Digital is eating the world, but…

Despite digital eating the world, the physical world still has a huge influence on the metaverse which remains a highly risk-on space.

Correlations between stocks and cryptocurrencies is substantial since a shrinking pool of capital tends to hit risk-on assets the hardest. So just because the major stock market averages have corrected at the time of this writing -31.5% on the NASDAQ Composite, -19.9% on the S&P 500 (peak-to-trough), -61.3% on BTC, and -63% on ETH does not mean the correction is nearly over.

If Bitcoin were to have any of its past bear market corrections of -94%, -87%, or -84%, it would be priced at $4,140, $8,970, or $11,040 based on a high of $69,000.

But let’s say that because Bitcoin did not have its typical bubble blow-off climax top exhibited in prior bull markets, it corrects -75%. This would suggest a price of $17,250 which is another -42% from current levels. Some often underestimate the loss because they simply subtract when using percentages, yet a crypto can halve to where it is only 50% of its original value then then lose another -50% putting it at a -75% loss from peak.

The big bad bears of 2014, 2018, and 2022

2022 reminds me of 2014 and 2018 when virtually all talking heads with massive followings (though much smaller in 2014) kept telling their audience to BUYBUYBUY. As Bitcoin continued lower, the need to believe the bottom is in continued to grow.

Eventually, dire news caused capitulation events such as January 2015 when Bitcoin hit $150, or December 2018 when Bitcoin hit $3,123. These huge selling spikes were pronounced. Indeed, 99bitcoins.com shows the death of Bitcoin has been predicted hundreds of times over the last decade.

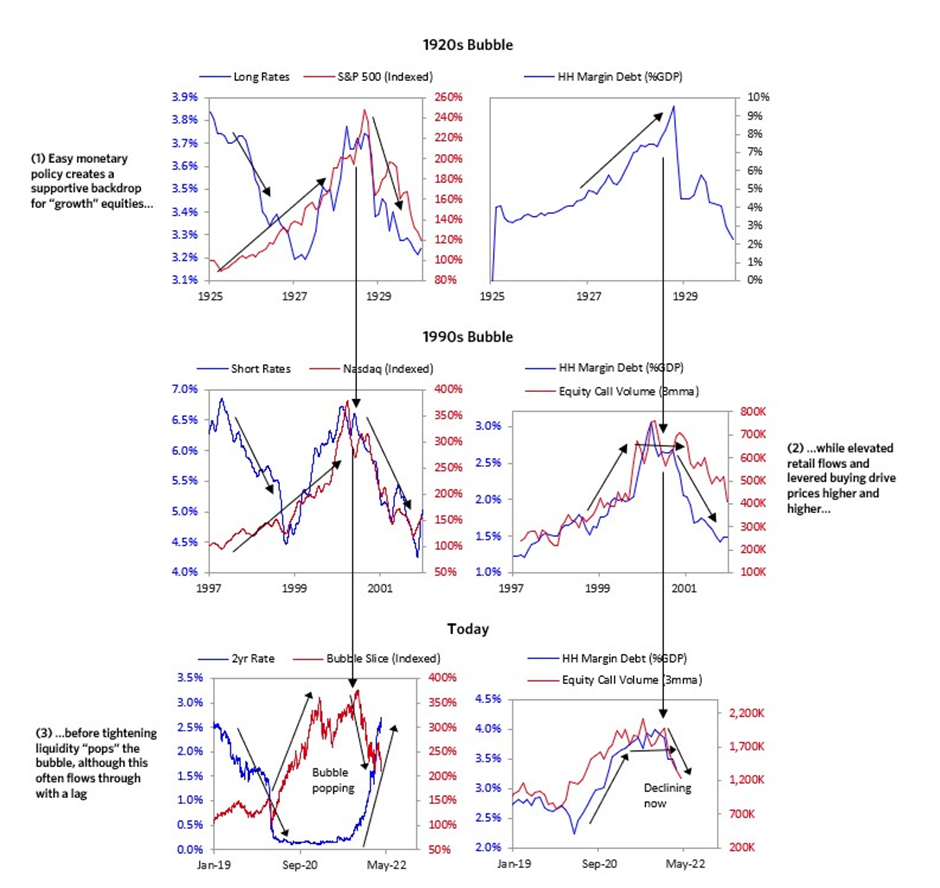

Bubbles as shown in the graphs below often overcorrect versus just settling back to normal levels as the emotion of fear can create oversold conditions lasting many months. In the stock market’s post-crash environment of 1929 and 2000, the bubbles were started by easy money which spurred buying which spurred increasing leverage before tightenings popped the bubble.

Today, we have soaring global inflation, some of the lowest overall rates of interest in thousands of years, and record levels of debt making the 1930s, 1970s, and 2000s seem somewhat tame. It could then be argued that what we saw post 1929 when the Dow Jones Industrial Averages lost -90% off peak or post 2000 when the NASDAQ Composite lost -78% could be repeated… or worse.

But Fed chair Powell will unlikely let things get this bad. He is a politician with political friends all who own an appreciable amount of hard assets, real estate, Bitcoin, and stocks. Thus, he is likely to find some excuse to start printing money again by the time the S&P 500 has lost at least 1/3 of its value. This suggests Bitcoin could correct -75% to -80% down to a price of $17250 to $13800. From current price levels, this is a drop of -42% to -54%!

1925-45 versus 2005-2022

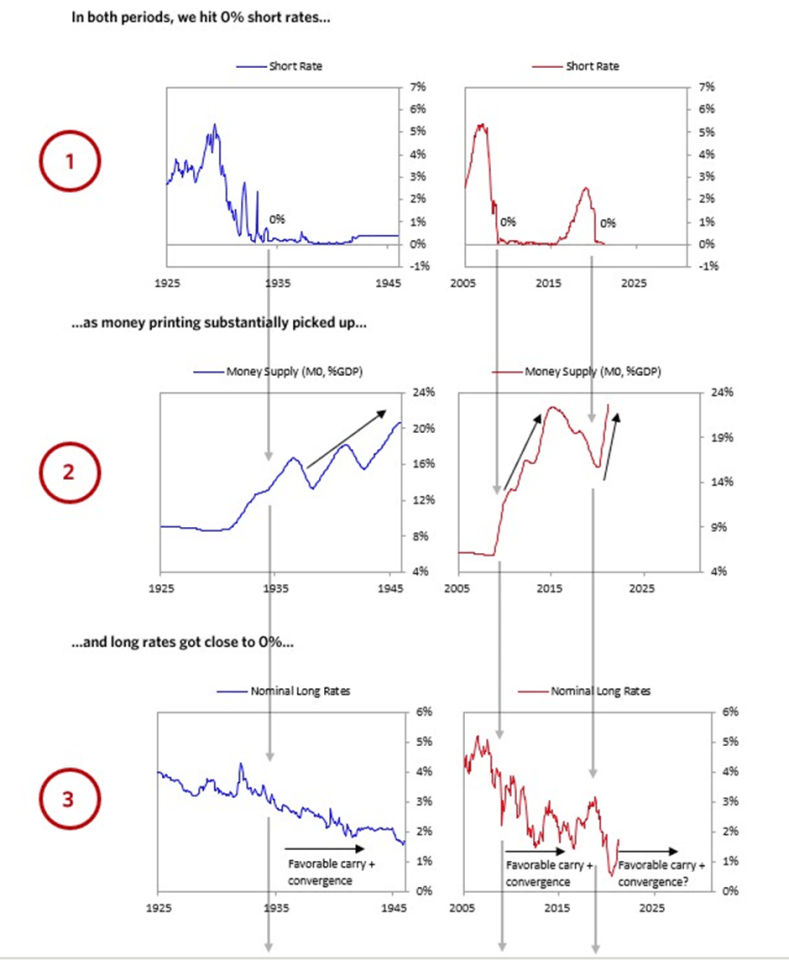

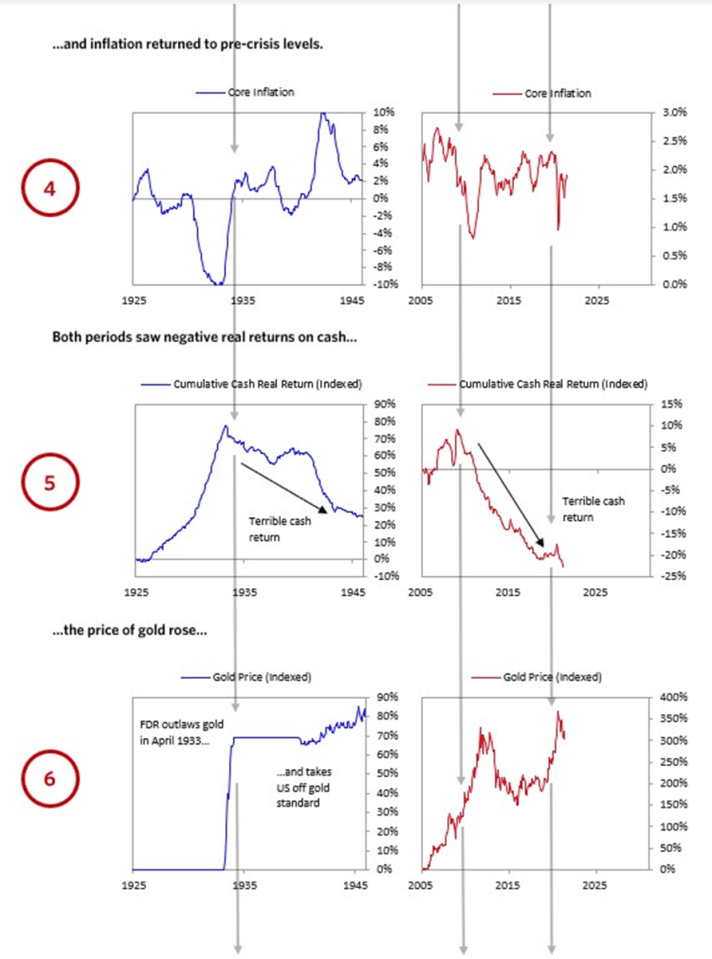

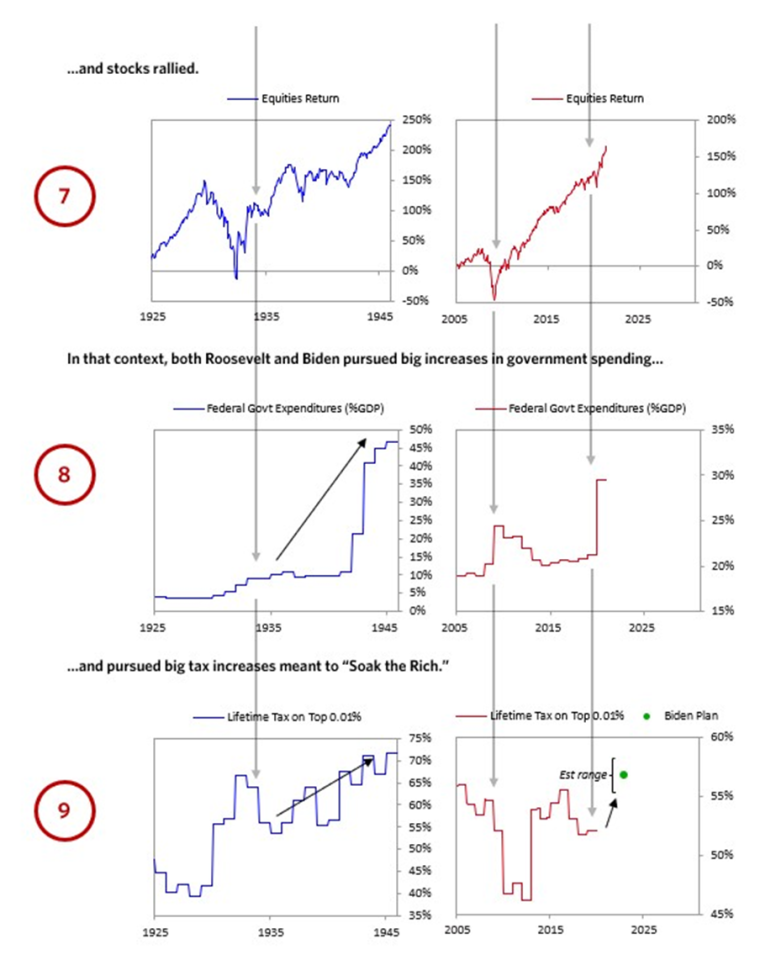

If we compare 1925-45 with 2005-2022, both periods produced a lot of debt growth, big wealth gaps, and bubbles that popped when there were tightenings. This is why we have been saying over the last decade that the Fed and other central banks have painted themselves into a corner.

Any Fed tightening led to rises in short rates that led to severe debt and economic downturns that led to big easings that drove short-term interest rates down to 0% and negative rates in other countries. The debt was and is being financed by both raising taxes on the wealthy (see chart set 9) and monetising the debts that were being created (see chart set 2). The low interest rates spurred by QE drove up the prices of most everything, most notably gold (see chart set 6) and stocks (see chart set 7).

Nevertheless, the charts below are some months old. Inflation globally has spiked to levels not seen in years forcing the Fed to tighten. Whenever they try to tighten their balance sheet by any material amount, the US stock market major averages have quickly sold off to typically around -20% before the Fed is forced to step in and calm the markets by saying they will once again loosen monetary policy a la QE 1, 2, #, Operation Twist, etc.

(Image courtesy of Ray Dalio)

If cash is king, shorting is a deity

In any event, staying on the sidelines made the difference between surviving the bear market compared to crippling or bankrupting one’s trading account in 2014 and 2018. Such could happen again in 2022. More importantly, my metrics have called every major top and bottom in Bitcoin within a few weeks since 2013 in real-time trading.

I published reports on sell signals in Bitcoin starting in Dec-2021 then repeated in Jan-2022 as Powell made it clear he had become hawkish first by removing the word ‘transitory’ as I discussed in Nov-2021 across webinars and reports then some weeks later, that numerous rate hikes were on the way. I wrote that the length of any correction will depend on Powell starting to find any excuse to start printing money again. Typically, -20% corrections in major stock market averages have been the “uncle” point for Powell, but today’s situation is far worse, thus the S&P 500 could correct well beyond -20% before Powell postpones or reverses rate hikes.

I have never shorted crypto until 2022 because the crypto exchange platforms were illiquid and suspect in 2014 and 2018. Today, the cryptospace has plenty of reliable exchanges from which to buy futures contracts which gain when crypto falls. Plus, one’s principle accrues interest when the funding rates are positive which is much of the time. In that case, longs pay shorts.

In consequence, it is nice to be up over +50% so far in 2022 with profits accrued purely from shorting. Shorting is a tough animal in terms of timing things right, so I don’t provide such suggestions in the Crypto Picks list on www.selfishinvesting.com. Also, the math is working against you. The best one can do is double their money if the crypto goes to zero, highly unlikely. And pyramiding on the way down is not suggested because the dead cat bounces can be sharp and short-lived.

Going long, on the other hand, can bring gains of hundreds of per cent or more in just weeks as we have seen many times in 2017, 2020, and 2021. In consequence, the Crypto Picks list remains empty as I suggested that members take profits in most all names in January 2022 then the rest in early February 2022.

Patience is key here. Staying on the sidelines teaches patience. Because crypto exchange shorting platforms carried big risk in 2018, I was mostly on the sidelines from February 2018 to February 2019 except for a small core position in Bitcoin and even smaller positions in two other coins.

I did similar in 2014, and for stocks, I sat out the post-dot.com bubble from Mar-2000 to Mar-2003 except for two tiny trades which made my 2002 slightly profitable as my KPMG audit shows.

I had to learn the hard way during some turbulent crypto bull markets that patience prevents overtrading and temperance prevents overleveraging in futures contracts. Just because I had mastered greed in stocks did not mean I mastered greed when it came to crypto futures.

The astounding gains made in a short time evaporated because I had never encountered such wild gains in my trading account. 10-fold or greater gains made in just a few weeks in certain long leveraged futures contracts were quickly reversed.

Contrast this with 1995-2000 when I achieved triple digit percentage returns 6 years in a row, tiny by comparison, thus greed was not an issue. Indeed, as I have always said, I am a perma-student of the markets as the markets will never stop throwing new and unexpected challenges that force each of us to examine our weaknesses.

(͡:B ͜ʖ ͡:B)

Dr.Chris Kacher, PhD nuclear physics UC Berkeley/record breaking KPMG audited accts in stocks & crypto/bestselling author/top 40 charted musician/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr. Kacher bought his first bitcoin at just over $10 in January-2013 and contributed to early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011 to within a few weeks. He was up in 2018 vs the avg performing crypto hedge fund (-54%) [PwC] and is up well ahead of bitcoin & alt coins over the cycles as capital is force fed into the top performing alt coins while weaker ones are sold.

Website 1 of 4: Virtue of Selfish Investing Crypto Reports

LinkedIn: https://www.linkedin.com/in/chriskacher/

Company 1 of 3: TriQuantum Technologies: Hanse Digital Access

Twitter1: https://twitter.com/VSInvesting/

Twitter2: https://twitter.com/HanseCoin

Encyclopedia1: https://de.wikipedia.org/wiki/Chris_Kacher

Encyclopedia2: https://everipedia.org/wiki/lang_en/Chris_Kacher

Author: https://www.amazon.com/author/chriskacher

Composer: https://music.apple.com/us/album/teardrop-rain/334012790

Youtube: https://www.youtube.com/user/teardropofficial

Interviews & Articles: https://www.virtueofselfishinvesting.com/news