Relentless

No stopping us now

The relentless surge higher continued and at one point, Bitcoin was trading just $200 away from $24,000 level. Astounding, considering that it only broke through the $20,000 the day before. The open interest (OI) continued to tick higher and the CME reclaimed second spot on the leader board, with OKEx leading the pack higher.

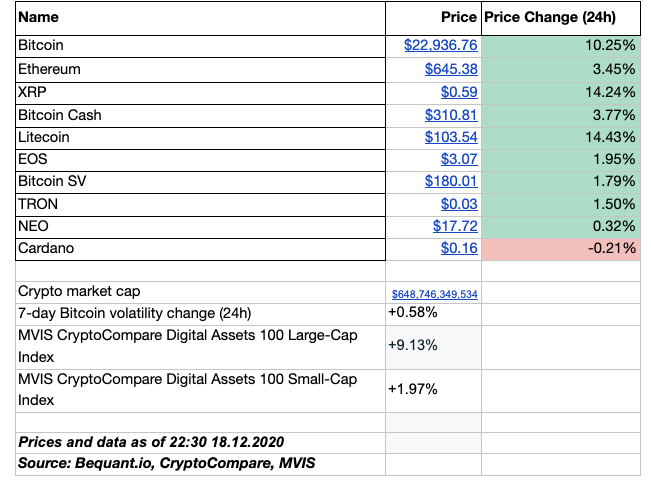

Equally, the OI across other majors remained strong and large cap assets generally fared better relative to small and mid-cap assets. Looking at the MVIS indices, the large-cap index is up 14.5%, while small-cap index is only up 5.2%.

Of course, the surge was largely driven by Bitcoin and month-to-date it is up 22%, while year-to-date (YTD) it is up 215%. Still lagging behind Ethereum, which is up 390% YTD.

In the Markets

What next?

The headlines about the break of $20,000 and what this means for the asset class going forward, mask the key headlines from this week and that is intuitional flow, which crypto natives have been craving for so long is already here and that it has been buying all along.

The question is what is next in terms of price evolution and asset class as a whole. Comments by Guggenheim Partners Chief Investment Officer Scott Minerd, who said that his firm’s fundamental analysis shows Bitcoin should be worth $400,000, will only fuel fire of the current FOMO mode.

Crypto AM: Longer Reads

Crypto AM: In conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on CEX.IO