Where to find shelter from rising inflation

In the wake of Covid-19, investors have started debating whether long-dormant inflation risks will soon resurface.

Stay-at-home orders and government spending have left consumers with extra savings and pent-up demand that could eventually drive a spending splurge.

At the same time, lockdowns have kept many businesses shut, destroying capacity in some sectors of the economy and fracturing parts of the supply chain. If demand rises faster than the recovery in supply, we could see prices rebound.

Markets are slowly waking up to this possibility. Inflation expectations, as measured by the yield difference between nominal and inflation-protected US Treasury bonds, have bounced back sharply from their pandemic lows. They are now just above their average of 2% seen for the past decade.

Investors should not underestimate the pernicious effect that inflation can have on the value of their wealth. Rapid price increases lower a currency’s purchasing power, reducing the amount of goods and services you can buy with money.

This damage can be mitigated by investing, although your capital is at risk and different asset classes will offer varying levels of inflation protection. Traditional portfolios, such as those holding equities and bonds, are potentially most exposed.

Discover more from Schroders:

– Learn: Are any stocks cheap in early 2021?

– Read: Taper Tantrum 2: Is there a sequel in the making?

– Watch: Will 2021 be the time for investors to stop hibernating?

How would rising inflation affect markets?

Inflation can be good for holders of assets, if their values rise faster than the general level of inflation. However, it can be bad for anyone with a fixed income.

Bonds are therefore an obvious casualty. Their fixed stream of interest payments become less valuable as the overall cost of goods and services accelerates, sending yields higher and bond prices lower to compensate.

Short-dated Treasury bills (T-Bills) are unlikely to yield better results. The US Federal Reserve has indicated that interest rates will remain close to zero for at least the next three years as it aims to hit its new objective of a 2% average inflation target, making any interest rates hikes in response to a rise in inflation unlikely.

Equities may sound more enticing because, in theory, a rise in prices should correspond to a rise in nominal revenues and therefore boost share prices. On the other hand, this may be offset by a contraction in profit margins given an increase in companies’ input costs.

What’s more, the market will often discount those future cash flows at a higher rate when inflation rises to compensate for the fact they are worth less in today’s money.

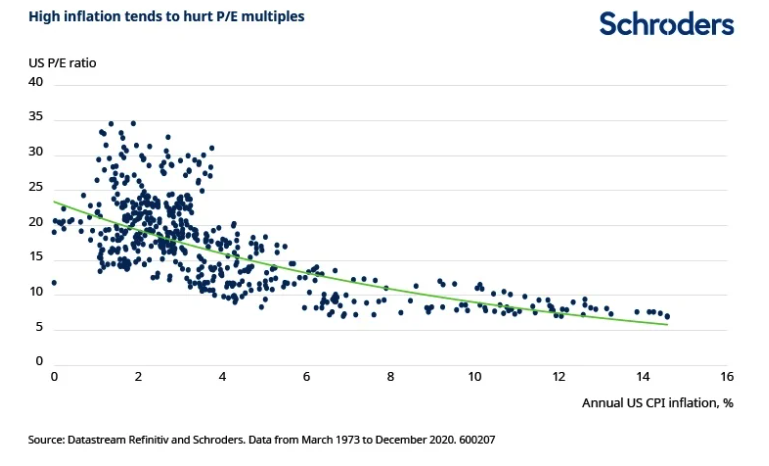

All else being equal, the higher the level of inflation, the greater the discount rate applied to earnings and therefore the lower the price-to-earnings (P/E) ratio investors are prepared to pay (see chart below).

For example, although nothing is certain, if the annual rate of US inflation increased to 4% today, it could result in a P/E ratio of 17x – a fall of 45% from current valuation levels.

Which assets have offered the most consistent inflation protection?

An inflation hedge is an investment that provides protection against price increases. So how often do different asset classes achieve this? And does this vary with the level and direction of inflation?

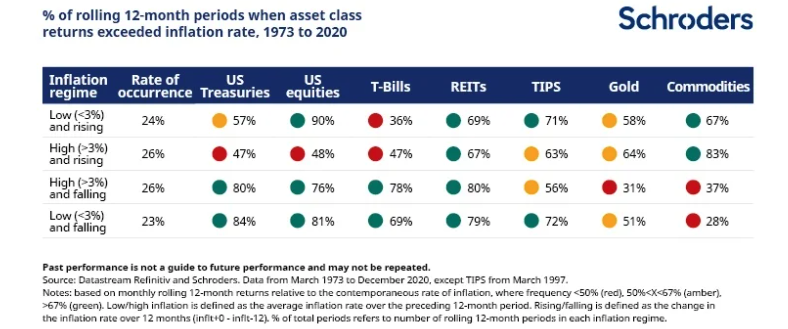

That’s exactly what we show in the table below: the percentage of rolling 12-month periods since 1973 when investment returns exceeded the US inflation rate by inflation regime. The colours represent how frequently an asset beat inflation from red (poor), through amber (average), to green (good).

Historically, the sweet spot for US equities has been low and rising inflation (where we are today). They outperformed a whopping 90% of the time during such episodes. T-Bills were the worst performer, beating inflation only 36% of the time, while US Treasuries were only marginally better with a 57% success rate.

However, when inflation was high (above 3% on average) and rising, equities and Treasuries underperformed more than half the time. In contrast, commodities and US REITs (real estate investment trusts) came out on top, having outperformed inflation 83% and 67% of the time respectively.

This makes sense. Commodities (e.g. raw materials and energy) are a source of input costs for companies as well as a key component of inflation indices. So by definition they will perform well when inflation rises.

Similarly, real estate assets offer a partial inflation hedge via the pass-through of price increases in rental contracts and property prices.

US TIPS (Treasury Inflation Protected Securities) displayed a somewhat disappointing success rate of 63%. This may be because over short holding periods the price impact of movements in real (inflation-adjusted) yields can dominate their inflation-linked income.

For example, a 1% rise in the real yield on 10-year TIPS today would reduce their market value by around 7%, imposing a mark-to-market loss on existing owners.

Meanwhile, although gold is often touted as a hedge against currency debasement fears, its track record isn’t much better. It beat inflation only 64% of the time, less than REITs and commodities.

The price-tag for inflation protection

Incorporating an inflation-hedging asset into a portfolio is no free lunch, as it may increase a portfolio’s risk profile. For example, although REITs and commodities have more desirable inflation-hedging properties, this is likely to come at the expense of more volatile portfolio returns.

TIPS, on the other hand, are historically less volatile. These implicit costs should not be ignored and should be factored into asset allocation decisions.

Investors must decide how much inflation protection they desire and what implicit costs they are willing to tolerate. Regardless, whichever inflation scenario unfolds, traditional equity and bond investors have a lot at stake and cannot afford to be complacent.

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.