Five years since Brexit: four charts to show UK shares could be returning to favour

As Brexit negotiations reached their denouement late last year UK investors sensed the outlook for their home market improving.

The Schroders 2020 UK Financial Adviser Survey revealed 40% of respondents were looking to increase allocations to UK shares over the subsequent 12 months, see: Are investors adjusting to the new normal?

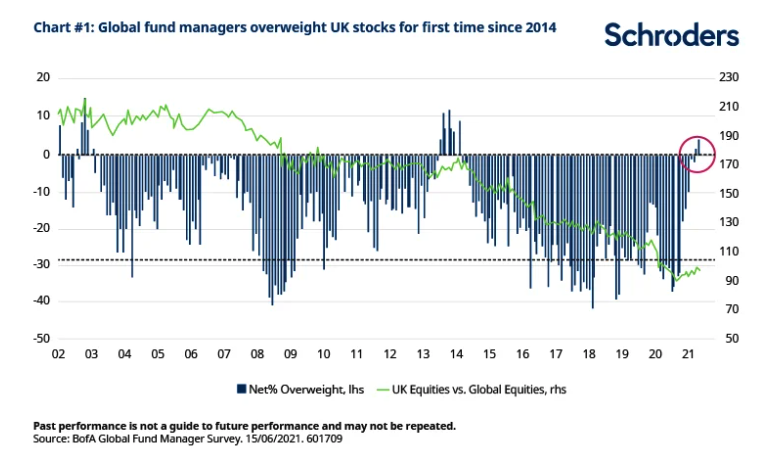

Six months on, with a “no-deal” outcome averted and following the efficient distribution of Covid-19 vaccines, it seems international investors are finally regaining some interest too. The latest Bank of America (BofA) global fund manager surveys reveal respondents are “overweight” UK stocks for the first time since March 2014 (see chart 1, below).

This is partly as a result of wider trends. Lowly valued and economically-sensitive shares (where the UK is well represented) have enjoyed a very good run since November. This followed news that Covid-19 vaccines had proved highly effective in trials, which dramatically improved the outlook for the world economy.

UK stocks, however, had lagged global ones for many years prior to Covid-19. Certainty around Brexit has also been a factor in their relatively strong performance of late (see most recent section of the green line in the BofA chart).

The deal in place has been judged better than the default of World Trade Organization rules and tariffs.

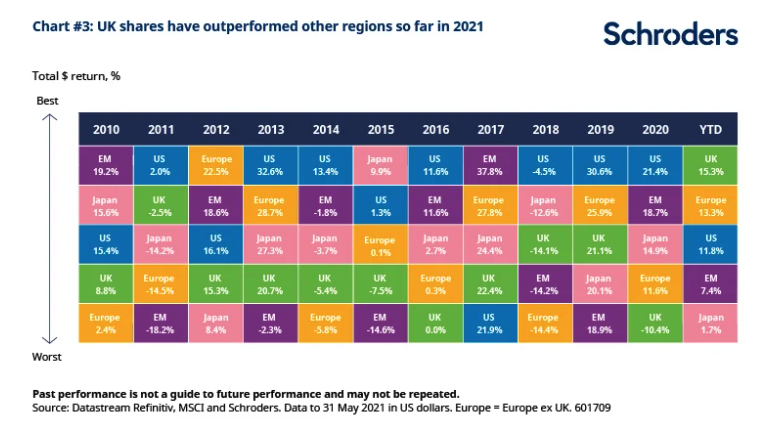

So far this year, UK shares have returned 15.3% (total returns, US dollars), comfortably outperforming other major regions, including Europe, the US, Japan and emerging markets (EM) (see chart 3, below).

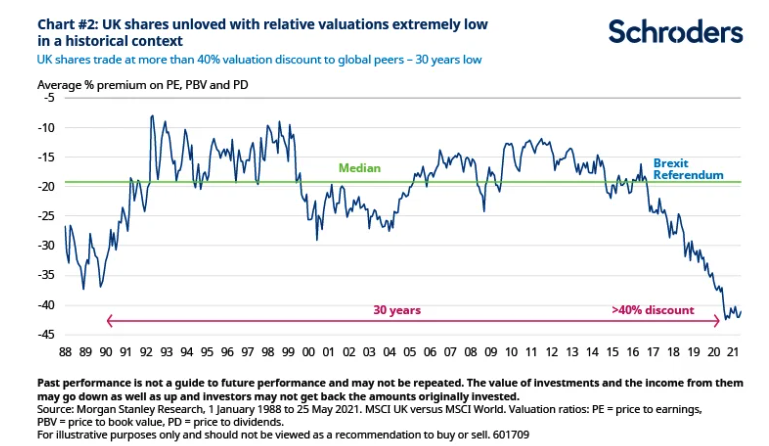

However, they still remain unloved, with relative valuations extremely low in a historical context (see chart 2, immediately below). This analysis is based on a range of metrics, namely the price-to-book value (PBV) ratio and price-to-earnings (PE) and price-to-dividends (PD) ratios (see definitions at the end of the article).

Sue Noffke, Head of UK Equities, says: “Perceived significant political and economic risks of Brexit led to total returns from UK stocks lagging those of international peers, with sterling weakness exacerbating this differential.

“Five years on from the UK’s decision to leave the EU, these risks have receded. But the valuation of the UK stock market continues to reflect the prior unloved status.

“The market trades at a 40% valuation discount to global peers, a 30-year low. The government has secured a large majority, while the domestic economy has weathered the storms of Brexit and the Covid-19 pandemic and is set to recover strongly.

“The UK stock market comprises a large element of international companies as well as domestic names. Many stocks have proved resilient and are cheaply priced relative to international peers, and offer good prospects for future growth.

“Active managers are finding the UK stock market provides a rich set of attractive investment opportunities to choose from.”

There has also been a resumption in UK “inward” mergers and acquisitions (M&A) from overseas buyers in 2021. This perhaps underlines the extent of the opportunity, which investors of a long-term mindset have noted for a while now, see: Who’s buying UK shares and what does it tell us?

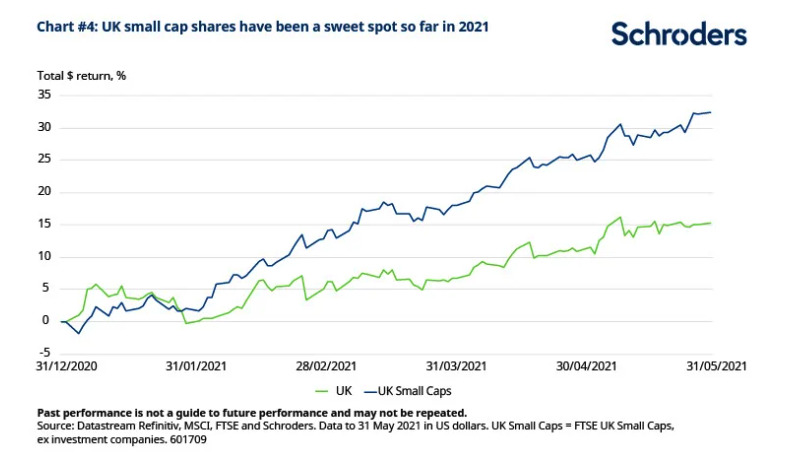

As lockdown restrictions have been eased, hopes for a fast economic recovery have increased. This has been reflected in the very strong performance of domestically-focused companies, including UK small cap shares. (see chart 4, below)

Rory Bateman, Head of Equities and UK fund manager, says: “There’s no doubt investor confidence is improving significantly.

“UK small caps are one of the best performing equity markets in the world this year, driven by clarity around Brexit and visibility around the end of the pandemic helped by the vaccination programme.

“There’s a long way to go as the UK market has lagged global peers for a long time, so we continue to believe there are many exciting growth prospects, particularly within the small and mid-cap areas.”

For investors in small and mid-cap companies, there are a wide range of opportunities across different UK industries, including technology, industry and construction.

Government initiatives to stimulate housing market activity should stand industrial and construction companies in good stead. For background on these and other trends see: Who will be the winners from the UK’s lockdown lifting?

However, investors should be aware of two key areas of vulnerability that are perhaps less well understood. The first of these relates to Brexit.

It appears that firms on both sides of the English Channel had been stockpiling goods and supplies, possibly as insurance against a failure by authorities to agree a trade deal.

Azad Zangana, Senior European Economist and Strategist, says: “Inventory levels are very high, and UK companies will probably reduce production, and possibly even discount stocks, in order to clear excess inventories. This would suggest downside risk to growth ahead.

“The second cause for concern is the high dependence of both households and firms on the UK government’s furlough scheme introduced during the pandemic. Unemployment may rise as the programme ends.

“We do expect the official unemployment rate to rise to over 6%, but the re-opening of businesses is likely to help most of those currently benefiting from the furlough scheme back to some form of employment.”

For background, see: How strong might the UK’s post-Covid economic recovery be?

After being overlooked for so-long it would seem that domestic and overseas stock market investors at large have begun to reappraise the outlook for UK shares.

Brexit certainty and an efficient vaccination programme have helped to change perceptions for the better.

Active investors are finding plenty of attractive opportunities.

Price-to-book value (PBV) ratio

A company’s “book value” is the value of its assets minus its liabilities (net asset value), at a set point in time. If a company’s share price is lower than its net asset value (PBV ratio of less than one) then it might be considered as potentially good value and worthy of further analysis. However, for companies with little in the way of physical assets, such as technology companies, PBV ratios have their limitations.

Price-to-earnings (PE) and price-to-dividends (PD) ratios

The PE ratio compares a company’s share price to its earnings per share. The PD ratio is a company’s dividend per share divided into its share price. Because a PD ratio accounts for cash actually being paid out to investors (dividends) as opposed to earnings, which are an accounting concept, it can be a more reliable valuation metric.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.