Shell’s profits surge amid soaring oil and gas prices

Shell has continued its rebound from the pandemic, posting profits of $9.13bn (£7.3bn) in the first three months of the year powered by high oil and gas prices.

The results are a trebling of the $3.2bn profit it reported for the same period last year.

The energy giant further revealed it would hike its dividend by four per cent and vowed to complete its massive $8.5bn share buyback scheme following the sale of its Permian assets last year.

It now expects to buy up to $4.5bn shares before the end of the second quarter.

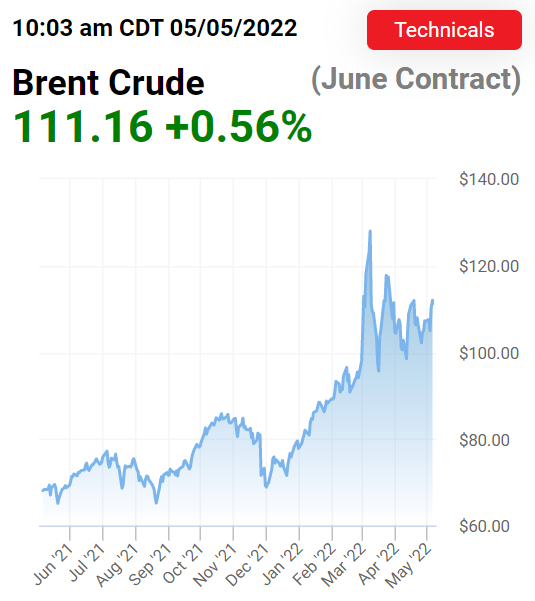

Fossil fuel trading has become increasingly lucrative for the oil and gas major, with demand recovering from the pandemic while conflict in Ukraine has exacerbated fears of supply shortages, causing gas prices to hit record highs and oil prices to breach the $100 milestone across both major benchmarks.

Favourable market conditions strengthened the energy giant’s full year results in 2021, and continued volatility across the energy sector has maintained the Shell’s momentum, with an uptick in performance echoed across the company’s latest results.

This is likely to continue, with the European Union (EU) leaning towards phasing out Russian oil imports over the next six months, which will likely maintain oil prices at elevated levels.

The firm revealed it had charged 13.7 per cent more for natural gas, and 20.5 per cent more for each barrel of oil during the first quarter of 2022, boosting its profits.

During the three month window, Shell’s adjusted earnings before interest, taxes, deductions and amortisations rose to from $16.3bn at the end of 2021 to $19bn, while cash flow from operations excluding working capital climbed to $14.8bn, up from $11.1bn in the previous quarter.

Meanwhile, net debt plunged eight per cent from $52.6bn at the end of last year to $48.5bn three months later.

The results follow Shell’s move to London last November, ditching its headquarters in Netherlands having been at loggerheads with Dutch authorities over its 15 per cent dividend tax, and continued legal pressure from the country’s courts over carbon emissions.

It also comes after rival firm BP revealed underlying profits of £4.9bn, its strongest figures in more than a decade off the back of rising energy prices.

Equinor, which supplies a quarter of the UK’s gas, and Total Energies have also recently reported strong underlying profits.

Chief executive Ben van Beurden said: “Today’s results, the progress we are making with our $8.5bn share buyback programme and the reduction of our net debt to $48.5bn all show we remain on track, and give us the confidence to plan future shareholder distributions and disciplined investments that will accelerate our strategy.”

Post-lockdown revival powers calls for windfall tax

The uptick in performance for energy majors has reignited calls for a windfall tax on domestic energy companies from the Labour Party yesterday, with the opposition pushing for a one-off £1.2bn levy to drive down energy prices for consumers.

Ed Miliband, the shadow energy secretary, said: “Another day, another oil and gas company making billions in profits, and yet another day when the government shamefully refuses to act with a windfall tax to bring down bills.”

Prime Minister Boris Johnson rejected the proposal following BP’s results on Tuesday, concerned it would deter investment in the North Sea oil and gas sector, a key tenet of the UK’s recently unveiled supply security strategy.

He told ITV earlier this week: “If you put a windfall tax on the energy companies, what that means is that you discourage them from making the investments that we want to see that will, in the end, keep energy price prices lower for everybody.”

Shell has committed to investing £25bn in the UK over the course of the decade, with a focus on low and zero carbon projects.

Business Secretary Kwasi Kwarteng has publicly backed its spending plans, and has urged the company to commit to its investment pledges.

He said on Twitter: “We’re backing North Sea oil and gas for our energy security, but in return I want to see profits reinvested back into the UK.”

van Beurden said: “Generating value through strong earnings and cash flow, coupled with maintaining a healthy balance sheet and continuing the disciplined delivery of our strategy, are crucial for Shell to play a leading role in the energy transition. This allows us to support our customers as they shift to cleaner energy. It’s also the best way for us to contribute to the security of energy supplies. “

Russian exit plans hit energy giants

Alongside hefty profits, Shell also recorded a painful $3.9bn write-down on its Russian assets, after its exit from the country in March.

This includes its arrangements with Kremlin-backed gas giant Gazprom such as its 27.5 percent stake in the Sakhalin-II liquefied natural gas facility, its 50 percent stake in the Salym Petroleum Development and the Gydan energy venture.

It also intends to end its involvement in the now shelved Nord Stream 2 pipeline project.

The company has also announced plans to completely pull out of trading in Russia following the country’s invasion of Ukraine, aiming to unwind most its Russian oil contracts by the end of the year.

Earlier this week, BP reported an eye-watering $25bn hit from its Russian divestment plans, with the group abandoning a 19.75 per cent stake in Rosneft.

The write-down resulted in the company reporting a $20.4bn loss for the quarter.

Shell chief executive Ben van Beurden said the war in Ukraine had caused “significant disruption to global energy markets”.

“The impacts of this uncertainty and the higher cost that comes with it are being felt far and wide.”

“We have been engaging with governments, our customers and suppliers to work through the challenging implications and provide support and solutions where we can.”

He also warned the world does not have a system to trace Russian oil as it is refined overseas, meaning Western government’s efforts to ban its use can only reach so far.

van Beurden explained: “We do not have systems in the world that trace back whether that particular molecule originated from a geological formation in Russia…. that doesn’t exist.”

Analysts praise profit levels but warn of transition risks

Analysts responded positively to Shell’s latest results, with the Royal Bank of Canada (RBC) describing its overall cash flow from operations of $14.8bn as a “highlight” of its first quarter update.

RBC’s Biraj Borkhataria, equity analyst and deputy head of European research said: “We believe this was way ahead of market expectations.”

“The bottom line here is that Shell continues to generate operating cash flows and free cash flows well in excess of any of its peers.”

UBS has maintained its buy position in the stock, at a target price of 2,450p per share.

Henri Patricot, director of equity research at the asset management firm forecast that shareholder distributions would rise to over a third of cash flow from operations, but not until next year.

He said: ” We model an increase to 35 per cent but from 2023 only. For the second half of this year, we model quarterly buybacks of $3bn and the return of

30% per cent of cashflows for the year.”

Laura Hoy, equity analyst at Hargreaves Lansdown described the oil industry’s upturn in performance as a “Cinderella story”, driven by “an extremely accommodative environment,”

She said: “The group’s exit from Russia took a $4bn bite out of the bottom line, but excluding this one-off expense, the group’s been firing on all cylinders as rising prices offset minor volume declines.

Commenting on its energy transition plans, she added: “While renewables is just a drop in Shell’s $19bn bucket, it’s likely to become a much larger slice of the pie as the energy transition ramps up. This technology is largely unproven, so oil and gas investors that have become accustomed to generous returns are taking a leap of faith. If the group’s able to build out this part of the business to become a reliable profit driver while oil prices are still high, it would make the transition all the smoother.”