What if markets take a downturn?

Market conditions have been favourable this year. Volatility has been low and returns have generally been positive for investors. Throughout 2017 we have detailed our positive outlook for the global economy and asset markets alike. While we continue to maintain this stance, here we share our thoughts on being prepared, and what to do should we experience a market correction.

1. Make sure you are comfortable with your risk level

The appropriate level of risk for your investments is driven by a combination of factors. Some of these factors will vary from portfolio to portfolio and will be linked to specific financial goals, your investment time horizon and willingness to take risk for each goal. Other factors include your overall circumstances, such as your ability to withstand short-term losses and your access to other income and liquid assets to meet unforeseen cash requirements. Be aware that the majority of asset pricing models suggest that to earn a higher return over time, an investor must have a greater tolerance for risk, or a greater ability to endure pockets of market turbulence. For example, Netwealth’s Risk Level 7 investors should have the ability to withstand much bigger peak to trough falls than Risk Level 1 investors. If you would like to discuss our risk levels, please get in contact with an adviser here.

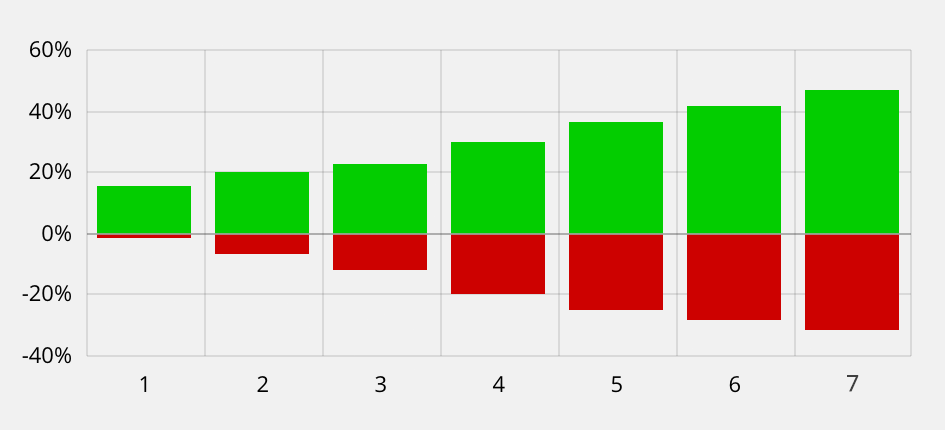

We always highlight to clients the worst historical 12 month returns in their chosen risk level before investing, and these are summarised below. While these are extreme outcomes by definition, and we should not rely on past experience to predict the future, they are examples of possible results when market environments deteriorate significantly.

Best and Worst Returns Over a 12 Month Period

Past performance is not a reliable indicator of future returns Source: Netwealth Investments, simulated historic returns based on monthly data of composite indices from the last 25 years

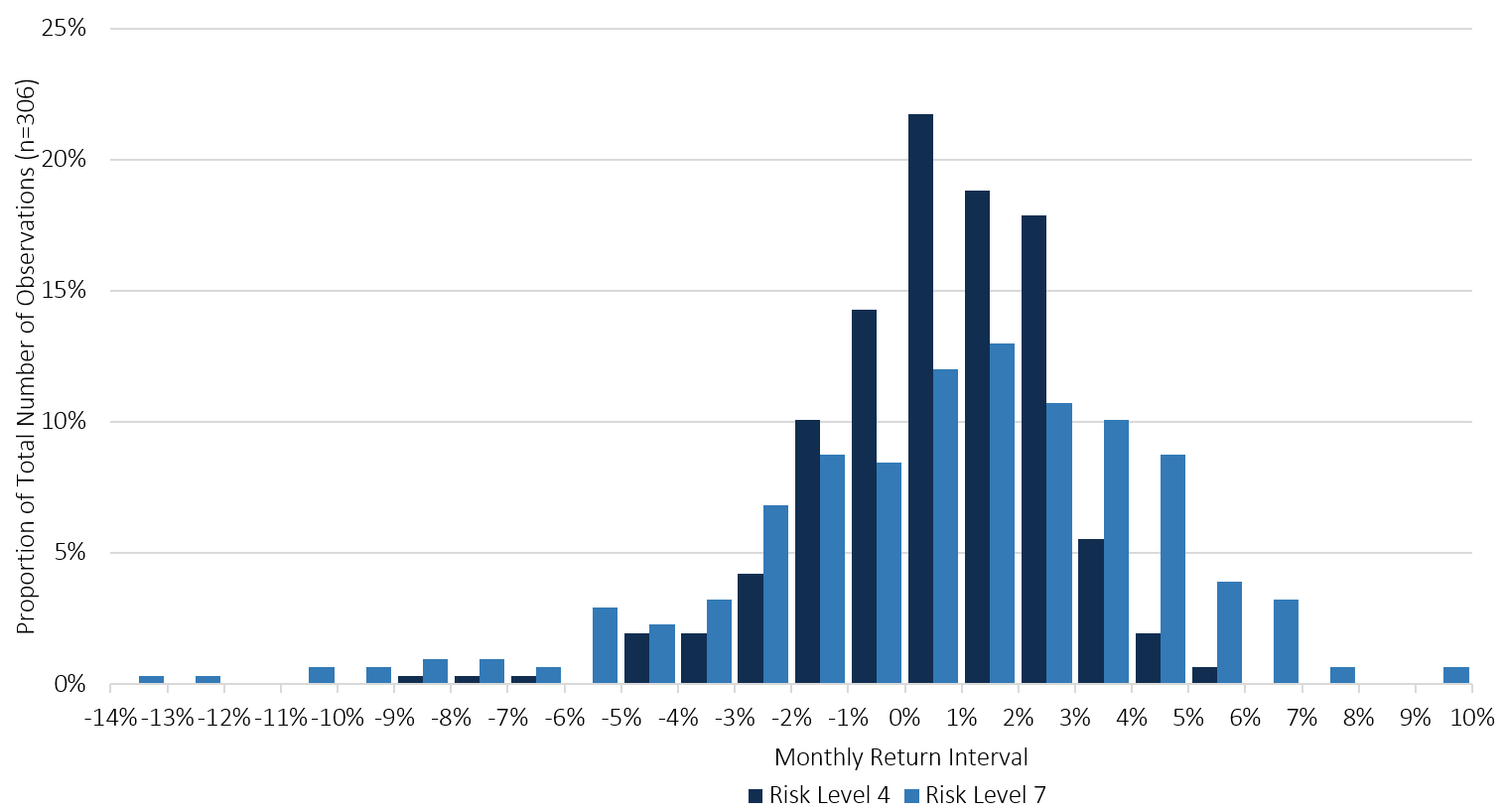

Perhaps a better indicator of usual volatility can be seen in the chart below, which illustrates the distribution of actual and historic simulated monthly returns for Netwealth Risk Level 4 (which provides a balanced exposure across equities and bonds) and Netwealth Risk Level 7 (which provides predominantly equity exposure) since 1992. It shows that the Risk Level 7 returns have greater variability than those of Risk Level 4, which are more clustered around small, positive levels.

Distribution of Historical Monthly Returns Grouped into

1 per cent Intervals

Past performance is not a reliable indicator of future returns Source: Netwealth Investments, simulated historic returns based on monthly data of composite indices from the last 25 years

2. Don’t panic in a downturn

It is an unfortunate fact of investing in risk assets that there will be periods of negative market returns, which will likely result in negative portfolio returns as well. The key, however, is not to let emotions take over. Evidence suggests that investors frequently succumb to what is known as "loss aversion" – the notion that individuals feel losses much more intensely than they appreciate equivalent gains. This often results in selling after the market has fallen, and "locking in" losses as a result, so it is vital to resist this behavioural impulse.

3. Be true to your investment horizon and objectives

It is very easy to become "spooked" by a period of market turbulence, and to make a hurried decision to reduce exposure and leave the proceeds in cash. However, we think this approach can be problematic in practice and can increase the likelihood of turning a short-term or medium-term loss into a permanent, realised loss for the following reasons:

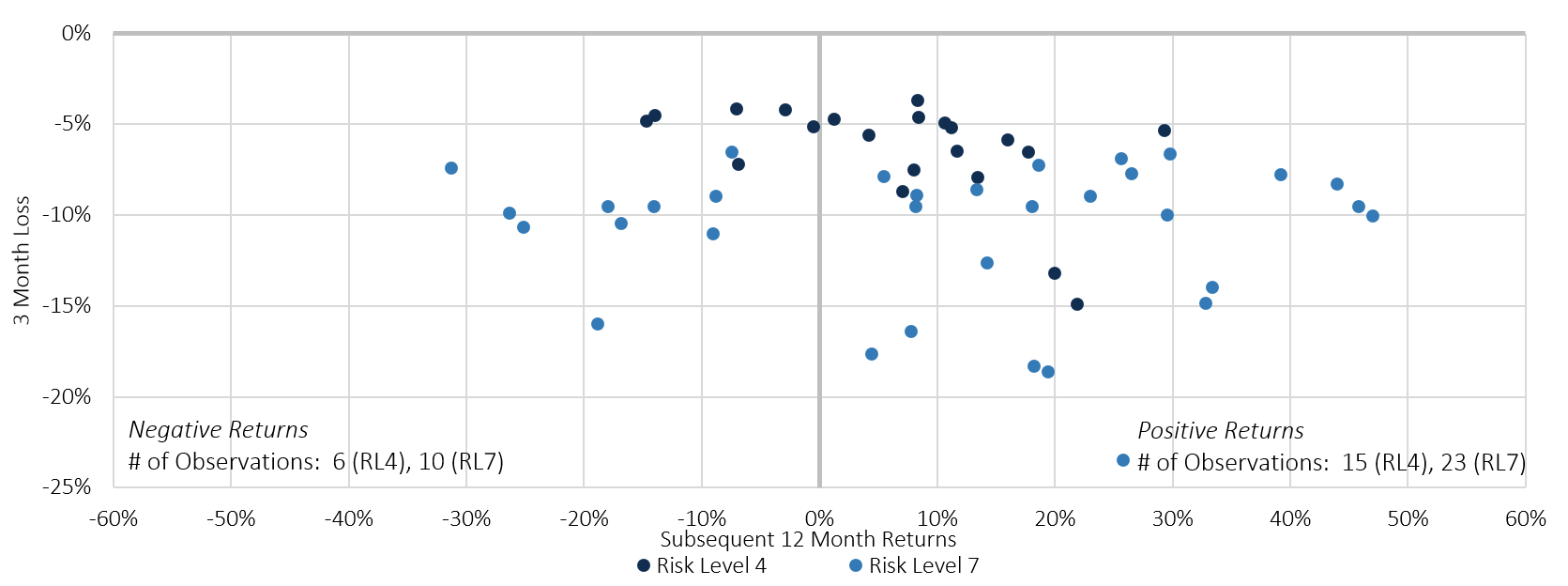

a) Markets have rebound potential. Historically after periods of negative performance, markets have often recovered strongly. If you sell after a downturn, you run the risk of missing out on this potentially meaningful period of positive returns.

In the chart below, we plot 12-month returns that follow significant losses1 over a 3-month period, again based on actual and historic simulated monthly returns since 1992. For Netwealth’s Risk Level 4 we consider 3-month losses of more than 3.5 per cent, whereas for Risk Level 7 we consider the losses of more than 6.3 per cent. There were indeed times when portfolios continue to lose value (as shown on the left side of the chart) following the initial fall. However, during the period analysed, more often than not the portfolios had rebounded 12 months later.

Subsequent 12 Month Returns After Significant 3 Month Losses

Past performance is not a reliable indicator of future returns Source: Netwealth Investments, simulated historic returns based on monthly data of composite indices from the last 25 years

b) Timing the market is incredibly difficult. Nobel Laureate Professor William Sharpe demonstrated1 that a market timer must be correct 74 per cent of the time to outperform a passive portfolio at a comparable level of risk. We think that such an assertion would be incredibly courageous for any investor and more likely a demonstration of a human tendency to demonstrate overconfidence2 rather than a legitimate investment strategy.

Furthermore, even if you choose to sell at exactly the top of the market, whether by luck or by judgement, timing when to reinvest is also incredibly challenging. A study4 by a University of Michigan professor concludes ‘being "out of the market" for as few as even one or two of the best performing months or days over several decades, a portfolio's return is significantly diminished.’ Our own analysis finds that an investor in the US market who missed the 10 best days of market performance saw their total returns diminish by more than 50 per cent since the beginning of 1987!

As we noted in August 2017, over the last 30 years, the average investor in US stocks has seen a return of less than half the broader market return per annum (4.0 per cent for the equity investor vs. 10.2 per cent for the broader equity market), in part because they have repeatedly chosen the wrong points to trade in and out of the market (Dalbar Associates)5.

Our approach

At Netwealth, our investment approach is to try and mitigate prolonged periods of volatility by a strategic diversification across asset classes, regions and currencies. We also implement cyclical adjustments to portfolios with the aim of addressing specific economic concerns or market risks that may knock performance off-track. However, such cyclical adjustments will never be of the magnitude whereby they diverge substantially from our diversified strategic allocations. In other words, clients should not expect us to amend significantly the risk profile of a portfolio, and thereby alter the portfolio characteristics to which they initially subscribed.

We think the key to avoiding emotional biases is to ensure that the client’s chosen level of risk is suitable for their financial goals and circumstances. It should be reflective of their ability to take risk (the extent to which they can cope financially with a fall in the value of their portfolio) as well as their willingness to take risk (the extent to which they can stomach a fall in value of their portfolio). The portfolio design tools on our website aim to help investors to make this decision based on information and analysis of risk and return. Additionally, we allow our clients to change their portfolio risk level through the life of their investments if they choose to or if their circumstances change.

Our last point follows part of our core philosophy at Netwealth: we encourage clients and potential clients to contact us at any time if they are unsure of anything to do with their investments, would like more guidance or would like advice specific to their circumstances.

Please remember that when investing your capital is at risk.

1Defined as losses of more than 1 standard deviation of simulated historic returns based on monthly data of composite indices from the last 25 years.

2Likely Gains from Market Timing, Sharpe, 1975

3Financial Decision Making in Market and Firms: A Behavioural Perspective, De Bondt & Thaler, 1994

4Stock Markets and Extreme Portfolio Performance, Seyhun, 2004

5www.ifa.com/articles/dalbar_2016_qaib_investors_still_their_worst_enemy/