How to find the right investor for your start-up — and stay ahead of the game

After spending two days in Porto with hundreds of start-ups and investors at Startup Portugal’s SIM Conference last week, Ambition A.M.’s Jennifer Sieg put together her own key takeaway guide for those about to embark on their funding journeys.

With some 200 start-up exhibitions and nearly 400 start-ups in attendance, I didn’t know what to really expect from the trip — but luckily, I got more insight than I could have ever hoped for.

Finding the right investment opportunities is one of the hottest topics when it comes to figuring out how to start a business because, at the end of the day, everyone needs money to make money.

But finding the right investor — or finding the right start-up — isn’t always easy for either major player.

To help you get started, Ambition A.M. put together our favourite three key takeaways.

Money won’t buy you time

Anyone would agree that more money would equal more pressure. What are you going to do with it, and how are you going to use it to help your business grow?

What many might fail to acknowledge, however, is that more money does not equal more time.

While speaking at the conference, Remote First Capital Andreas Klinger said one of the most common mistakes a founder can make is assuming that investment can accelerate an already-established timeline too quickly.

Before you know it, your three main projects can turn into 10 unmanageable ones.

“All of a sudden, your leadership team that has been hired two months ago is having multiple projects they have no idea about, all these new people coming in… you lose your focus, you lose your control, and the whole company goes a-wall very quickly,” Klinger said.

Marcelo Lebre, founder of HR management platform Remote, frustratingly agreed.

“It’s a marathon, it’s not a sprint,” he said, adding that marathons – realistically – aren’t easy.

Make sure your values align

Founders are quick to assume they need to impress investors, but realistically, it all comes down to whether the values of both parties align.

While speaking at the conference, start-up advisor Mike Sigal said start-ups and investors must follow a framework that works for both parties — and there’s many to choose from, as long as there is the right complementary “thesis”.

The thesis he referred to is one that outlines the values of each party, meaning that if you’re looking for an investor, you should make sure they’re the right match for your start-up, vice versa.

What are you looking for? What do you believe in? Is your mission statement similar to theirs, and will they uphold the values your business plan is proposing?

Sigal said: “What does this mean for an entrepreneur? This means that if you don’t fit their [investors] thesis, you get no money.

“So going and talking to funds, whose thesis is not aligned with your stage, your geography, your sector, how you’re thinking about growing the business, you shouldn’t be talking to that VC.

“Not all dollars are the same.”

The littlest of things can have the biggest impact

Walking through the exhibition stands set up by hundreds of founders, you’d be forgiven if you left overwhelmed.

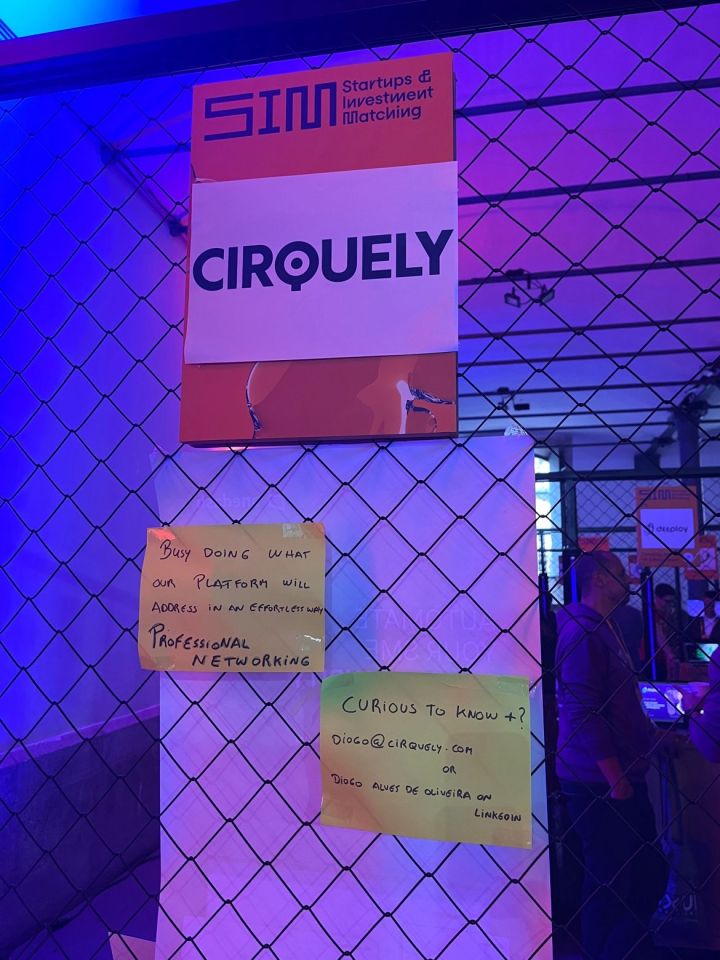

My favourite exhibit, however, was founder-less — and it was the most brilliant marketing technique I’ve spotted in a while.

Taped on the back of the empty stand, a plain piece of paper read: “Busy doing what our platform will address in an effortless way: professional networking.

“Curious to know +? Diogo@cirquely.com or Diogo Alves de Oliveria on LinkedIn.”

Odds are, without the sign, I would have kept walking past – after all, there were hundreds of start-ups to get too – but the founder’s zero-cost marketing effort worked.

Yes, I turned to LinkedIn, curious to know more, and what I found was that sometimes, it is the littlest of things that can make the biggest difference.

Moral of the story? Don’t be afraid to get creative – journalists and investors might like the effort.