Four charts that sum up the week: Sterling rallies, UK growth forecast cut, London house prices rise and Europe beats Britain

London house prices ended seven months of decline, the Bank of England said it was feeling less optimistic about the UK economy and the French economy sped ahead of Britain and Germany in the first quarter, this week.

Here are four charts that sum up what happened.

1.

London house prices are on the up again, but we're heading for crisis:

(Source: RBS Economics)

In good news for homeowners – but bad news for just about everybody else – London house prices are on the up again, ending seven months of decline according to the latest RICS survey.

Some 28 per cent of respondents said they saw house prices rise, which was largely due to waning supply and it's now reaching crisis levels.

"Alongside an increased flow of second-hand stock, it is absolutely critical that the new government focuses on measures to boost the flow of new build," Jeremy Blackburn, RICS head of UK policy, said.

"The affordability and availability of homes in the UK is now a national emergency and addressing this crisis must be the priority for the new government."

2.

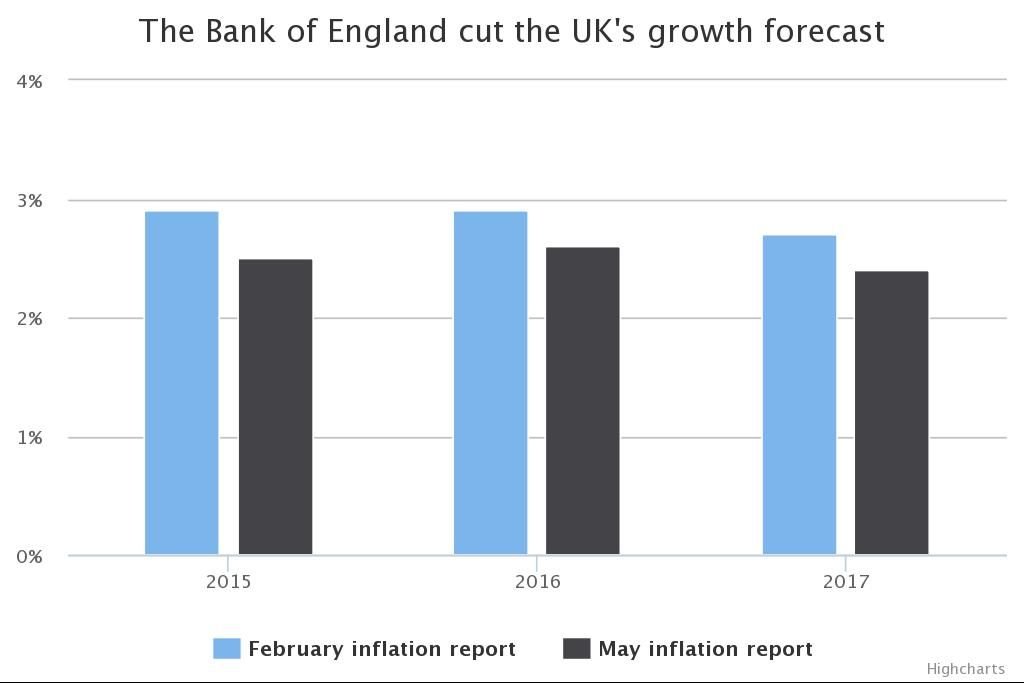

The BoE cut the UK's growth forecast

The Bank of England's quarterly inflation report trimmed the UK's growth forecast for this year to 2.5 per cent from 2.9 per cent, and to 2.6 per cent from 2.9 per cent for 2016.

Policy makers said that this was down to the strength of the pound, a steeper path for future interest rate rises, as well as poor productivity growth which governor Mark Carney described as the "most difficult judgement".

Threadneedle Street delivered a little more clarity about interest rate rises, saying it expects they'll remain close to historical lows for the foreseeable future, before rising some time in the second quarter of 2016.

3.

Sterling had a roller coaster ride

The pound has yo-yoed this week, initially catching the last waves of glee over the Tories' shock election win, and later wavering amid contradictory news about the outlook for the UK economy.

The pound soared on Tuesday after official data showed industrial output and manufacturing smashed economists' expectations in March, also igniting hopes for a revision of the awful first quarter GDP figure.

It rip sawed on Wednesday, initially rising after official data showed wages rose by an inflation-busting 2.2 per cent in March – and later reversing gains on the Bank of England's dovish quarterly inflation report.

4.

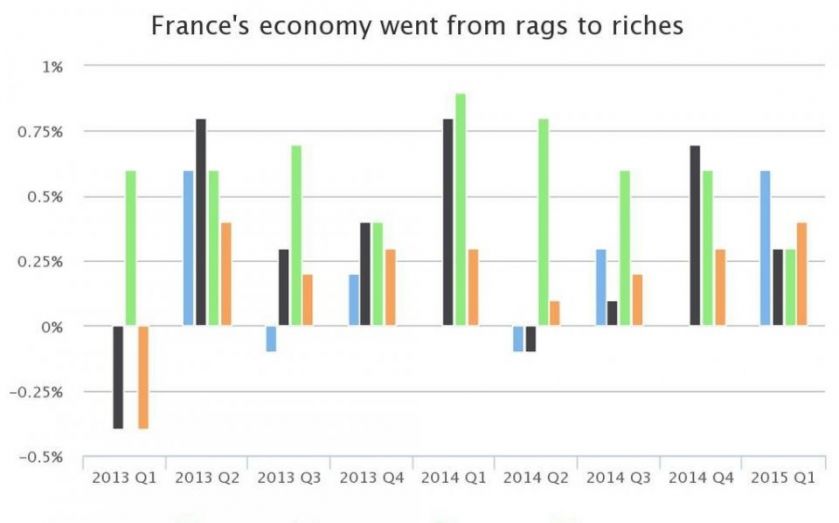

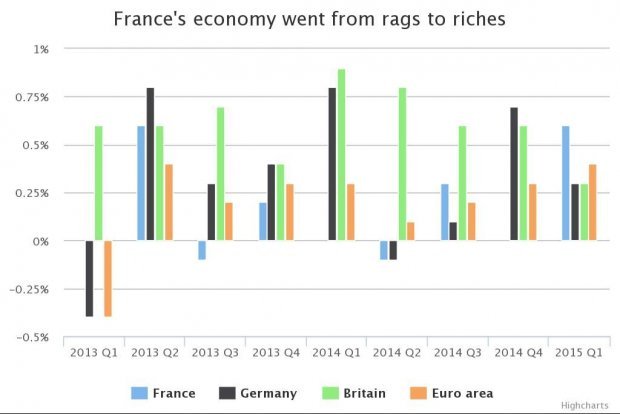

France's economy sped ahead of the UK

(Source: Trading Economics)

Once upon a time France was referred to as the "sick man of Europe" due to its high unemployment, weak growth, low productivity and high taxes.

But its economy went from rags to riches in the first quarter of the year, growing at twice the rate of Britain and the single currency area's star economy Germany.

This, alongside a stellar performance Italy, helped the wider Eurozone economy post 0.4 per cent growth for the first quarter of 2015.