London’s FTSE 100 bumped higher by investors pouring into UK banks

London’s FTSE 100 bounced higher today driven by inventors pouring into banks on expectations of more interest rate rises from the Bank of England.

The capital’s premier index rose 0.07 per cent to 7,282.07 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 0.2 per cent to a shade below the 19,000 point mark.

Traders have ramped up bets on the Bank continuing to lift borrowing costs despite UK inflation edging lower last month to 9.9 per cent from a 40-year high of 10.1 per cent.

Most expect governor Andrew Bailey and co to send rates 50 basis points next Thursday.

Higher interest rates often boost banks as they allow them to charge most for loans.

High street lenders NatWest, Lloyds and HSBC pushed near the top of the FTSE 100, gaining more than 1.65 per cent, “driven by investor expectation of higher interest rates and how that might have a positive impact on the banking sector’s earnings,” Russ Mould, investment director at broker AJ Bell, said.

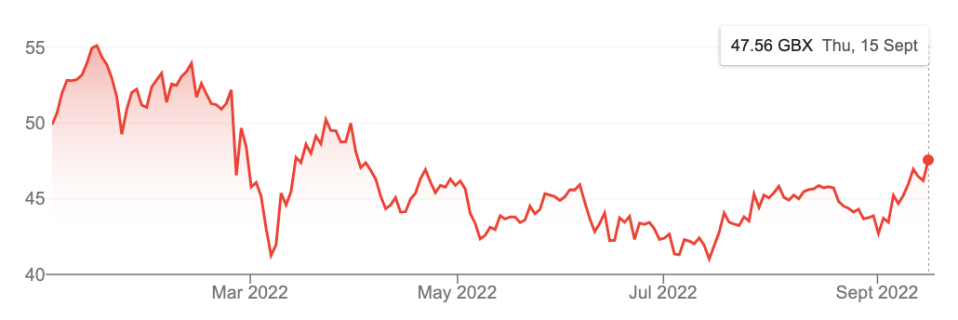

Lloyds Bank’s share price this year

Reports in the Financial Times today also reveal new chancellor Kwasi Kwarteng is mulling scrapping the cap on banker bonuses.

Removing the cap, it is argued, could strengthen London’s competitiveness in the global finance industry by allowing City banks to lure the sector’s best talent by offering better remuneration.

Critics say it could lead to a return of high risk behaviour that triggered the financial crisis in 2007.

London’s FTSE 100 was supported by housebuilders after MJ Gleeson, one the sector’s top firms, reported a jump in profits.

On the FTSE 250, travel companies led the index higher, with Tui up 4.87 per cent and short haul airline easyJet advancing 3,46 per cent.

The pound, which has reversed some of its losses against the US dollar in recent days, slid 0.5 per cent against the greenback.

Oil prices tumbled over three per cent.