‘Tax-cutting Conservatives’ Boris Johnson and Rishi Sunak confirm tax rise is going ahead

The Prime Minister and Chancellor have doubled down on a controversial planned tax hike to boost health funding, after it was reported that Boris Johnson was “wobbling” on the policy.

The PM is under pressure from some Conservative MPs to scrap or at least delay the national insurance increase to win back support as he awaits the findings of Whitehall and police inquiries into claims of lockdown-busting parties held in Downing Street.

But Johnson, together with Chancellor Rishi Sunak, has now made a firm commitment to go ahead with the 1.25 percentage point increase, designed to tackle the Covid-induced NHS backlog and reform social care.

Writing in The Sunday Times, the pair insisted that it is right to follow through on the “progressive” policy.

“We must clear the Covid backlogs, with our plan for health and social care – and now is the time to stick to that plan. We must go ahead with the health and care levy. It is the right plan,” they said.

“It is progressive, in the sense that the burden falls most on those who can most afford it.”

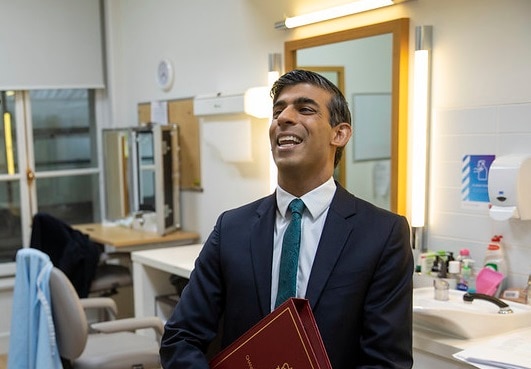

Boris Johnson and Rishi Sunak

“Every single penny of that £39bn will go on these crucial objectives – including nine million more checks, scans and operations, and 50,000 more nurses, as well as boosting social care.”

Johnson and Sunak said they are both “tax-cutting Conservatives”, but there is “no magic money tree”.

“We believe passionately that people are the best judges of how to spend their own money,” they said.

“We want to get through this Covid-driven phase, and get on with our agenda, of taking advantage of our new post-Brexit freedoms to turn the UK into the enterprise centre of Europe and the world.

“We want lighter, better, simpler regulation, especially in those new technologies in which the UK excels. We are also Thatcherites, in the sense that we believe in sound money. There is no magic money tree.”

In April, national insurance is due to rise by 1.25 percentage points for workers and employers.

From 2023, it is due to drop back to its current rate, with a 1.25 per cent health and social care levy then applied to raise funds for improvements to care services.

Political opposition to the change has come from all sides of the Commons, as MPs fear the impact that cost of living pressures could have on stretched household budgets.

Inflation is at a 30-year high after the coronavirus pandemic and the energy price cap is due to lift in the spring, possibly increasing bills by 50 per cent.