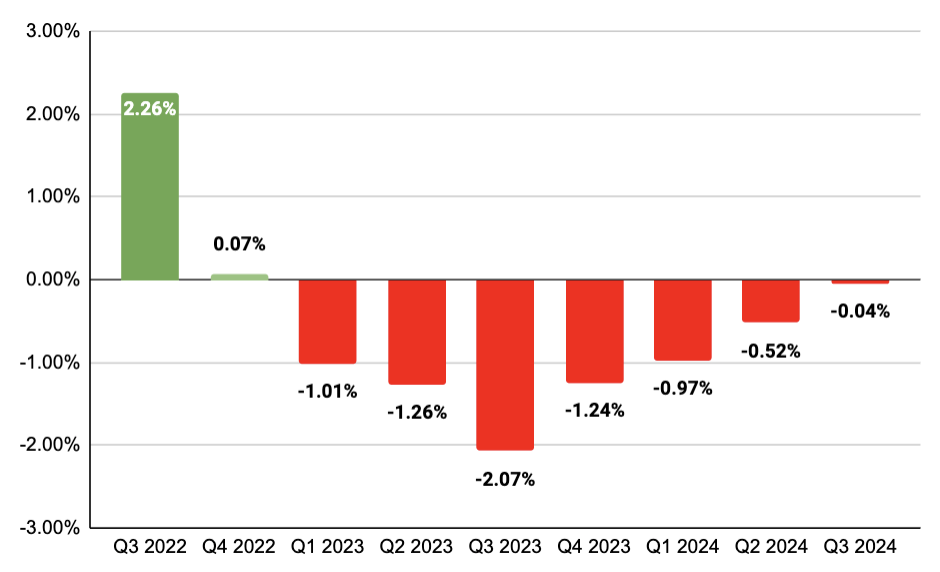

Bank of England’s GDP projections