Bitcoin and Ethereum Roar Higher as Ethereum Classic Suffers Attacks

This week the price of Bitcoin (BTC) went from about $10,200 to briefly surpass the $12,000 mark before traders realized gains and moved the cryptocurrency back to $11,700 in a quick sell-off. The cryptocurrency is seemingly slowly moving back up as bullish sentiment prevails.

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week at $295 and continued to surge past the $400 mark, but its advances ended up being rejected and its price correct back to $370. It has since then slowly recovered to $390.

This week’s major headlines in the cryptocurrency space revolved around Ethereum Classic (ETC), as the cryptocurrency’s blockchain suffered two 51% attacks that saw malicious miners steal millions worth of ETC tokens by spending them twice.

Ethereum Classic was created after the Ethereum (ETH) blockchain was split in 2016 after the Decentralized Autonomous Organization hack. At the time 3.6 million ether (worth $50 million then) were stolen, and one side of the community supported a move – a hard fork – to appropriate the affected funds, while the other opposed it. The latter became Ethereum Classic, maintaining the original blockchain, while the Ethereum we have today is the forked blockchain.

Ethereum Classic’s security is now being brought into question, as an unknown miner managed to rent computing power from a marketplace to attack it twice. By controlling over 51% of the total computing power in the network, the miner managed to reorganize the blocks in the blockchain, to spend ETC tokens twice.

In the first attack the attacker double-spent $5.6 million worth of ETC after spending $200,000 to acquire the computing power, while in the second one a similar method was used to double-spend $1.7 million.

The funds were double-spent as the hacker moved ETC to cryptocurrency exchanges and to wallets under their control. He traded the funds on exchanges and withdrew them, and then reorganized the blockchain so that the transactions moving the ETC into his wallets were the valid ones.

Over the week popular cryptocurrency exchange Bitfinex also moved to resolve a hunt launched in 2016, when hackers managed to steal nearly 120,000 BTC, then worth $72 million, from its wallets. The funds are now worth over $1.3 billion and the hackers have moved at least $51 million this month, presumably in a bid to launder them.

To resolve the issue, Bitfinex announced a reward to the hackers if they choose to return the funds, of 25% of everything they return, and a 5% reward to anyone who manages to get them in contact with the hackers. In total, Bitfinex could offer over $400 million if all $1.3 billion are returned.

Researchers found this week that given Ethereum’s price performance over the last few months, over 90% of its circulating supply is in a state of profit, which could mean a significant bearish move is incoming The last time this happened, the price of ETH dropped from $925 to $380 in early 2018. Demand for ether has been growing thanks to the decentralized finance space.

Demand for bitcoin is also on the rise, however, as billion-dollar business intelligence software firm MicroStrategy has revealed it plans to invest up to $250 million in alternative assets over the next 12 months, and specifically mentioned bitcoin as an option.

Top-Tier Exchanges Top Riskier Platforms

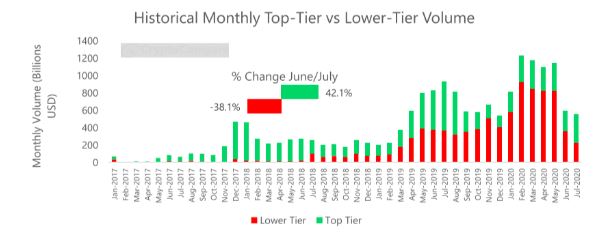

CryptoCompare’s July 2020 Exchange Review came out this week, and revealed that Top-Tier cryptocurrency trading platforms, those graded AA-B according to the firm’s Exchange Benchmark, have seen their spot volumes increased by 42.1% to $334 billion last month, which helped them surpass lower quality exchanges to represent 60% of the crypto space’s total spot volume.

Lower-tier exchanges, the report adds, saw their volumes decrease 38.1% to $224 billion in July. The volume is dwindling on riskier cryptoasset trading platforms as investors likely moved toward safer cryptocurrency trading platforms when prices started moving up.

Top-Tier exchanges have been gaining market share over time, as in late 2019 they accounted for 32% of the crypto space’s total spot volumes. Similarly, exchanges using the traditional maker taker-fee model represented most of the volumes last month, while those implementing controversial models represented less than 18% of the volume.

Bitcoin’s fundamentals were also reaffirmed over the week, as a whale moved $1.1 billion worth of BTC for a mere $4 fee, while remaining anonymous. While blockchain sleuths believe Xapo, a bitcoin storage service that was acquired by Coinbase Custody last year, was behind the move, no one knows for sure.

Crypto AM: Market View in association with