World reserve currencies: Is the US Dollars’ days numbered?

“Every dog has its day” is an expression believed to have come from 405 BC when a Greek playwright, Euripides, was mauled and killed by a pack of dogs. An analogy to this tale could be the US Dollar. Is the end nigh? Has the mighty Greenback ‘had its day’?

Having been on the boards for a selection of private and public companies and having been involved in managing money and studying financial markets globally for over four decades, I have learnt that one of the key attributes needed for a successful business is trust. Investors will give their money to you if they trust you, whether it be investing in a pension/ISA you manage, buying shares or lending money to a company for which you are a director. For this very same reason it is interesting to note that, after over two years of writing Digital Bytes on a weekly basis (an analysis of some of the developments in the Blockchain and Digital Assets sectors) the recurring attribute cited as to why Blockchain technology is being harnessed is trust. Making sense of the deluge of information, sifting through the PR and marketing spin, as well as the all too common fake news, is sometimes a real challenge when trying ‘to see the wood from the trees.’ Unsurprisingly, it is judicious to look rationally at where we are, the direction of travel and the likely impact on our lives and businesses, which is what Digital Bytes aims to do.

Understandably, the recent focus for many has been on Covid-19 and the dreadful loss of life caused by this pandemic. Even prior to this, the global economy had been stumbling along under a mountain of debt for companies, governments and individuals. This ‘binge’ on borrowings had been fuelled largely by weak economic growth, with governments forcing interest rates down potentially breaking their own laws by engaging in ‘monetary financing’. This practice is illegal in many countries and occurs when a central bank creates money to buy government bonds thus enabling those governments to, in effect, spend without limits. In 2014, it was prohibited for the European Central Bank (ECB) to do this. Indeed, its quantitative easing programme has already been questioned by the German constitutional court, which has threatened to no longer provide the ECB with further financial support. Of concern is that artificially pushing interest rates lower can do more harm than good thereby helping fiscally irresponsible governments and, in so doing, addicting a nation to cheap credit and denying savers a decent return on their savings.

US debt has increased by $2.6 trillion since the beginning of April 2020 to $26.6 trillion in June 2020. However, following the law of diminishing returns, the more money is pumped into the economy then, seemingly, the smaller is the impact. Meanwhile the economy becomes increasingly indebted, governments spend more, corporate share buybacks continue, thus resulting in now only 14 companies in the S&P 500 currently being net cash positive. Investors chase bonds and equities prices ever higher, pension funds and insurance companies become increasingly unstable, the banking system weakens, bank lending retreats and unproductive zombie companies stay afloat via low borrowing costs. Longer term, these levels of debt in the USA undermine the value of the US$, impacting on the confidence and the trust in its enduring value.

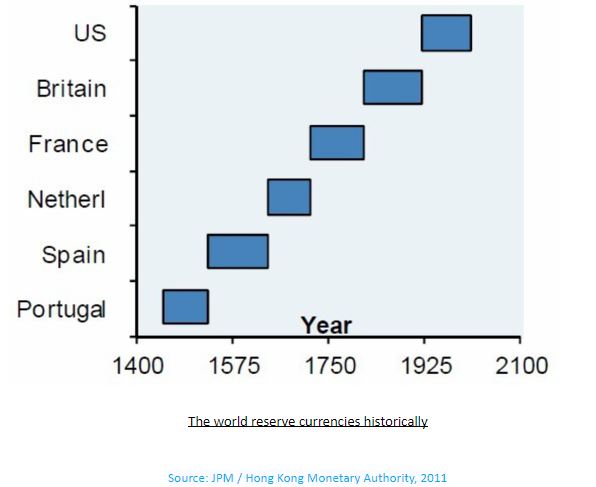

The US$ has been the reserve currency for 94 years. Subsequently, from an historic perspective, is it due to be replaced? America’s currency replaced Britain’s, which replaced France’s, which replaced Holland’s, which replaced Spain’s, which had replaced Portugal’s currency back in the 15th century!

Unremittingly, a growing debt burden becomes a big problem for everyone. According to the World Bank, the ‘tipping point’ is reached when a country’s debt-to-GDP ratio approaches/exceeds 77%. In Q4 2019, the US debt-to-GDP ratio was 107% and now stands at 84%!

In the US this last week there have been over 40,000 new cases of Covid-19 being reported on three consecutive days. The death toll has reached 125,000+ and could exceed 150,000 by July 18th, according to the US Center for Disease Control and Prevention. Will Covid-19 undermine the US economy to such an extent that the strength of the US$ is questioned? Indeed, the Fed has just announced that banks have to cancel any proposed share-buy backs or dividend payments. The Fed is concerned about bank balance sheets and the breaching of capital reserves in the event of potentially US$700 billion of loan defaults as unemployment hits 19.5%. As we see the end of the era of hyper-globalisation, an increase in nationalisation – remember America remains in a trade war with China – and, progressively, a call for more equality in society, is America’s free-wheeling capitalist ‘style’ genuinely what the world aspires to going forward?

So, what could replace the US$ as the world reserve currency? The ‘knee-jerk’ answer would probably be the Chinese Digital currency which has recently been launched by the second biggest economy in the world. In order to gain international usage, will the Chinese insist that its digital currency is the method of payments to use the airports, railways, roads, bridges and harbours it has built in over 60 countries as part of its ‘Belt and Road’ initiative? Indeed, the IMF and Bank of International Settlement have both been advocating digital currencies for a while. Indeed, there are many nations currently researching digital currencies for their own countries.

However, there are two other alternatives – what about a worldwide digital currency backed by a basket of global equities, bonds, commodities, properties and foreign exchanges? This would remove the interdependency on any one nation or set of politicians. The second alternative would be to see a far more complex scenario with a multiplicity of corporate digital currencies launched by global corporations weary of using the current complex, expensive and relatively inefficient analogue payment systems. The front runner (resisted to date) is Facebook’s Libra, powered by its 2.6 billion monthly users. Others such as Amazon, Google, China’s Tencent and Alibaba already dominate payments in China but may be forced to look overseas as the People’ Bank of China rolls out its own Digital Currency.

Either way, the use of digital currencies is set to expand, and many are likely to be built using Blockchain-powered platforms which give greater levels of transparency thus hopefully engendering trust by those that use them. After all, digital currencies leave a digital footprint and are, therefore, ideal in helping governments with their fight against the shadow economy of money laundering, drug lords and terrorism-funded activities.

Jonny Fry CEO of TeamBlockchain and Editor of Digital Bytes – a weekly analysis of how, where and why Blockchain technology and Digital Assets are being used globally by different industries in various jurisdictions. To receive your weekly copy, click here