Science at the heart of the square mile

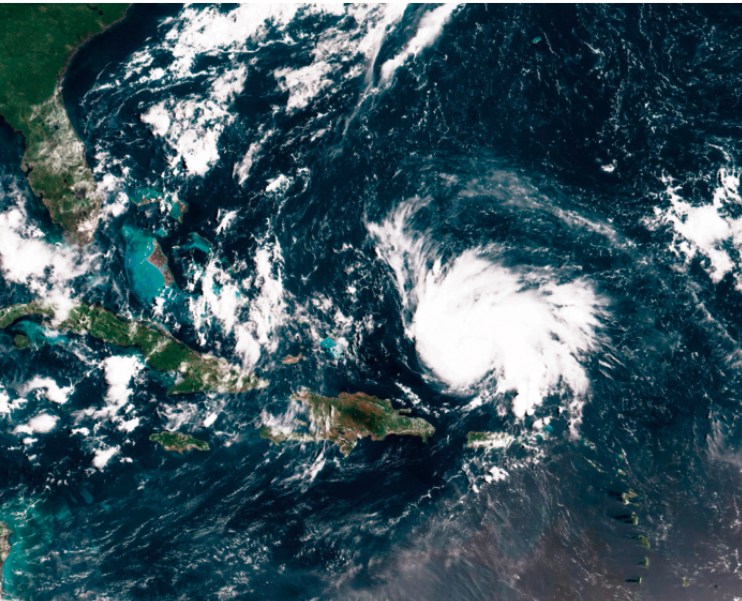

The modelling started with Hurricane Andrew,” Oriol Gaspa Rebull tells me about the forecasting work Aon does to measure the risk of so-called ‘catastrophic’ events.

That 1992 hurricane, which did extraordinary damage to South Florida, woke the industry up to the increasing severity of weather events. Every ‘event,’ of course, leaves insurers on the hook, which is why they turn to Aon to provide reinsurance to reduce their risk. Aon, then, need to price up the level of risk involved – and that’s where the model comes in. But Oriol, who leads the UK catastrophe analytics team at Aon, tells City A.M. that just handing judgement calls to ‘the model’ wouldn’t work.

“You can only model what you know. So, the model changes every time something happens that isn’t in the model: the storm surge after Katrina in the US, the Tohoku tsunami in Japan, Hurricane Sandy, also a US catastrophe.

“But what the reinsurance industry realised is that if you just look at the numbers now, you might miss something. The job of the analytics experts in the catastrophe area is to work out what we are missing, and how to quantify those factors.”

There are always opportunities – so be vocal about the ones you want

Oriol Gaspa Rebull

As ever, scratching underneath the surface of the reinsurance industry produces ever more questions. Perhaps that’s why Rebell tells us that the industry is a “hidden gem.” For one thing, when it comes to catastrophic modelling of everything from floods to wildfires to earthquakes, Aon works in collaboration with academia to advance, and make practical use of scientific research.

“I went to a conference about earthquakes in Japan, and these top researchers were explaining how difficult it had been for them to develop a model,” he recounts. “In the reinsurance industry we’d been working with academia and modelling the complexity those researchers were trying to put into their model for about ten years.’

Perhaps that’s why Rebull found the role at Aon so interesting. He came into the insurance industry from outside.

“I was researching earthquakes at a UK institution, and I was hired because of my technical skills. I didn’t know what reinsurance was,” he chuckles.

He talks of three parts of his team. He works with senior people with real expertise who can talk to clients in the markets with experience. A second raft of people are developing their skills, running the modelling, learning the industry and the client. And the third raft are younger people and graduates, who spend the first two years learning the modelling work.

His advice to the youngsters in his team is “be vocal.”

“Tell people what you would like to do. You never know what may come your way. In a company as large as Aon, there are always opportunities – but we’re not wizards, so you need to tell people what you want to do.”

For Rebull that was travelling the world, working on exciting new challenges. Reinsurance is full of those.

“People are not aware at all of how sophisticated the industry has become. People always say to me ‘I never imagined it was that complicated’.

What’s keeping Rebull’s attention today? The weather. Climate matters to insurers – from the catastrophic modelling to the cost of insuring a Bordeaux vineyard.

“One thing that really grabs people is the work we’re trying to do with the climate. It’s a hot topic. But it’s eye-opening when people realise that actually we’re helping clients on journeys towards a less

impacted world.”