FTSE buoyed as Draghi speech reverses trend – London Report

BRITAIN’S top share index turned positive late yesterday after European Central Bank president Mario Draghi said unconventional monetary policy measures could include buying sovereign bonds.

Draghi also told the European Parliament the ECB will continue to do “whatever it takes” within its mandate to save the euro and that the single currency was irreversible.

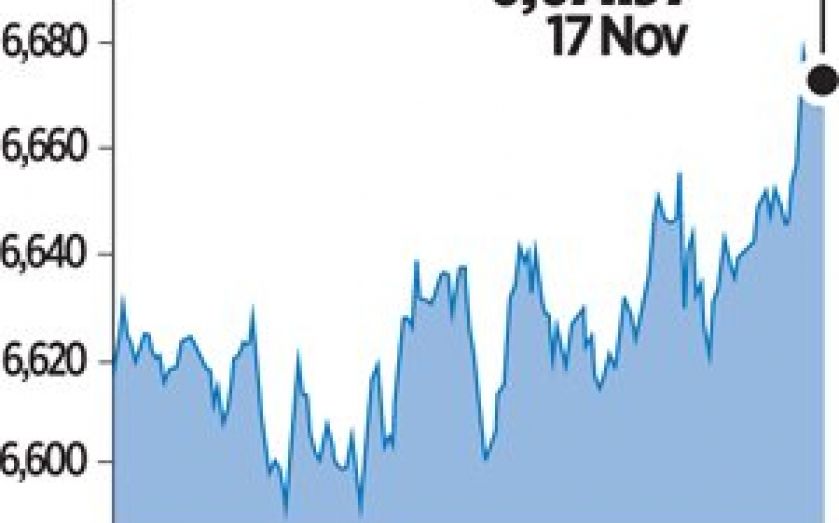

The FTSE 100 index ended 0.3 per cent higher at 6,671.97 points, after earlier touching a low of 6,616.12 as news that Japan’s economy unexpectedly shrank in the third quarter reinforced worries about global growth.

Drugmaker AstraZeneca fell 1.3 per cent to 4,596.50p after US rival Pfizer dampened investors’ expectations of a renewed bid for the British firm by signing a major cancer drug deal with Germany’s Merck. That reduces the Viagra maker’s need for Astra’s products.

On the small-cap FTSE Alternative Investment Market index, Quindell fell 19 per cent to 55.50p after the IT consultancy firm said Canaccord Genuity had resigned as its financial adviser and joint broker on 21 October.

Quindell said the resignation would be effective from today. Quindell’s stock has shed about 90 per cent of its value in the past seven months.

On the positive side, blue chip ARM Holdings rose 2.4 per cent to 890p, the top gainer in the FTSE 100 index, after Exane BNP Paribas raised its stance on the stock to “outperform” from “neutral” and lifted its target price to 1,100p from 900p, traders said.

The biggest faller was Weir Group, which slid almost 3.8 per cent to 2,047p.

Supermarkets were also lower, with Sainsbury’s closing down 1.63 per cent at 265.70p and Tesco shedding 1.18 per cent to close at 192.70p.

After the market closed, Marks & Spencer said it had appointed Helen Weir of John Lewis as its new chief finance officer. M&S shares ended up 0.85 per cent at 473p.

Miners were stronger despite the mixed international news with Fresnillo up 2.22 per cent to 736.50p and Anglo American rising 1.29 per cent to 1372.50p.

With China’s economy also showing signs of slowing, Asia-facing stocks were under pressure as Standard Chartered fell 2.25 per cent to 936.30p and HSBC dropped 0.42 per cent to 640p. Consumer goods giant Unilever was 0.27 per cent lower at 2,598p and luxury goods firm Burberry eased 0.51 per cent to 1550p.