Shakespeare: The pandemic is changing the retail market, even online

Lockdown has created a difficult situation for retailers of goods that are deemed ‘non-essential’ as brands try to adhere to social distancing guidelines for employees while balancing the need to continue trading.

Some Brits have taken to social media to argue that ordering non-essential items online creates unnecessary risks for warehouse employees. But encouragingly for other companies, new YouGov data shows that just over two thirds (67%) of Brits think it is acceptable to buy non-essential items online during the coronavirus outbreak, while a quarter (26%) think it’s unacceptable.

At the end of March many major retailers such as Next announced that they would also cease online operations following government orders to close physical stores. Despite the current government guidance encouraging people to continue online shopping, retailers said they would be shutting down to protect their warehouses and distribution centre staff.

Since trading ceased in store and online on the 26th March, Next’s buzz scores (a net measure of whether consumers have heard anything positive or negative about the brand in the last fortnight) increased from 3.9 to 6.4, implying the public viewed this move to protect staff positively (although this has since begun to sharply decline after Next put warehouses up for sale and its share price fell by 45%).

However, there will be brands which benefit from the hole left behind by retailers like Next. YouGov Profiles data indicates that of those who tend to purchase their clothes from Next, a fifth (20%) have bought clothes or accessories for themselves from Marks & Spencer in the last three months. This suggests that, should Next be unable to provide services to its customers, M&S should stand to benefit considerably.

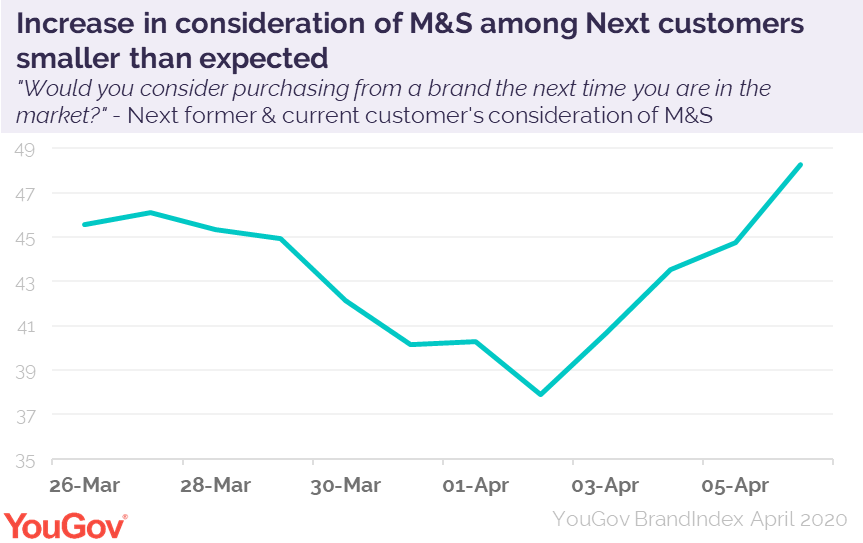

However, YouGov’s data shows it hasn’t been as clear cut as that; consideration of M&S amongst Next customers decreased by 7.7 points to +37.9 before increasing to +48.3, but this overall increase has been dampened by a general decrease in spending nationwide.

It’s likely to be a tough environment for a lot of companies out there. When YouGov asked about disposable income for the rest of March and April, 43% of Brits said they planned to spend less and 14% said they didn’t have any disposable income at all. This could explain why a brand which should have benefited from the removal of a competitor hasn’t yet benefited as much as they could have.

Stephan Shakespeare is chief executive at YouGov