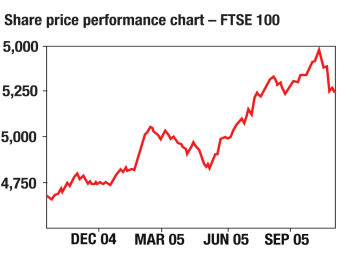

FTSE falls to lowest level since July

The FTSE fell to its lowest level since July as fears about rising interest rates wiped out value on stock exchanges across Europe.

It emerged yesterday that the Monetary Policy Committee (MPC) voted unanimously to keep British interest rates at 4.5 per cent. Analysts said that this signalled a rate cut to coincide with November’s key inflation report is increasingly unlikely.

The FTSE 100 index dropped 1.6 per cent to 5180.6 around midday. It closed at 5167.80. The FTSE All-Share dropped by 1.7 per cent to 2591.77

The MPC was split 5-4 when it last cut rates in August. Many are now looking to February 2006 for the next cut.

American producer price inflation figures released on Tuesday were way above analyst forecasts, raising real fears that oil-related inflation could feed through into the American economy. American inflation is now growing at a rate of 2.6 per cent annually, making it likely that the hawkish Federal Reserve board will make a series of 25 basis point cuts in the run-up to Christmas.

British inflation figures were also high; the consumer price index rose more quickly than at any time since it was adopted in 1997.

However gross domestic product (GDP) growth is still way below trend as the first estimate of third-quarter GDP is likely to show when it is released tomorrow.

Meanwhile, Hurricane Wilma is whipping up a storm in the American markets.

The hurricane is now a category five, and the strongest Atlantic hurricane ever recorded, according to the US National Hurricane Centre.

Its 175mph winds are nearing the Gulf of Mexico, where oil production has already been devastated by Rita and Katrina.