Grainger cuts costs to ride out the gloom

Residential property company Grainger said yesterday it had sold £122m of assets and is slashing costs as it hunkers down to ride out the credit crunch.

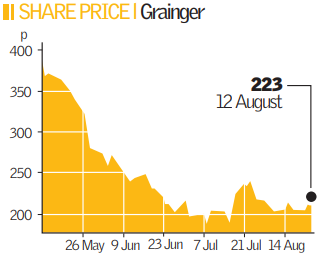

Shares in the listed company, which owns and manages more than 20,000 properties in Britain and Germany, edged up nine per cent as the firm outlined measures to cut costs, including a near halt to acquisitions and its development pipeline. Grainger said it was working on reducing £1.65bn of debt.

Grainger said it was working on reducing £1.65bn of debt.

In the last 10 months, the firm sold £122m of assets, with £62m still in lawyers’ hands and a further £32m, currently on the market.

In the 10 months to the end of July, sale prices of vacant properties in its core portfolio and equity release home reversion scheme were two per cent above September 2007 prices.

But the firm warned that the rapidly worsening housing market, coupled with the lack of mortgage finance meant that sales transactions yet to be completed would be sold at seven per cent below September 2007 values.

Grainger chairman Robin Broadhurst said these were “unquestionably difficult times for businesses in the residential sector”.

“In response to these market conditions we are putting increased emphasis on cash generation – by driving through a significant programme of asset sales, by reducing acquisitions and spend on development projects and by cutting overhead costs,” he said.

The company predicted that the housing slump was far from over, adding that it intended to slash costs by 10 per cent by the end of the financial year. Shares in Grainger closed 19p higher at 223p.