Tullow Oil cuts output forecast as drilling success rate drops

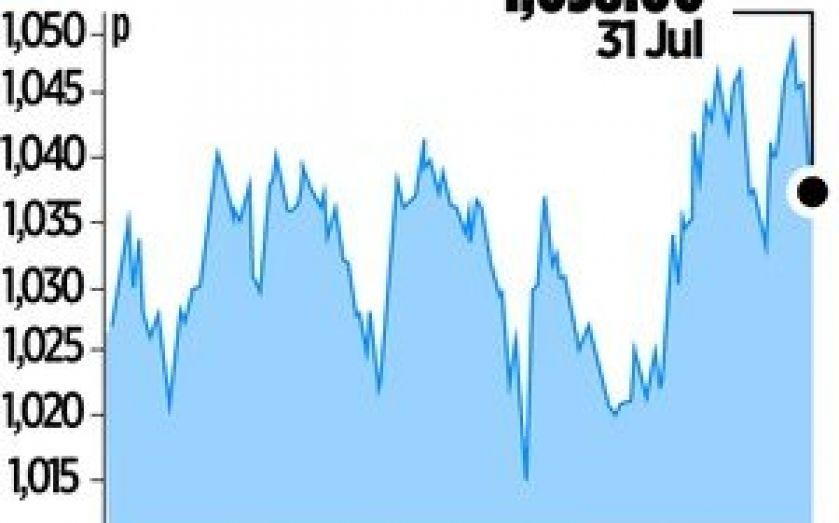

TULLOW Oil’s share price remained buoyant yesterday despite the FTSE 100-listed firm unveiling a lower drilling success rate, soaring net debt and cutting its full-year production guidance.

The oil explorer said net debt had risen 149 per cent to £1.7bn over the first half of the year and that wells drilled had a 63 per cent success ratio, down from 74 per cent the previous year.

Although production increased by 14 per cent over the first half, Tullow cut its full-year outlook to 84-88,000 barrels of oil per day (bop)d from 86-90,000 bopd, due to maintenance shutdown after a water pump failure in Ghana.

However, revenue rose 15 per cent to $1.3bn (£860m) over the first half and Tullow raised its resource estimate for Kenya by around 20 per cent after an oil discovery this year.

“Our exploration-led growth strategy delivered major successes in Kenya and Ethiopia, further enhancing East Africa as a new oil region,” said chief executive Aidan Heavey. “We have six exciting exploration campaigns under way in the second half in 10 countries with 20 wells targeting multiple basins.”

Shares closed 1.1 per cent higher.