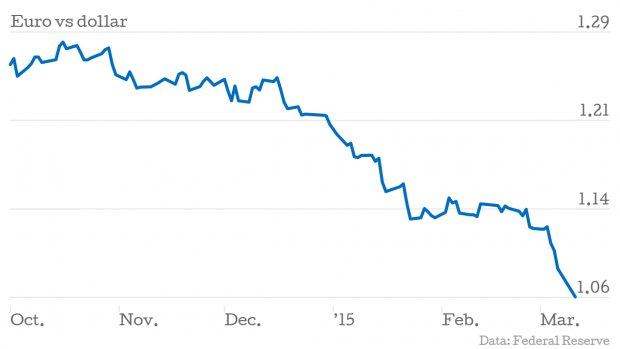

Euro slides to new 12-year low amid dollar rally

The euro continued its downward slide today, falling below $1.06, its lowest level since April 2003.

That means the currency is now within a whisker of parity with the dollar. Indeed, over at Deutsche Bank, economists believe the euro will break parity, hitting $0.85 by 2017.

In his first public speech since Frankfurt started its €1.1 trillion bond buying programme earlier this week, European Central Bank governor Mario Draghi said the bank's policies were already starting to have an effect.

We can deploy and will deploy monetary policy in a way that can and will stabilise inflation in line with our objective. Our monetary policy is certainty supporting the recovery.

The pound was up against the euro, swinging to a seven-and-half-year high of 1.4149 – a rise of 0.65 euro cents.

But the strong dollar depressed the price of Brent crude. Oil is priced in dollars, so when the greenback fluctuates it affects oil prices for buyers using a different currency, prompting traders to adjust their prices accordingly.

Beyond this, oil prices are still facing a rout, due to a glut in the global supply, as well as waning appetites from once-ravenous emerging economies such as China and India.

Brent crude, the global benchmark, had skidded to a one-month low of $55.92 per barrel earlier this morning. However, it later pared losses, and was last trading around $56.5 per barrel.

The price of oil was about $115 per barrel back in June, but crashed to just $45 per barrel at the start of this year. It has since hovered at around $60 per barrel, with some saying it was bottoming out, but recent losses stalled this.