What happens to high yield bonds in times of market stress?

The current macroeconomic backdrop is creating challenges for investors. Global growth is slower and inflation is benign. Meanwhile, central banks appear to be returning to more accommodative policies and geopolitical tensions have increased.

Downturns in the business cycle, often caused by adverse economic conditions, can lead to a number of trends that are negative for investors in high yield bonds.

For example, some companies may find their credit ratings downgraded, which impacts their ability to borrow and can force some investors to sell their bonds. There may be a higher number of companies that are struggling to repay the interest on their debts as business conditions become tougher and their sales decline. There can also be more widespread selling of riskier assets such as high yield bonds as investors look to dial down risk in their portfolios, or react to negative news headlines.

Unsurprisingly, considering the economic backdrop, some investors have become increasingly nervous about taking risk.

What is high yield?

Corporate bonds (debt issued by companies) are rated on a scale by analysts according to the strengths or weaknesses of the company and how risky it is to lend it money (by buying its bonds). At the highest quality, least risky end is the AAA rating. Bonds rated AAA, AA, A or BBB are considered investment grade; bonds rated BB, B, CCC, CC or C are classified as high yield. High yields bonds are considered riskier and as such will pay a higher level of interest to the bondholder or lender.

However, with higher risk comes potentially attractive investment rewards.

High yield tends to recover quickly and strongly

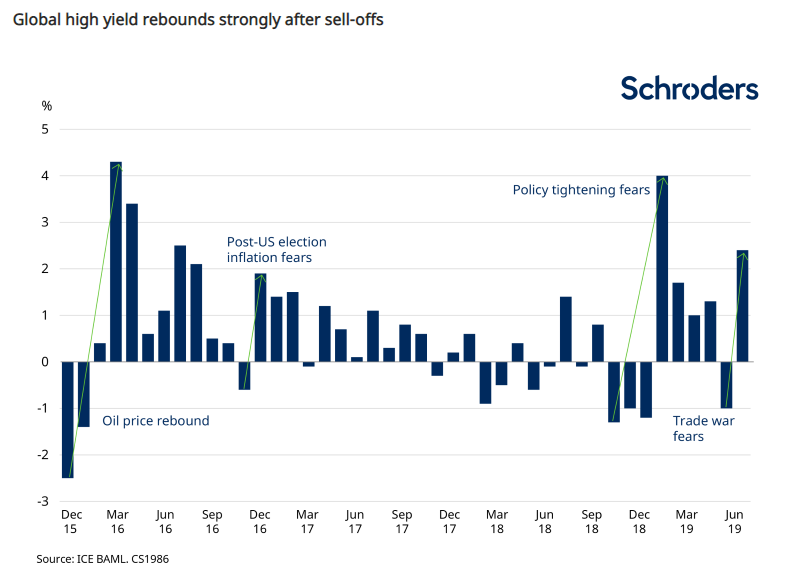

The point at which an investment is made clearly plays a significant role in determining returns. It has often made sense to invest after markets have fallen, when valuations have become lower or cheaper. This has been the case for high yield corporate bonds, which have demonstrated resilience over time, bouncing back strongly following sell-offs in the market.

Read more on on bonds and investment returns:

– Investment returns of 6% or 11%: who’s right?

– The death of yields in six charts

– Fallen angels: why passive investors may face greater risks

Although this backs up the investment adage of “buy the dip” (i.e. buying assets after they fall in value), detailed analysis is crucial to identifying such buying opportunities. The following chart illustrates this rebound effect as exhibited by global high yield during recent periods of market stress.

Past performance is not a reliable indicator of future returns, prices of shares or bonds, and the income from them, may fall as well as rise and investors may not get the amount originally invested.

This is also clearly demonstrated if we look back to the global financial crisis. In 2008, the pan-European HY market returned -31 per cent and US high yield returned -26 per cent. Both then rebounded forcefully the following year, with the pan-European market adding 85 per cent and the US market 58 per cent. And each made further good gains, in excess of 15 per cent, in 2010.

Past performance is not a reliable indicator of future returns, prices of shares or bonds, and the income from them, may fall as well as rise and investors may not get the amount originally invested.

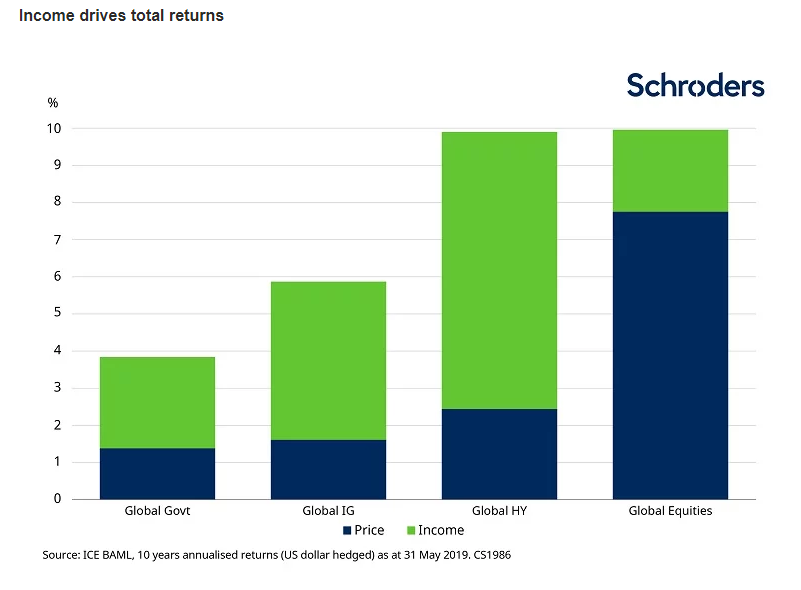

Between the end of 2007 and 2010 the US and pan-European high yield indices returned 34 per cent and 31 per cent respectively, or 10 per cent and 9.5 per cent annualised. The chart shows total returns, that is changes in the price of the bond plus the yield income paid on the bonds. The key driver of returns during this period, and indeed over the long-term, is income.

Past performance is not a reliable indicator of future returns, prices of shares or bonds, and the income from them, may fall as well as rise and investors may not get the amount originally invested.

Whilst this looks appealing, the higher level of income or interest also reflects the higher level of risk involved. In particular, there is a higher risk that a high yield company may be unable to make a periodic interest payment.

This is not to say that the yield on the bond will necessarily provide an accurate or fair reflection of the risk. If the yield is high, it may be exaggerating the risk, in which case the bonds may be particularly appealing. High yield issuers are often smaller companies in more niche, specialist areas. As such, it is not unusual for yields to move out of sync with company fundamentals.

Companies issuing bonds are obliged by the terms of the ‘bond’ to pay interest and ultimately fully repay bondholders, which is set out in legal documentation. This is not the case with income on equities, paid in the form of dividends, which are at the discretion of the company’s management and dependent on the company’s performance.

The current global uncertainties certainly call for a circumspect and judicious investment approach. Investors are right to tread carefully, certainly in relation to riskier asset classes. However, it also makes sense to keep the unique and sometimes subtler characteristics of different markets in mind when constructing portfolios and making investment decisions.

Risk associated with bond investing

A rise in interest rates generally causes bond prices to fall.

A decline in the financial health of an issuer could cause the value of its bonds to fall or become worthless.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.