Public sector finances: Five charts that sum up what’s happening to the UK’s finances

Chancellor George Osborne has something to smile about today, after public finance figures showed the biggest January surplus since the end of the financial crisis, putting the government on course to meet its targets. However, before he rushes out to celebrate, net borrowing still remains stubbornly high.

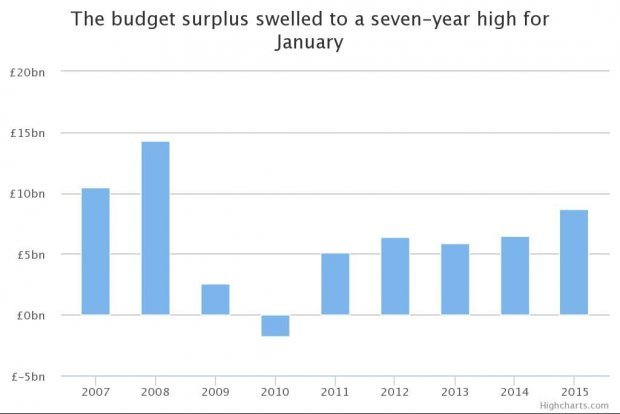

1. The budget surplus swelled to a seven-year high

Figures published this morning by the Office of National Statistics (ONS) showed that the surplus swelled to £8.8bn, almost double the figure from January last year, when it stood at £4.7bn.

2. Thanks to a generous boost from tax receipts

The surplus was aided by tax receipts which surpassed expectations growing 3.1 per cent in January. Self-assessed income tax receipts rose to £12.3bn in January, a 15.6 per cent increased from the same time last year, the ONS said.

3. Which put the government on track to meet its borrowing targets

The gains pushed government borrowing in the first 10 months of the current tax year to £74bn, £6bn less than the same time last year, the ONS said. This means that, as long as government borrowing doesn't exceed the amount from February and March last year, it will meet its borrowing target of £91.3bn this financial year.

4. Which also helped cut the bloated budget deficit of the last two months

The budget deficit was larger than expected during the previous two months – this will help the government to show it is working to tame a deficit that was threatening to become unruly. The budget deficit is the gap between what the government is currently spending and its income (which is mainly from taxes but also interest, dividends and rent income.)

5. However, despite the gains, public debt remains stubbornly high

Despite this month's gains, debt as a percent of gross domestic product – or the size of the British economy – remains stubbornly high at 96.5 per cent. So Osborne isn't out of the woods yet.