Investment in central London property hits record high

Investment in central London commercial property jumped to record levels in the first quarter, driven by big ticket deals in the City & the Docklands and overseas buyers snapping up trophy schemes in the capital.

According to Cushman & Wakefield, 32 deals took place across the City and the Docklands in the first three months of the year totalling £3.31bn – the district’s highest ever investment volume.

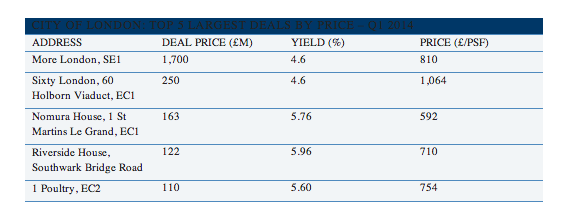

However Kuwait’s sovereign wealth fund St Martins’ £1.7bn acquisition of More London accounted for over half of the total investment volume, in one of the UK’s largest property deals to date.

The top five deals in the City & Docklands accounted for £2.35bn, or 71 per cent of total investment in the first quarter.

Overseas investors continued to be the dominant force in the capital and accounted for 77 per cent of investment. However UK buyers were the most active, completing 23 deals over the quarter worth £765.5m as investors regained confidence in the economy.

Bill Tyser, partner in Cushman & Wakefield’s City investment team, said: “From a global perspective, City of London prime yield profile remains attractive and there continues to be a considerable weight of money both domestic and international facing the market.

As the second phase rental recovery builds, coupled with positive outlooks on the UK economy and employment growth into London we can expect continuing strong activity and further yield compression as we move through 2014.”

Despite strong demand for a slice of London’s West End, there continues to be very little property available to buy and investment volumes fell by 20 per cent to £824m. Deals included Meyer Bergman’s acquisition of Waterstones’ flagship in Piccadilly from IVG for £67.5m and Shaftesbury buying Jaeger House from Derwent London for £30.75m.