Bitcoin to be available at hundreds of US banks, and Ethereum hits a new high

CryptoCompare data shows the price of Bitcoin (BTC) moved from close to $59,000 at the beginning of the week to a $53,000 low before recovering. At press time, the flagship cryptocurrency is trading at $58,300.

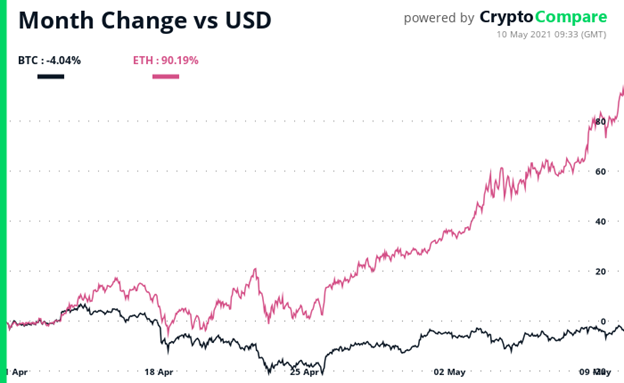

Ether (ETH), the second-largest cryptocurrency by market capitalisation, moved up throughout the week from around $3,200 to a new all-time high of $4,150. Behind the cryptocurrency’s rise are upcoming technical upgrades and institutional demand.

The week was marked by Dogecoin (DOGE) – a cryptocurrency inspired by the Shiba Inu dog meme – hitting a new all-time high after being listed on the social trading platform eToro and ahead of Elon Musk’s appearance on the “Saturday Night Live” comedy sketch TV show.

During the show, Musk called DOGE a “hustle” after explaining cryptocurrency, and the price of the cryptocurrency plunged, to some marking the end of a 9,000 per cent run so far this year.

While Bitcoin’s price rise has stalled over the last few weeks, the cryptocurrency may soon become available to millions of investors, as for the first time customers in some US banks will be able to buy, hold and sell BTC through their existing accounts.

Stone Ridge, a subsidiary of a $10 billion New York-based asset manager, partnered with fintech giant Fidelity National Information Services, to allow some US banks’ customers to gain exposure to Bitcoin. Hundreds of banks are said to be enrolled in the program.

Goldman Sachs, a global investment bank with morethan $2 trillion in assets under management, is set to offer Bitcoin derivatives to large clients. It will reportedly use “non-deliverable forwards” – which are short-term futures contracts that can give investors exposure to BTC.

A report published last week by OKEx Academy in collaboration with CryptoCompare found that weekly volumes of CME Ethereum futures hit a new all-time high of $353 million for the week ending April 25, indicating strong institutional interest in Ethereum due to growing capital inflows to ETH exchange-traded products and exchange-traded funds.

According to the report, there are three main drivers of institutional interest in ETH: normalisation of cryptocurrency investing, growing Ethereum use cases and promising updates for the cryptocurrency. It also adds that the network’s “passive income-generating potential is at least partly responsible for ETH’s recent price performance” based on the amount of ETH staked in the deposit contract for Ethereum 2.0.

Ethereum has, over the last 30 days, been significantly outperforming the number one cryptocurrency Bitcoin.

Over the week, a paper published by the Federal Reserve Bank of St Louis explored Ethereum’s booming decentralised finance (DeFi) sector and its implications for the traditional financial world. It suggests that if security risks are addressed, the sector may cause a “paradigm shift in the financial industry”.

Cryptocurrency fund Multicoin Capital has announced a new $100 million fund that will invest in DeFi, non-fungible tokens (NFTs), and Web 3 applications, with a focus on DeFi projects on the Solana (SOL) blockchain.

Coinbase launches education-focused charitable organisation

Nasdaq-listed cryptocurrency trading platform Coinbase has launched a charitable organisation called Coinbase Giving. It’s set to focus on “driving philanthropic initiatives underpinned by a common goal of increasing economic freedom.”

The organisation will reportedly focus on three main categories: increasing education and access to cryptocurrencies, supporting the next generation of crypto professionals, and speeding up the development of cryptocurrency protocols. It will generally support open-source projects.

The exchange is also seemingly acquiring crypto professional data analytics and trade execution services firm Skew. The acquisition is subject to customary closing conditions and is expected to close in the coming month.

Over the week the owner of the New York Stock Exchange (NYSE), the Intercontinental Exchange, sold its 1.4 per cent stake in Coinbase for a whopping $1.2 billion. The company sold its stake less than a month after Coinbase went public on April 14.

Another acquisition happened in crypto land this week, as crypto and blockchain-focused financial services firm Galaxy Digital is set to acquire institutional cryptocurrency custodian BitGo. Galaxy Digital will reportedly pay $1.2 billion in stock and cash in the deal.

BitGo’s shareholders will, as part of the deal, get $33.8 million in newly issued Galaxy Digital shares, and $265 million in cash.