Green shoots: Four charts that suggest the worst is over for the UK economy

The UK economy suffered its worst month in living memory in April, but there are tentative signs that things began improving in May as coronavirus restrictions were gradually lifted.

“The government’s plans for a progressive opening up of non-essential stores in June suggest that the low point for the economy is behind us,” said Ruth Gregory, senior UK economist at Capital Economics.

“But with the damage caused by the lockdown measures likely to weigh on the level of activity for some time, the road to recovery will be slow.”

Here are the latest pieces of data that suggest the UK economy may be recovering, albeit at a crawl rather than a sprint.

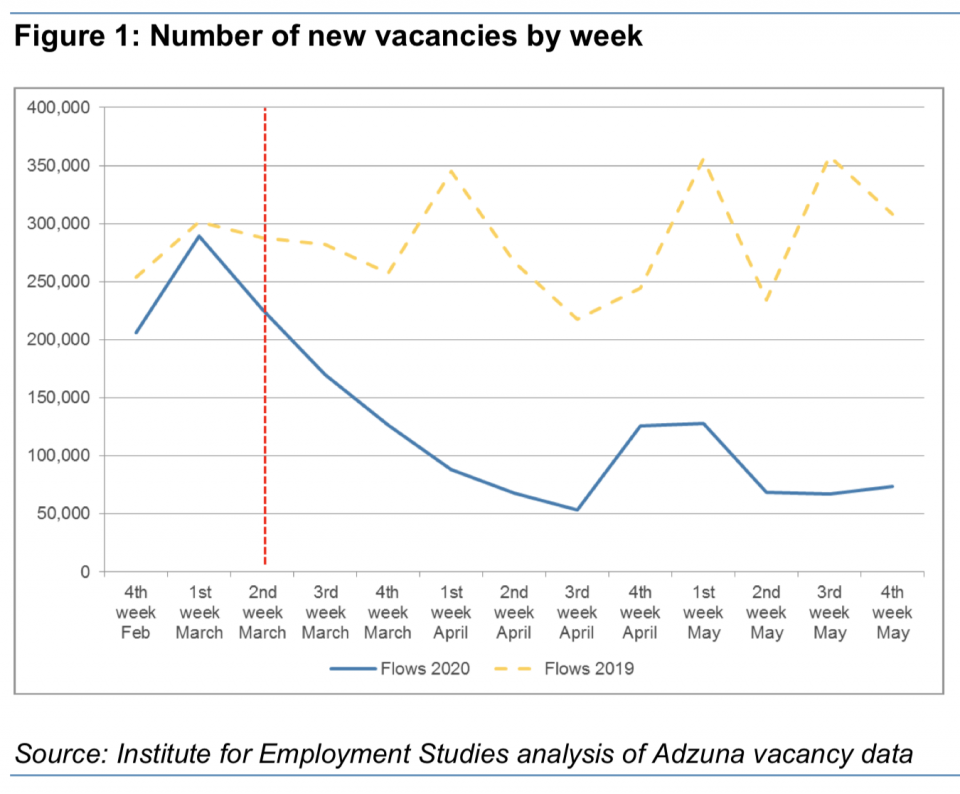

Job vacancies bode well for UK economy

The number of job vacancies has crashed amid the coronavirus pandemic as the employment market has dried up. The latest figures show that more than 8m people have been furloughed by their employers.

But data from the Institute for Employment Studies (IES) suggests that the collapse in the job market bottomed out in May. It said that in the week to 24 May vacancies increased slightly by five per cent or 16,000.

IES data shows new vacancies have picked up since the end of April

This suggests some employers are planning for an economic recovery and looking to hire staff. The government plans to allow non-essential retailers to reopen from 15 June, which could help the labour market.

Vacancies remain about 67 per cent lower than in the week before the crisis began, however. IES researchers said it is “the toughest jobs market in a generation”.

Before the Open: Get the jump on the markets with our early morning newsletter

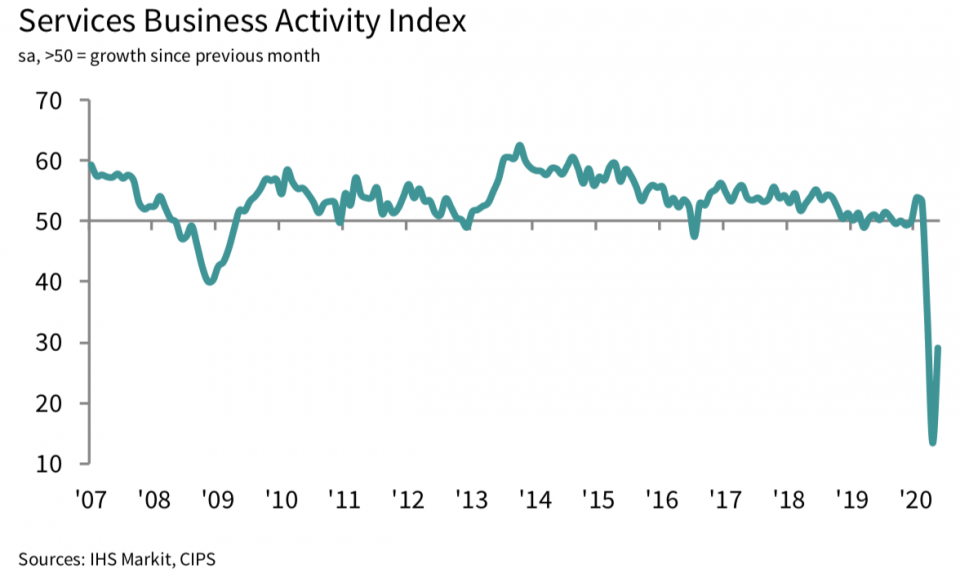

Minor uptick in PMIs as lockdown eased

Purchasing manager’ index (PMI) surveys are some of the most up-to-date indicators and are closely watched by economists and policymakers.

They crashed in April around the world to record lows as normal life was brought to a halt, with the public indoors are businesses shuttered.

But the IHS Markit composite UK PMI – a gauge of the health of the private sector – picked up to 29 in May from 13.8 in April.

IHS Markit data suggests April was the worst month for the services sector

Although a score below 50 should indicate contraction, many economists said the reading showed that the worst was behind the UK economy.

“In practice, the index is excessively influenced by general levels of business sentiment,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

There was a pronounced lift in the manufacturing PMI reading. This suggested some firms returned when the government eased the lockdown in mid-May.

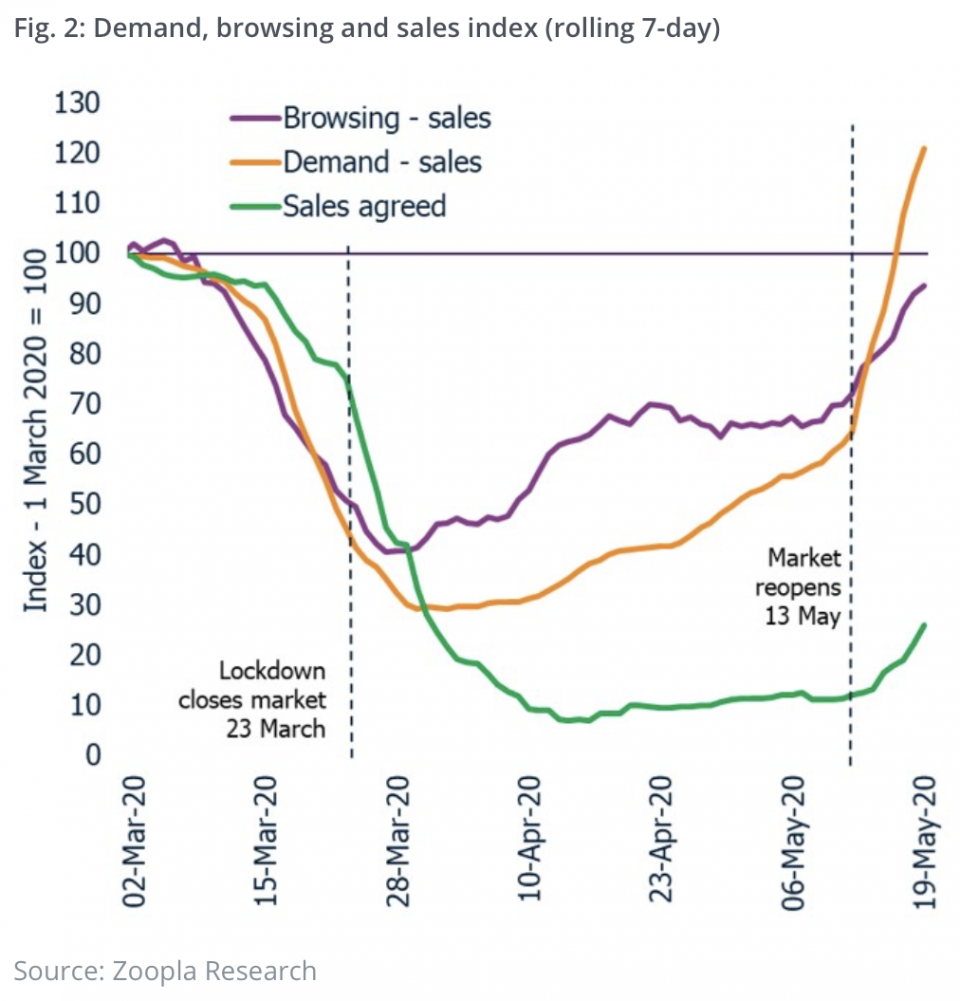

Housing market could boost UK economy

The entire housing market was effectively frozen in April as coronavirus restrictions stopped people from going to viewings. As the UK economy collapsed, job losses also caused demand to slump.

Yet restrictions were eased in mid-May, causing demand for houses to soar by 88 per cent, according to property website Zoopla.

Data from Zoopla shows a surge in interest in the property market

Richard Donnell, director of research and insight at Zoopla, said the surge in demand was largely due to the housing market being locked down for 50 days. Spring is a traditionally busy period.

Yet he said that “the majority of would-be movers plan to continue their search, encouraged by low mortgage rates and continued government support”.

However, UK house prices dropped by 1.7 per cent in May compared to April, according to Nationwide. That was the sharpest fall since 2009. Analysts said prices could fall by five per cent this year due to the crash in the UK economy.

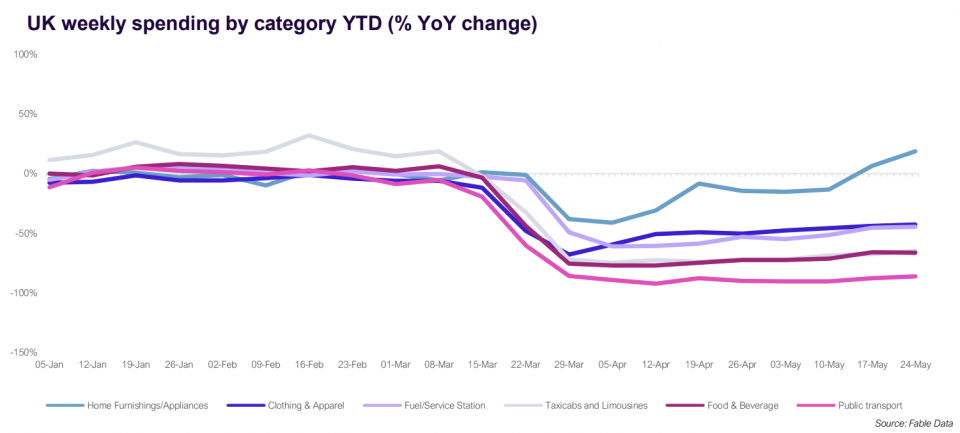

Consumer spending picks up slowly

Consumer spending is of course one of the key drivers of the economy. Yet it plunged at a record pace in April. That came as the lockdown kept people away from non-essential shops, pubs, restaurants and theatres.

However, data from Barclaycard last week provided some hope. The number of its small and medium-sized clients actively taking payments increased by 24 per cent since the low point in early April.

Fable Data shows UK spending increasing in the period up to 24 May

Fable Data, which collates information from banks and fintech firms, said consumer spending has risen slightly in recent weeks. Lockdown is making Brits buy home furnishings and appliances in particular.

Data from the Bank of England this week showed that Brits were saving record amounts. UK households returned £7.4bn to banks in the largest net repayment since records began.

But that prompted some to say there could be a spending rebound that would help the UK economy once coronavirus restrictions are lifted.