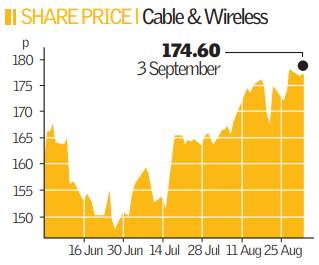

Pru and C&W wrap up £1bn pensions deal

Prudential and Cable & Wireless (C&W) have struck a landmark £1bn deal which will see the telecoms company transfer its pension liabilities to the insurer.

In the largest bulk annuity deal in the UK this year, Prudential will assume responsibility for payments to 5,000 retired members of C&W’s defined-benefit pension scheme. The move, which paves the way for a break up of its European, Asian and US businesses, will please investors.

The deal will also hand Prudential £100m in new premium income, the company said, highlighting the increasing attraction for insurers of taking on pension liabilities.

The transaction is the largest ever “buy-in” arrangement, in which the pension fund takes an annuity policy from an insurer, which then agrees to match what the fund pays to pensioners. That contrasts with a “buy-out” deal, whereby another firm assumes the pension fund from the company.

Stephen Haasz, who leads the corporate solutions team at the Pru, said: “We’ve had a large number of queries about buy-ins, some as large as two or three billion pounds.” Buthe stressed that no more deals were imminent and several companies were just “dipping their toe in the water”.

C&W has been looking to de-risk its liabilities and the transfer will reduce the exposure of its Cable and Wireless Superannuation Fund (CWSF) to market risk and the longevity of its pensioners. The £1bn premium will be funded by assets and cash from the pension fund, with C&W contributing £10m in cash. C&W will continue to administer the pension fund, which pays out about £57m a year.