Gulf Keystone surges 17pc on legal outcome

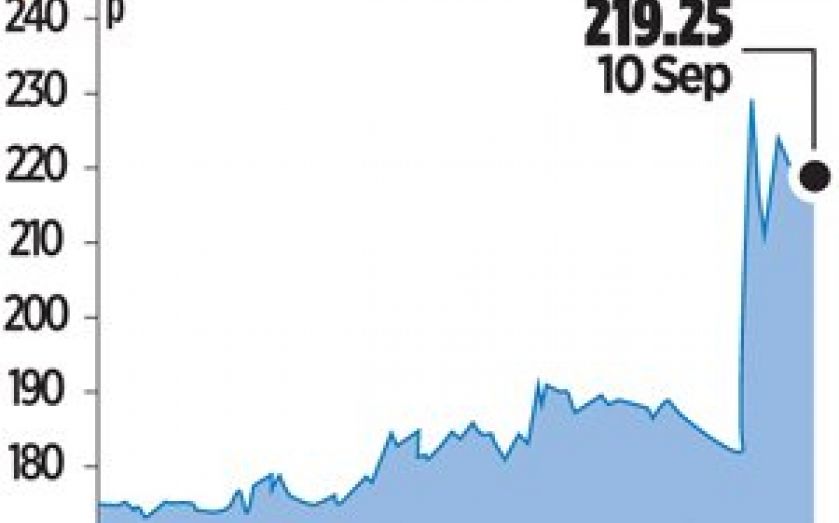

AIM-LISTED oil explorer Gulf Keystone Petroleum’s share price soared almost 25 per cent yesterday, after a three-year court battle over assets in Kurdistan was ended in its favour.

The English Commercial Court in London dismissed all claims by Excalibur Ventures, which argued that it was owed a 30 per cent interest in GKP’s assets in the Shaikan oil field.

“The board and management will now focus on progressing the ramp-up in production and development of the Shaikan discovery in Kurdistan,” said chief executive Todd Kozel.

“On the corporate front, our next objective is to complete the move [from Aim] to the standard segment of the official list [on the London Stock Exchange] by the end of 2013.”

GKP has long been seen as an attractive takeover target for companies looking to tap into the lucrative Kurdistan oil market and it is thought that the conclusion of the court case removes an obstacle towards a potential sale.

However, analysts have warned that GKP still comes with risks.

“GKP has not given a definitive recovery plan and other companies with similar valuations have more mature assets in Kurdistan, such as Genel Energy,” Mark Wilson at Macquarie Bank told City A.M.

Dragan Trajkov, analyst at Westhouse, said that political uncertainty in Kurdistan could be the main obstacle for a potential sale. Shares closed 16.8 per cent higher at 219.25p.