Water companies need vast sums to meet improvement plans, Moody’s warns

Water companies across England and Wales will need to find hundreds of billions of pounds to meet their commitments to upgrade hundreds of miles of leaking and creaking infrastructure and tackle sewage overflows and spills over the next three decades, Moody’s has predicted.

The credit rating agency’s investors services division calculates, on the basis of the industry’s own forecasts, that it will need to find £272bn – three times as much as the sector’s existing capital value, which stood at £94bn in March 2023.

Stefanie Voelz, vice president and senior credit officer at Moody’s, said significant new debt and equity funding will be needed if the plans are to be delivered.

“Companies are responding to tighter environmental regulations and pressure on water resources from climate change and population growth,” she said.

The UK water industry is creaking under a £54bn debt pile, with the UK’s largest supplier Thames Water reeling from a boardroom exodus. Meanwhile Ofwat is currently overseeing enforcement cases into six suppliers over their treatment of sewage.

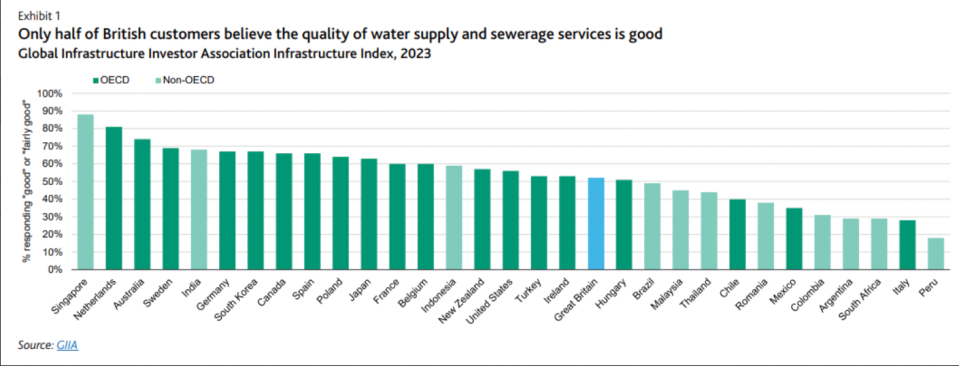

Public perception that UK water companies perform poorly on leakage and pollution is contributing to demands for higher investment,

“In our opinion, leakage is not high by international standards, treatment of wastewater is good, and surface water quality is in line with comparable countries,” said Graham Taylor, senior vice president at Moody’s.

“Water charges are also in line with peers, although this may change as higher investment feeds through to customer bills.”

For the next five-year regulatory period from April 2025 to March 2030, English and Welsh water companies have proposed around £40bn in enhancement expenditure, more than three times their allowance over the previous five years.

However, this will be funded chiefly through customer bills, with households on the hook for a rise of more than 30 per cent above inflation and further increases in subsequent pricing windows.

This follows Jefferies upgrading its stance on the water sector to buy, with analysts impressed with spending plans put forward by major publicly-listed water companies.

Nevertheless, it argued risks remain with plans still requiring approval from regulators and Labour holding a bullish stance against the industry ahead of next year’s likely election.

They said: “We reiterate that regulatory risks still remain, including the looming UK elections where poll-leading Labour has been vocal in its criticism of the water sector. The business plans also still have to undergo Ofwat’s regulatory and won’t be finalised until December 2024.”

Earlier this year, Moody’s downgraded its outlook for the UK’s water industry due to an uncertain macroeconomic environment and increasing scrutiny from regulators over poor performance.

In a previous investment note, Moody’s downgraded its outlook for the sector from ‘stable’ to ‘negative’.

“Ongoing regulatory and affordability pressure as well as a volatile macroeconomic environment continue to weigh against a positive outlook,” Moody’s said.

It later downgraded Thames Water owner Kemble’s credit rating this summer on a £400m segment of its debts – due 2026 – from B1 to B2, meaning it considers the sums to be highly speculative and a credit risk.

The government has outlined proposals to clamp down on water suppliers with potentially unlimited fines for environmental damage in its unveiled ‘Plan for Water,’