A bonfire of red tape doesn’t actually make us more competitive

Stripping back regulation causes more uncertainty and can actually wind up making British businesses less competitive rather than trigger economic growth, writes Carum Basra

Last week, Liz Truss returned to the public eye to defend her brief time in office. In her speech, she called for an overhaul of the regulatory system, advocating sweeping cuts to rules she sees as stifling innovation and growth. But her arguments are both misguided and misinformed. The truth is stable and well-designed regulation supports innovation, opens markets to new entrants, and provides predictability for businesses to invest and expand. It upholds the values that people care about – worker protections, consumer rights and environmental safeguards. Without these, public trust evaporates.

For years, the view echoed by Truss has held that regulation inherently stifles investment and growth. This ideology runs counter to reality on the ground as well as the benefits smart rules provide. According to some measures, such as the World Bank’s Doing Business Index, the UK has historically been one of the OECD’s most lightly regulated economies. Promises of the savings that could result from further deregulation have proved to be an illusion. David Cameron’s much trumpeted Red Tape Challenge saved the average UK business just £230 annually.

Businesses are generally supportive of regulation, as research by the Aldersgate Group has shown. Across construction, automotive and waste industries, most businesses reported to the industry group that environmental regulations had a positive overall impact on their competitiveness. For these firms, the costs of compliance were offset by gains in quality, performance and competitiveness. This aligns with the findings of a recent essay collection compiled by Unchecked UK, in which leading UK businesses argue that well-designed regulations support innovation, investment, and growth.

Clear standards prevent companies from being undercut by competitors who cut corners on quality or protections. By mandating minimum benchmarks, regulation creates a level playing field where businesses compete on service, innovation and meeting societal goals – not a race to the bottom.

Meanwhile, wholesale deregulation risks unintended instability when business needs predictability. Rishi Sunak’s u-turn on Truss’s plans to scrap EU-era laws shows the impracticality of such an approach. Months of pressure from industry, civil society, and conservation groups forced the government to drop the “sunset clause” that would have automatically removed 4,000 EU-derived laws. This demonstrates that unilateral deregulation remains unpopular and unworkable. The path forward lies in pragmatic, evidence-based reforms updating rules where necessary while retaining balanced oversight.

The notion that Truss’s ideas are “not fashionable on the London dinner party circuit” may be true, but neither are they in Long Eaton, Blyth, Stevenage, or numerous other key battleground constituencies. Extensive focus group research conducted by Unchecked UK and More in Common in these critical swing seats shows that key voters want strengthened oversight and enforcement from government, not deregulation.

People associate stripping back rules with declining standards and a rigged system. They expect regulations to tackle problems in their everyday lives like crumbling schools, sewage pollution and online harms.

Liz Truss decries the regulatory state, but in doing so caricatures both business and public opinion. Truss’ ideological position looks increasingly outmoded. Her party would likely benefit both politically and economically from leaving rigid anti-regulatory dogmas behind and crafting evidence-based reforms that empower business within balanced oversight focused on the public good. To compete globally, the UK must lead with high ambitions for standards, not engage in a race to the bottom. With pragmatic reforms and robust enforcement, regulation drives innovation and prosperity.

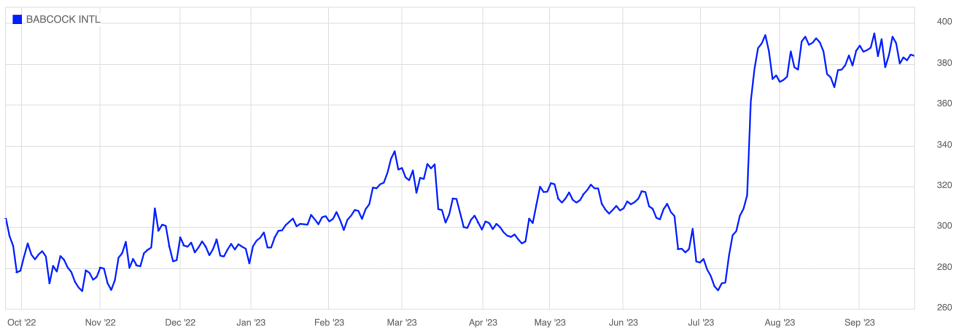

Babcock boss plays down prospect of future takeover

The boss of Babcock has played down the prospect of a takeover amid the company’s turnaround plan.

David Lockwood, chief executive of the British defence firm, told The Mail on Sunday that an upcoming sale was “incredibly unlikely”.

The defence boss was instead focused on doing the “interesting bit” of managing the company’s business strategy after cutting costs and scaling back operations.

He also argued that acquisitions in the defence sector were challenging due to the government scrutiny on each deal.

“I think it’s incredibly unlikely. I hope it’s incredibly unlikely for a few reasons. For one, there aren’t that many people in the nuclear space. Anyone wanting to enter that arena would have to clear a UK government hurdle, which, given that we maintain the UK’s nuclear fleet is a, very high hurdle,” he said.

Lockwood was at the centre biggest takeover rows when he sold the defence firm Cobham to US private equity group Advent in a £4bn deal – which eventually led to its controversial break up.

However, the boss is committed to turning around Babcock – after being brought in three years ago after the FTSE 250 firm issued multiple profit warnings.

In July 2021, Babcock announced write-offs and charges to the tune of £2bn, and job cuts of up to 1,000 staff – after a review of the company’s balance sheet.

Lockwood’s plans have included offloading a large segment of its rescue helicopter business and parts of its civil training division.

He has now confirmed the ‘stabilisation’ phase of his overhaul is complete.

The measures have also won the backing of City investors, with the company’s share price enjoying a 30-plus per cent boost this year.

Babcock’s annual results released last month showed a rise in sales but a decline in profits from £182m to just £6m.

This followed a £100m hit from a major contract to build Type 31 frigates, with the company still locked in talks over the deal with the Ministry of Defence.

Babcock begins trading 0.16 per cent down the London Stock Exchange on Monday morning, at 384p per share.

Bill Gates-backed nuclear power firm fears losing out on UK projects

A Bill Gates supported-nuclear power player is concerned it may miss out on government approval to build projects in the UK with questions over its fuel source.

Terrapower, one of the contenders in the race to build small modular reactors in the UK confirmed its intention earlier this year to enter the competition to build scaled-down power plants in the UK – in a bidding war with a hefty £20bn cap.

However, there is a row brewing between Terrapower and the government over its use of a uranium fuel source which is chiefly sourced from Russia, according to The Sunday Times.

Terrapower’s pitch for small modular reactors (SMRs) is based on bespoke ‘Natrium’ reactors, powered by high-assay low-enriched uranium.

These are considered advanced modular reactors, in contrast to Rolls-Royce’s scaled-down light water reactors, based on existing technology, which have already won £210m in funding from the government.

Whitehall officials are concerned there are insufficient supplies to import at scale to meet demand for Terrapower reactors, as most of the uranium it needs is produced in Russia – which is under sanctions following the country’s invasion of Ukraine.

The company now fears exclusion from the race to build the next generation of reactors, with the group in also in competition with GE-Hitachi, and Newcleo for projects in an increasingly crowded field.

Terrapower was founded in 2006 by Gates, the co-creator of Microsoft and the world’s fifth richest man.

Gates led a £588.3m funding round for the nuclear project last year and remains its biggest investor.

He is currently chairman of the company, and is set to meet Prime Minister Rishi Sunak next month to discuss climate change, but he will not be acting on behalf of Terrapower.

When approached for comment, a government spokesperson said: “We are determined to ensure the UK remains the best place in the world to invest in low-carbon technology, including nuclear.

“Great British Nuclear is assessing the bids received as part of the latest phase of the competition launched earlier this year and will announce an update in due course.”

Terrapower has also been approached for comment by City A.M.

Copper prices slide as waning demand in China causes stocks to rise

Copper prices have dipped despite hopes of rebounding demand in China, as its economy recovers from the pandemic with stocks in the London Metal Exchange rising again.

Prices are down 1.82 per cent heading into trading next week, dropping to $8,194 per tonne – a monthly low – with the world’s oldest metal exchange reporting a doubling of copper stocks since July.

The institute’s warehouses are now home to 162,900 tonnes, according to the latest data after inventories were bolstered at sites in Hamburg, Rotterdam and New Orleans – with 50 per cent hikes posted in August and now September.

Ewa Manthey, commodities strategist at ING, argues this a clear signal of weakening demand, but she also noted that stocks are still low by historical standards.

This meant if demand rebounds, a price rally comparable to gains made earlier this year after China lifted pandemic restrictions could be possible.

She said: “We believe low inventories fuel the possibility for spot prices to rise rapidly if consumption picks up sooner than expected. Meanwhile, loose nearby spreads indicate an ample supply of available material.”

With copper essential for renewable projects, electric vehicles and infrastructure, such an upturn was still possible – and expectations of a rebound in China’s economy over the second half of this year from Opec and the International Energy Agency (IEA).

However. Mathey noted that worries around China’s real estate sector are continuing to escalate after Moody’s Investors Service put two of the country’s strongest property developers – China Jinmao Holdings Group and China Vanke – on review for possible downgrades.

China’s new home prices fell for a third month in August and at a slightly faster pace, according to the latest government data – sliding 0.29 per cent last month from July, when they fell 0.23 per cent.

This meant further government intervention could be needed – targeted specifically at commodities – on top of the previous stimulus measures last month such as slashed down-payment requirements for home buyers and allowing lenders to lower rates on existing mortgages.

“China’s recovery is still uncertain, with anything related to real estate continuing to struggle. For copper, risks remain to the downside heading into the year’s end on China’s uncertain outlook for the property sector. We believe commodity-intensive stimulus is needed to support short to medium-term demand growth,” she said.

Another factor influencing prices is the sustained hawkish response to inflation from central banks, with the US Federal Reserve hinting policies will remain restrictive, pushing the dollar to a six-month high last week.

Any further interest rate hikes could add more headwinds during a time of already weakening demand for copper, argues Barbara Lambrehct, commodity analyst at Commerzbank.

She said: “The firm US dollar is one factor weighing on its price, especially as it is reflecting the view that the Fed will probably keep its key rate high for some time yet. In addition, copper stocks are continuing to rise.

Commerzbank is still optimistic about the copper price in the medium term, as it is “one of the so-called critical metals that will play an important role on the path to climate neutrality”.

Looking ahead, the IEA is hosting a summit next week – focusing on how to ensure sufficient supplies and investment to meet net zero goals, which could boost sentiment towards the red metal.

Asos: All eyes on pandemic poster child’s turnaround results

Investors will turn their focus to online retailer Asos’s trading update on Tuesday to see if the digital fashion store has shown signs of a rebound, following its ongoing turnaround plan and bid to pick up the pieces after a post-pandemic lull.

Asos was once the poster child of pandemic success, at its height buying high street darling Topshop and its sister brands, for £295m after the Arcadia brand collapsed in 2020.

But in May, the company proved to be beaten by a tough economic climate posting a £87.4m loss.

The London-listed company has been battling dwindling sales since a return to physical shopping post pandemic and supply issues fuelled by the Ukraine war – recently tapping shareholders for £75m to repair its balance sheet following a season of losses.

In June, the fashion brand said it was on-track to deliver adjusted earnings before interest and taxes (EBIT) guidance of £40-60m in the second leg of the year, but revenues were down 14 per cent.

In efforts to improve the business, the pure play online retailer said it is now the process of turning “stock into cash.”

Over the last two years the group said it had a build of clothes and other items – describing it as a “mismatch between our intake and sell-through” – this led to £130m of stock being written off in 2022.

Russ Mould, investment director at AJ Bell, told City A.M: “Analysts expect ASOS to have closed its financial year at the end of August with net debt of £238m and anything lower than that should be seen as good news, as less debt means less risk and less risk can mean a higher share price.”

“When it comes to the profit and loss account, the guidance issued by chief executive Jose Antonio Ramos Calamonte alongside the interim results and third-quarter update will act as a benchmark.

He added: “The CEO suggested that the second half of Asos’ fiscal year would see a low double-digit percentage drop in constant currency sales (compared to the 10 per cent year-on-year decline seen in the first half).

“He also flagged some two percentage points of gross margin improvement, thanks to lower inventory, and an adjusted operating profit of between £40m and £60m for the second half.”

‘Winners and losers’ as digital commerce feels the post-pandemic pinch: Ingenuity boss

Digital commerce leaders are facing a different “exam question” as a result of higher costs and a tougher economic environment, the boss of Ingenuity has said.

Vivek Ganotra told City A.M. that marketing costs, conversion costs and inflationary aspects on operation have pushed up the cost of sales to e-commerce brands and forced them to confront the fact that the “core proposition has become harder.

“Things are not straightforward. And the common theme I’m hearing from brands is that they’ve over-estimated their ability to do it themselves,” Ganotra said from the sidelines of Ingenuity’s Future of Commerce conference in Manchester.

Digital retail rocketed during the pandemic but life has become more challenging post-Covid-19 as competition – both in physical retail and for disposable income – has returned.

However this year alone new figures suggest as much as $5.8 trillion will be spent online this year.

Ganotra believes the market is now one where the “winners and losers” will be dictated by their investment in fast-moving technology and their ability to leverage new marketing strategies – including social media influencers.

According to Ingenuity’s Future of Commerce report, launched alongside the conference, suggests some brands are now generating 25 per cent of their revenue through the conversion of influencer marketing.

“On tech, you need to dial up your continuous investment in things like artificial intelligence, but with discipline. Don’t spend six months spending money on consultants developing an AI strategy – instead retailers need to develop really hard use cases and find some really good engineering talent to test the boundaries and find out what works for you,” he said.

THG, which owns City A.M., is based in Manchester where the conference is being held. Ingenuity is the firm’s complete commerce division.

MultiversX offers up massive million dollar hackathon prize fund

Web3 ecosystem MultiversX is to hand out a mammoth $1m prize fund at its xDay Hackathon.

Organised alongside Encode and Dora Hacks, the event is powered by partners including Google Cloud, Tencent Cloud and Deutsche Telekom, offering one of the largest hackathon prize funds in history.

The event, which began yesterday, runs until October 21.

Beyond cash and seed funding rewards, the grand prize offers the winning project an exclusive spot on the xLaunchpad platform, granting access to an incubation platform that provides emerging projects with assistance in multiple areas including: funding, legal & compliance, marketing and developer support among other services, while also giving access to a community of more than 100,000 users.

The xDay Hackathon has already garnered impressive interest, with more than 500 participants registered. The event has been designed to offer invaluable learning opportunities, including 19 workshops and four AMA sessions. Developers can build tools, scripts or smart contracts in languages like Rust, C/C++, Python, and TypeScript, making the xDay Hackathon a global call for coders of all skill levels.

“The xDay Hackathon is the very best time to build. Builders, tools, prizes, funding. Everything is ready for the global builder community. Time for builders to explore new ways of utilizing the unique capabilities of the MultiversX network,” said Beniamin Mincu, CEO of MultiversX.

Registrations for the xDay Hackathon are still open at xday.com/hackathon until October 16. The event spans six tracks: AI, DeFi, Payments, Infrastructure & Dev Tooling, Mobile Apps, Gaming & Metaverse, running from September 21 to October 20.

While the event is hosted online, the grand finale will be held at the xDay conference, in Bucharest, Romania, with optional in-person attendance.

The MultiversX ecosystem has rapidly grown to become a leading force in the blockchain space, boasting an impressive 2.3 million wallets, over 345 million processed transactions, and a thriving community of builders with 2,500+ tokens, 6,500+ applications and in excess of two million NFTs created.

About MultiversX

MultiversX is a highly scalable, secure and decentralized blockchain network created to enable radically new applications, for users, businesses, society, and the new metaverse frontier.

About Encode

Encode Club is a leading web3 education community. Its mission is to help ambitious, talented people achieve personal and professional goals together in web3. Encode does this through organising high-quality programmes including hackathons, coding bootcamps, educational workshops, and accelerators in partnership with the leading blockchain protocols. Once participating in the programming, they help people get hired through the dedicated recruitment arm or receive investment through the investment fund.

About DoraHacks

DoraHacks is a global hackathon organiser and one of the world’s most active developer incentive platforms. It creates a global hacker movement in blockchain, quantum computing and space tech, and provides a wide range of toolkits to help developers around the world team up and fund their ideas and BUIDLs via hackathons, bounties, grants and more.

Retailers put all their chips on inflation cooling during golden Christmas run-up

A better than expected inflation reading, and growing consumer confidence and sales, have offered a glimmer of hope for the UK’s retail sector, as they turn their focus to the vital Christmas trading months.

According to today’s ONS figures, retail sales volumes rose by 0.4 per cent in August 2023, partially recovering from a fall of 1.1 per cent in July 2023, when customers steered clear of the high street following unusually wet weather.

A long-running Consumer Confidence Index, published by GfK also showed that expectations for the UK’s wider economy over the next 12 months saw a robust six-point increase to minus 30, 44 points higher than last September.

It’s welcome news for the thousands of British retailers who have been navigating a volatile market since inflation peaked at 11.2 per cent last October, making consumers count their pennies and steer clear of extra spending.

It wasn’t all rosy for retailers or consumers though, even with this week’s pause in interest rate rises.

Fresh figures out this morning showing that a steep downturn in services saw economic activity contract at its fastest pace since the financial crisis – outside of the pandemic – raising the chances of a recession.

In the week, the Organisation for Economic Co-operation and Development (OECD) forecast inflation in the UK will be higher than previously expected next year while growth will be lower.

But of course, the OECD has been wrong before (and so has the ONS).

“The rise in retail sales in August suggests that the economy picked up a little after the 1.1 per cent m/m fall in July,” Thomas Pugh, economist at RSM UK, said.

Pugh said there are reasons to be “hopeful” about the outlook for consumer spending as the sector heads into the Christmas season.

“Real wages are now rising and should increase sharply over the next year as inflation drops more steeply than wage growth. That should support consumer spending power over the next year.”

In recent months, the financial outlook from some of the high street’s most valued retailers, such as Next, have started to take a more positive tone.

This week, the retail behemoth said it is likely that inflationary pressures on selling prices and operating costs will continue to ease, as it raised its profit guidance for the third time this year.

“In reality, we were overly cautious about the prospects for sales in the current year, we underestimated the support nominal wage increases, and a robust employment market, would give to our top line,” the retailer said.

“Sales are better than expected; Online service has significantly improved; costs are lower than expected and, although it is early days, and there have been bumps along the road, all three streams of new business are showing signs of promise.”

Struggling retail vessel the John Lewis Partnership, also said losses before tax and exceptional items fell from £66.8m to £54.5m in the half year when compared to the same period last year.

Dame Sharon White, said that the company would be pinning its hopes on the festive period – and its iconic Christmas advert – in an attempt to ramp up sales on final time before the year ends.

“We typically make most of our profit in the last three months of the year so a successful peak is always critical,” the retail boss said in a statement.

The boss of homeware retailer Dunelm, also said this week that a cool down in easing freight costs which would support its margins, in the months ahead.

Nick Wilkinson, chief executive officer, told markets this week: “In a period of extensive economic uncertainty, we have maintained our focus on enhancing our customer proposition, expanding our offer whilst staying fully committed to value and making every pound count.

Helen Dickinson, of the British Retail Consortium, said: The next few months are vital for retailers as they gear up for the all-important Christmas trading.

“While cost-of-living challenges continue to loom large, retailers are working hard ensuring customers get the best possible value.

She added: “Their capacity to do this is limited by the upcoming rise to business rates, which will see retailers paying hundreds of millions more every year and which the Chancellor should scrap in his upcoming Autumn Statement.”

Crypto AM Summit and Awards: Nomination entries close at 11pm tonight!

There are only 18 days to go until the start of the Crypto AM Summit and Awards, and entries must be submitted before 11pm this evening.

To enter, simply send a video of no more than five minutes explaining why the nominated person or business deserves an award to camsa23@cityam.com. Remember to add the category (listed below) which is being entered.

There is no charge or fee for entering an award – it is FREE to enter.

Tickets for the event can be purchased here… CAMSA23.

Social media – don’t forget to tag your posts with ‘#CAMSA23’.

Awards categories…

Best start-up

In honour of every individual and business who has strived to achieve or failed in their valiant attempts and tried again and again. We will be applauding a start-up worthy of all our praise.

Best Accelerator, VC or Investor

Fuelling the fires of innovation, development and entrepreneurship, the industry’s accelerators and VCs are recognised for their remarkable work.

Best Innovation in Education

In honour of academia educators, researchers or scientists who have made exceptional gains in advancing our knowledge of the transformative power of blockchain technology.

Best Digital Asset Law Firm

A salute to keen-eyed legal eagles who patrol our industries with utter diligence and total care, ensuring we stay within the boundaries of lawful frameworks.

Best Contribution from an Asset Management Firm

A doff of the cap to those behemoths of the financial world who are not only having their heads turned by digital assets, but also embracing the many use cases.

Best Digital Asset Exchange

There are hundreds of crypto exchanges in the world, each one different from the other. But which one has caught our judges’ eyes over the last year?

Best Community Building & Enhancement

Healthy communities are proving to be powerhouses driving platforms and doing the heavy lifting for many projects. But which community is proving itself to be head and shoulders above them all?

Best Digital Asset Custodian

Saluting the unsung heroes of our digital world – the people responsible for the safekeeping of our digital assets

Best Staking Product

Recognition for the crypto staking companies offering the most praiseworthy staking options or mechanisms for investors to earn rewards.

Best Sustainability Innovation

Honouring those who are making headway in the changing landscape of a greener future.

Best use of AI, Analytics or Audit

FA toast to the companies and individuals embracing the seemingly impossibly high-tech world of artificial intelligence and applying it to financial use cases.

Best Cyber Security or Fraud protection Innovation

Heaping praise on the hard work of the good guys in the face of ever more sophisticated bad guys.

Best AR / VR or Metaverse Project

Great strides are being made in the seemingly unstoppable Web3 metaverse phenomenon. But who or what is the industry leader of this formidable pack?

Outstanding Contribution to the ReFI Sector

Recognising those individuals or organisations that have gone above and beyond to advance adoption and help further the values of regenerative finance to the wider world.

Best Insurance Innovation

With so much risk, innovation and insurance is essential, but who has shown the way with the most leading edge product.

Best Web3 Gaming Project

A crowded market in one of the world’s biggest and fastest-growing industries. Who will our judges single out in this epic battle royale?

Outstanding Technological Innovation of the Year

Honouring the brilliance of those who can apply technology to the unique out-of-the-box thinking that sets them apart from those around them.

Outstanding Industry Influencer or Personality

There’s no denying that the wide and colourful world of cryptocurrency, DeFi, and blockchain has its fair share of characters with astonishing social reach, but which individual has been the face of the past 12 months?

Best Enterprise Blockchain

Celebrating the people and the companies who continue to deliver permissioned business solutions through streamlining processes at scale.

Outstanding Regulation and Compliance Impact

Applauding and giving credit to the army of tireless individuals at the sharp end of the complex world of crypto assets, digital assets and DeFi.

Most outstanding contribution to the industry

As Crypto AM continues to commit to connecting the community, our top award goes to the individual who has shined brightest this last year.

The Crypto AM Awards Judges 2022

Dr Jane Thomason

Summit Director

Dr Jane is the Emeritus Chair of the World Metaverse Council, and on the editorial board of “Journal of Metaverse”. She is the author of “Advancements in the New World of Web 3” (2023). She was featured by CNN in “Decoding the Secrets of the Metaverse,” and is AIBC Eurasia as “Web 3 Leader of the Year”.

Loretta Joseph

Co chair IDAXA

Currently, Loretta is the consultant to the Commonwealth Secretariat on Virtual assets, co-chair of IDAXA, Chair Australian Digital finance Standards council . Deputy Chair, ADC Advisory, ADC Forum Australia and member Global think-tank, Digital Assets, Salzburg Forum. Loretta is also the Fintech consultant at the Bank of Mauritius and Vanuatu Financial Services Commission Vanuatu and Member of the Board, JamboPay Kenya.

James Ramsden KC

Partner & Founder – Astraea Group

James Ramsden KC is a Partner and co-founder of Astraea Group, a multidisciplinary law firm which has forged an unrivalled expertise around the developing field of decentralised finance and cryptocurrency. James specialises in complex and high value dispute resolution and international arbitration and is instructed as Lead Counsel in some of the most significant cases in the area of cryptocurrency.

Dotun Rominiyi

director of emerging technology

Heads emerging technology globally for the capital markets division of LSEG. Steering adoption of blockchain and DLT across the group’s capital markets businesses. A career history in video games and financial services with expertise that includes software

engineering and architecture, product design and delivery, blockchain and DLT, high performance computing as well as real-time and scalable distributed systems.

Katie Evans

Chief Business Development and Communications Officer- Swarm

Katie Evans is Chief Business Development and Communications Officer at Swarm with over a decade of experience in financial markets, focusing on crypto, equities and commodities. Before Swarm, she worked at multi-asset retail investment platform eToro, where she worked with market analysts and comms specialists across Europe, APAC and the US.

Jonny Fry

CEO- TeamBlockchain

Jonny Fry is the CEO of TeamBlockchain Ltd, an advisor to various firms also Chairman at Gem Cap UK. For 20 +years he was a CEO of a UK listed asset management firm. Jonny is been the author of “Digital Bytes” which offers weekly insights into the global applications of blockchain technology and digital assets across various industries and jurisdictions. Jonny Fry is a recognised figure in blockchain and digital assets sectors and was voted Crypto A.M. 2022 “Influencer of The Year”.

Sophia Shluger

Chief Commercial Officer- PV01

Sophia is Chief Commercial Officer at PV01, a leading global blockchain finance provider. Operating between blockchain and traditional capital markets, PV01 enables fixed income assets to be issued, traded and settled on chain. She is the former MD of Amber Group Europe, a Venture Partner at VNTR Capital, a financial services executive and a global business development professional with over 15 years of track record and deal-making experience from Goldman Sachs, XP, Santander Investment Securities and American Express.

On Yavin

Founder and managing partner- Cointelligence and Co-Founder and CBO- Syndika

On Yavin, Founder and managing partner at Cointelligence Fund and Co-Founder and CBO at Syndika. At the start of 2021 he launched Cointelligence Fund, an early stage venture capital crypto fund focused on the metaverse and blockchain based games, where he serves as Managing Partner. In 2023, On co-founded Syndika, a premier Web3 and AI syndicate, with full-scale capabilities to support startups, corporates, and initiatives.

Helen Disney

Director- Blockchain

Helen Disney is Director of Blockchain and Digital Assets at The Realization Group and the founder of Unblocked. She is co-author of the book ‘The Era of Convergence’ which will be published in late 2023.

Harry Horsfall

CEO- Flight Story

Harry is a serial entrepreneur with a long track record of founding, scaling and directing cutting-edge firms at the forefront of Web3. Building a bluechip Web3 marketing agency with Flight3 and Zebu Live. With over a decade of experience in the blockchain space, Harry is an established thought leader, and one of the industry’s most vocal proponents build. In a previous life, he built and sold his music festival.

Judging Process Code of Conduct

The goal of the Crypto AM Awards judging code of conduct is to ensure that the judging process is transparent, professional, and ethical.

1. Confidentiality: Judges undertake to maintain the confidentiality of their role with respect to the identity of applicants, and the marks awarded.

2. Conflict of interest: All judges must notify the chief judge immediately when he or she becomes aware of any potential, real, or perceived conflict(s) of interest. This may include any previous professional or personal relationship between the Judge and an applicant, or the organization of an applicant. If a judge has any economic interest in a firm that is being proposed for an award i.e., is an investor/holder of any o`ptions, tokens, equity, debt instrument etc this too needs to be disclosed. A judge must also declare any potential, real or perceived conflict(s) of interest that they are aware may apply to another judge.

3. Communication: In order to provide transparency, traceability and clarity of communication, all emails related to judging should be sent directly to Crypto AM via camsa23@cityam.com, who will then undertake to ensure appropriate circulation of messages.

Judges are to refrain from communicating in any way with entrants or finalists prior to the awards ceremony. If a judge is contacted by an entrant or finalist directly, or through social media, please alert the Head Judge immediately.

4. Promptness: The dates for submission of scoring and feedback will be made available to all judges in advance and judges will be required to comply with these dates. In case of difficulty, Judges must notify the Chief Judge immediately

The Judges’ decision is final and there will be no opportunity for appeal, discussion or correspondence.

Judges will also have the right to make nominations that they believe are relevant and missing from the available judging selection, except those in any way connected with their own organization.

Segways, travelators and very, very green: What a car free London could look like

Londoners believe the capital will be the first major city to go car free – and futurists believe that’ll herald a whole new urban aesthetic.

A survey of 2,000 people found that Brits think we’ll see the first car-less city as soon as 2050, and that

the UK will beat the likes of China, Saudi Arabia and Europe to it. London ranked as the most likely city in

the world to go car-less, followed by Amsterdam, Tokyo, Copenhagen and Beijing.

More than half expect bikes and e-bikes to replace cars whilst more than one in ten think a car-free future would have Londoners finally making segways cool.

Swapfiets, the subscription bike and e-bike service which commissioned the survey, commissioned an AI artist and futurist Dan Sodergren to envisage what the city of the future might look like.

Current mayor Sadiq Khan, who has brought in the ultra low emission zone across London, would be pleased to know a car-free city could save around 1.5m tonnes of CO2 annually.

Brits think car-less cities will be much more liveable when asked how they think they will look. There will

be less roads but more green spaces and trees (41%), more cycling and pedestrianised zones (40%) and

lots more street dining (24%). Brits would also expect to see new landmarks, more commemorative

statues and more sporting facilities.

Amanda Gandolpho, Swapfiets Brand Director, said: We hope that the pictures inspire people to visualise how more liveable cities will look once they are less congested, with cleaner air, and healthier people and the shift to cycling is a big contributor to that.