The FTSE 100 is lagging behind soaring global markets – but why?

Stock markets around the world have soared in recent months even as economies crashed, aided by central banks pumping trillions of dollars into the system.

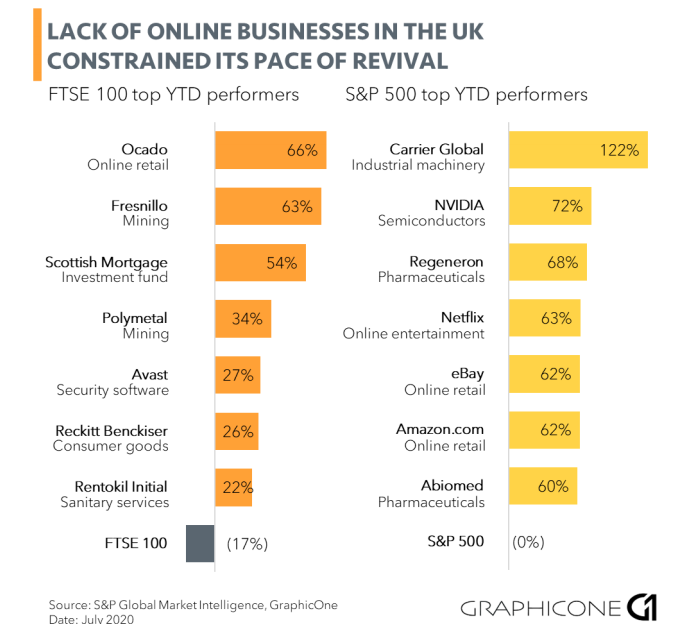

But although all stock markets are rising, some are rising faster than others. Britain’s FTSE 100 is lagging behind almost all other major stock indices.

It has risen just over 23 per cent since its March low – an impressive climb considering the UK economy is in the midst of the worst economic crash in recent memory.

Yet the US’s Nasdaq index has soared around 54 per cent since its March low, when global stock markets crashed as the extent of the coronavirus outbreak was becoming clear. The country’s S&P 500 is up roughly 42 per cent since its nadir.

In Europe, Germany’s Dax is up around 51 per cent in that time. And China’s CSI 300 index has risen around 37 per cent since its March pit, helped by a stellar rally in recent days.

France, Japan, and even Italy’s stock markets have outstripped the FTSE since March.

So why is the FTSE 100 lagging so far behind its peers?

FTSE 100 heavily exposed to banking

It is “an index that has become a victim of its own composition,” says Chris Beauchamp, chief market analyst at trading platform IG.

At the end of 2019, financials was the biggest sector in the FTSE 100 at 20.3 per cent, according to data from Sibils Research. Consumer staples came in second but energy was not far behind at 14.4 per cent.

| Bank | 02/01/20 share price | 13/07/20 share price | % Loss Year to Date |

| Lloyds | 63.71p | 30.6p | 51.9% |

| Natwest (RBS) | 244.3p | 121.55p | 49.8% |

| Stanchart | 720p | 444.3p | 38.2% |

| HSBC | 595.1p | 380.8p | 36% |

| Barclays | 185.2p | 119.56p | 35.4% |

Beauchamp says there is “a huge chunk of the index in terms of weighting that really is underperforming”.

The UK’s banks have suffered after the Bank of England slashed interest rates to record lows in March in a bid to support lending in the economy. Lower interest rates limit the amount of money banks can make from lending, denting their profits.

Investors also fear that banks could be left with many bad loans on their books once the crisis is over.

Lloyds shares have not recovered at all since the March stock market crash and are 50 per cent lower than in January. HSBC’s shares have collapsed even further since March, driven by geopolitical tensions over Hong Kong. The lender is down over 30 per cent this year.

Beauchamp also says the rally in sterling in recent weeks has held back the FTSE 100. A stronger pound means FTSE firms’ foreign earnings are worth less.

Oil demand hit hard by coronavirus

The oil giants that make up much of the index have had a particularly tough time as lower global demand has seen energy prices tank. Brent crude oil started the year at about $67 per barrel, but it is now trading at roughly $43.

In June, Shell said it will slash up to $22bn (£17bn) from the value of its assets amid low prices and demand. BP said it will take a hit worth up to $18bn.

Fiona Cincotta, market analyst at trading firm City Index, says the FTSE’s “big sectors, your oil, your gas and your banks, the heavyweights, they’re just not recovering in the same way the tech stocks have done”.

FTSE 100 lacks tech superstars

Technology stocks have massively boosted other indices around the world in recent months. The shift towards working from home, virtual conferencing and TV streaming has sent share prices sky-high.

The US’s tech-heavy Nasdaq hit a record high last week. It has completely shrugged off the coronavirus pandemic and is about 17 per cent higher for the year.

“It’s tech stocks which have absolutely outperformed,” says Cincotta. “These sorts of stay-at-home stocks as well. The FTSE just doesn’t have those.”

Sibils Research data shows that information technology made up just one per cent of the FTSE 100 at the end of 2019.

In the US, the Nasdaq and the S&P 500 have been massively boosted by the likes of Amazon, which has soared 69 per cent this year. Netflix is not far behind with an astonishing 66 per cent rise.

Cincotta says: “Even somewhere like the [German] Dax has got SAP and Infineon Technologies.”

Brexit looms in the background

There may be other factors at play too.

Beauchamp says part of the reason “no one wants to touch UK assets with a barge-pole” is “because you’ve got Brexit and you’ve got a government that seems to be in disarray because of Covid”.

He says some investors are particularly worried about Brexit, especially now there is a “countdown” to the end of the transition period in December.

Central banks have been at the root of the stock-market rally. They have pumped trillions into the global economy.

But the US’s Federal Reserve has been by far the most active, explaining in large part the country’s striking market rally.

Cincotta says: “The Fed has been very forthcoming with stimulus. I think the Bank of England has been but to a lesser extent and that will have also played a part.”

In brighter news for the FTSE 100, some analysts are warning that the tech rally has the hallmarks of a bubble.

Mike Novogratz, longtime investor who now runs Galaxy Digital Holdings, told Bloomberg on Friday: “The economy is grinding, slowing down, we’re lurching in and out of Covid, yet the tech market makes new highs every day. That’s a classic speculative bubble.”

A tech-less index like the FTSE could fare better than others if those warnings are true.