Exclusive: Good Energy boss hits out at ‘misty-eyed’ calls to nationalise utilities

People should not get “misty-eyed” over nationalised utilities and its potential to ease soaring household bills, warned the boss of a long-standing energy supplier.

Good Energy chief executive Nigel Pocklington told City A.M. he understood that levels of anxiety around the eye-watering costs of energy were “very high.”

However, he slammed nationalised utilities as “hopelessly inefficient” and argued that, historically, they drove “very little innovation.”

By contrast, private firms had powered key modernisations in the sector that had made the market more efficient and improved customer service.

He said: “There’s a real risk we throw out innovations in terms of service and efficiency because we’re keen to point the finger at energy companies.”

As examples of private sector enhancements, he highlighted Good Energy’s feed-in tariff scheme for solar panels and Kraken, Octopus Energy’s data and technology platform designed to boost customer service and company efficiency.

Pocklington urged Downing Street hike its pledged £15bn package of support for households to reflect expected rises in the energy price cap this winter, amid continued supply disruption and volatility in Europe.

In his view, this should include more targeted support through the benefits system and public information campaigning on energy efficiency, such as turning down boiler flows.

Pocklington believed this should be done immediately, rather than waiting for the outcome of the Tory leadership contest to be settled on September 5.

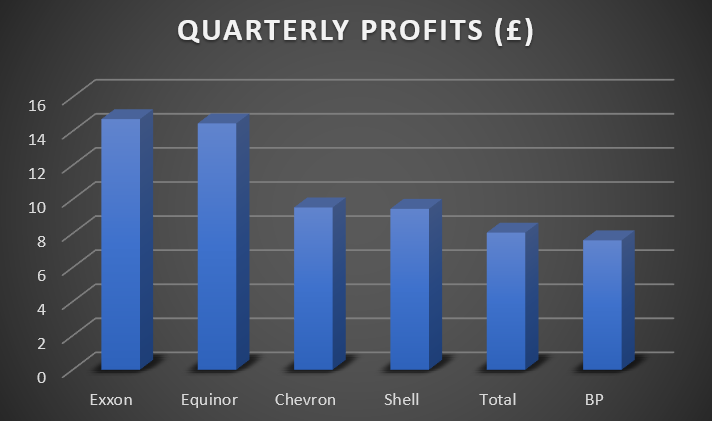

However, he was also keen to stress the distinction between energy suppliers in the retail market, and energy producers riding a commodities boom such as Shell and BP.

He felt it was unfair to treat energy companies as a “single blob” and that there was a “huge difference” between his business and global energy giants developing projects in the North Sea.

The chief executive said: “I promise you we’re not returning billions to shareholders. Energy supply is a very difficult market to make any sort of money in at all.”

While big energy producers were raking in record quarterly profits amid a boom in oil and gas prices following Russia’s invasion of Ukraine, the retail market has been rocked with instability.

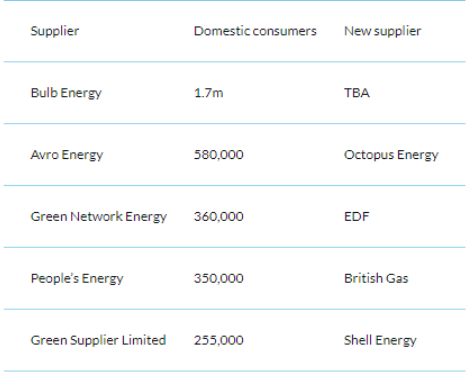

The industry has suffered from nearly 30 suppliers collapsing over the past 12 months, hammered by the lethal combination of soaring wholesale costs, the constraints of the energy price cap and insufficient hedging strategies in the face of market volatility.

When the market eventually recovers, Pocklington argued profit was key to maintaining stability in the energy sector and would boost development and help the country transition to net zero.

He said: “It is profit that enables that investment in the future. One of the reasons that bills have gone up is that the price cap and the way some of these companies were managed made it made it much harder to run an efficient energy business. Therefore 30-odd energy companies went bust, and we all – to a household – picked up the tab for those. Profit saves us from those costs.”

Good Energy is a challenger company that offers renewable energy from 1,700 independent suppliers.

It has operated in the industry for over two decades, providing ethically resourced solar and wind power to its 250,000 customers.

Backlash to rising energy bills escalates

The privatisation of the energy sector was first initiated with British Gas’ sale in 1986 under former Prime Minister Margaret Thatcher, and the subsequent offloading of 12 regional companies in 1990.

Since then, there have been both multiple reforms to further liberalise the market across Labour and Conservative governments, alongside pushes to re-nationalise the industry from activists and campaigners.

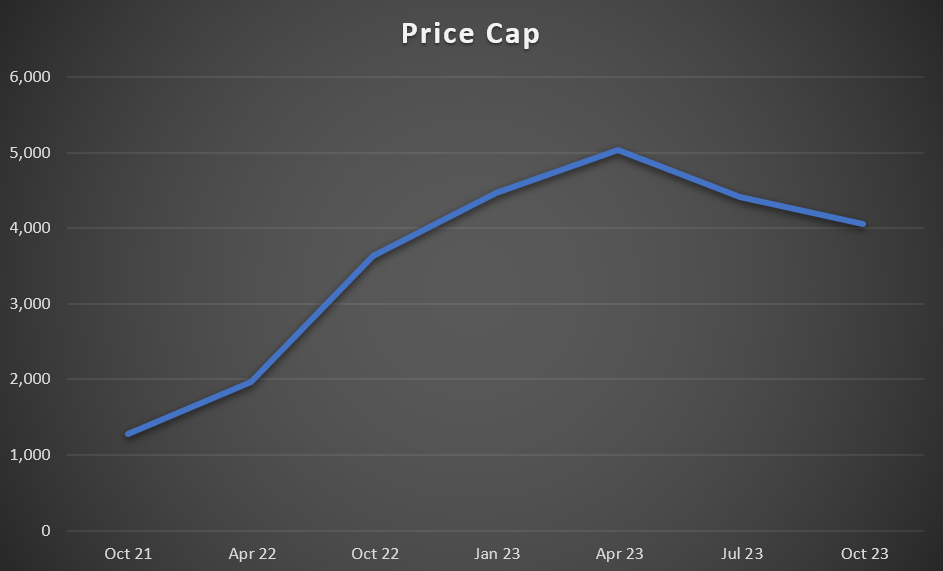

The most recent calls for public ownership follow alarming predictions for the energy price cap this winter from multiple forecasters, including Investec, Cornwall Insight, BFY Group and Auxilione.

Among the most concerning updates – Cornwall Insight has outlined that it expects energy prices to remain ultra-high into 2024, while Auxilione has predicted the cap could skyrocket to £5,008 next April.

For context, the price cap is currently set at £1,971 per year, which is already an all-time high, and it is expected to climb to at least £3,500 per year in October.

If bills reach over £4,000 per year in January – as widely expected – this will mean energy prices will constitute 45 per cent of the state pension.

This has led to former Labour Prime Minister Gordon Brown suggesting that nationalisation should be put on the table to curb household energy bills.

He wants the upcoming price cap hike – which will be announced on August 26 – to be cancelled, and for energy firms to be offered loans and grants to cover the wholesale costs.

If the firms cannot afford this, he has called for them to be taken temporarily into public ownership.

Meanwhile, nationalisation campaigners We Own It have urged for Bulb Energy to be taken permanently into public hands.

It has been on life support since last November, when it fell into de-facto nationalisation, propped up regular transfusions of public money – now estimated at over £3bn.

This reflects a growing consumer backlash to the expected price hikes, with grassroots campaign Don’t Pay UK attracting over 100,000 signatures online.

It is encouraging bill payers to refuse to cancel their direct debits on October 1, if energy prices are not eased to help consumers amid a cost of living crisis – which has also seen the price of food and rent spike.

There have also been protests from demonstrators at Scottish Power’s headquarters in Glasgow over the costs of energy bills.

The Government held a meeting with dozens of energy firms in Downing Street earlier this week, pressuring them to come up with solutions to lower soaring costs for households.

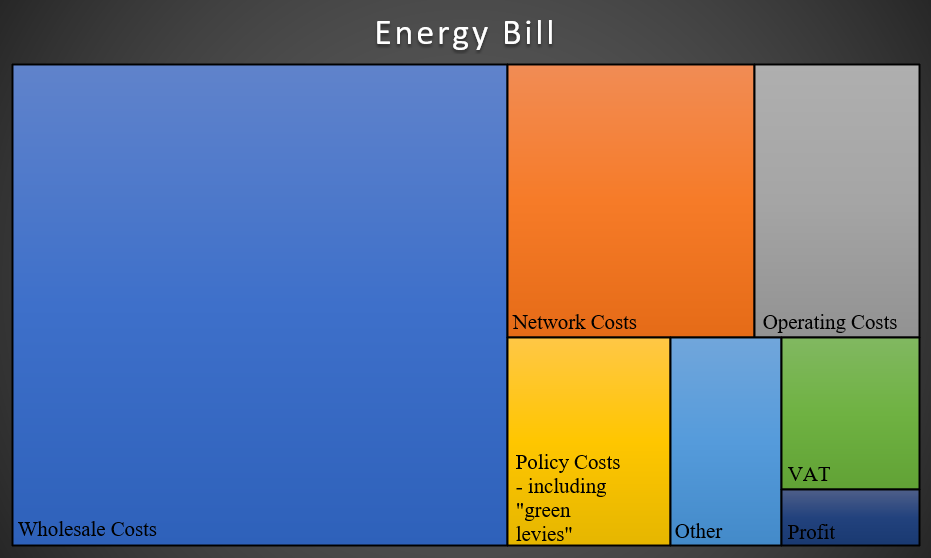

Since then, energy suppliers including British Gas, EON UK and Octopus Energy have called on the Government to move policy charges such as VAT from customer bills onto general taxation – as first reported in The Financial Times.

Tory leadership contender Liz Truss has advocated for expected rises to national insurance to ditched, alongside a moratorium on green levies.

Meanwhile rival Rishi Sunak has pledged to bring in another support package, having unveiled two earlier this year to combat rising energy bills.