“HMRC must do more, faster”: Slow action on tax avoidance is losing UK money, report claims

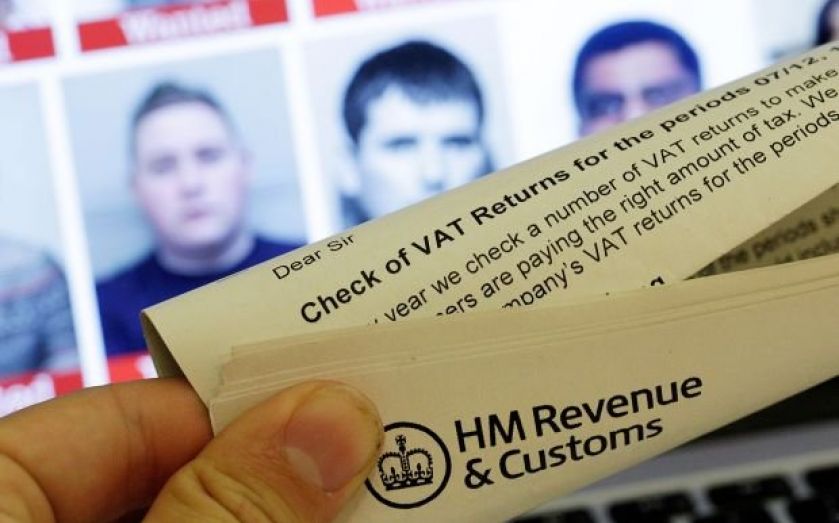

The government department tasked with chasing tax avoidance schemes and recovering the cash is too slow, resulting in millions being lost, a report out today claims.

The Public Accounts Committee looked into the process HM Revenue and Customs follows to recover tax lost through avoidance schemes and found that up to £10m from one particular scheme may be lost forever, because HMRC failed to act quickly enough.

“HMRC must do more, faster,” chair of the committee MP Margaret Hodge said. She added that a £1.9bn accounting error, which led to HMRC publishing over-inflated accounts of its record on collecting lost tax, was astonishing. The error was not picked up for three years, the report found. “HMRC’s action against tax avoiders continues to be unacceptably slow, putting tax revenues at risk,” Hodge added.

The report comes at a sensitive time for the government ahead of the Autumn Statement as tax receipts are down, creating a tough environment for chancellor George Osborne to navigate.