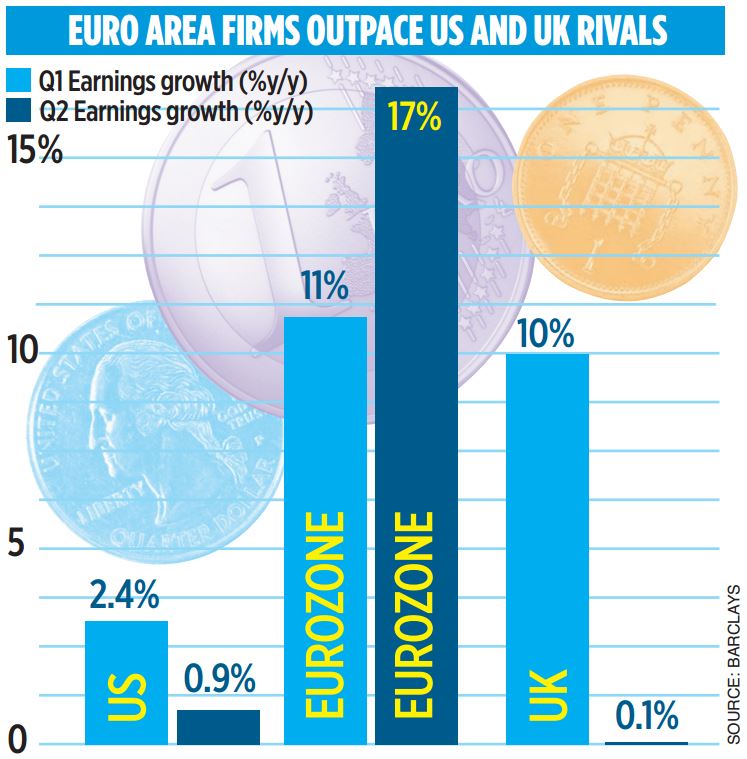

Currency chaos splits global profit outlook as Eurozone businesses outpace UK and US rivals

Currency turmoil is wreaking havoc with British and American company earnings, leaving businesses trailing the growth of rivals in the Eurozone.

Profit growth in the Eurozone is on track to race past American levels for the first time since 2007 and leave the UK for dust after reporting forecast-busting earnings in the latest reporting season.

China’s shock move to devalue its currency – the biggest cut to the yuan since 1993 – has also sharpened the headache of companies listed in New York and London, as they battle a strengthening dollar and pound.

“Eurozone earnings growth will not just be a 2015 phenomenon but a much longer term trend,” NN Investment Partners’ Patrick Moonen said. “It will be the first year since 2007 that Eurozone earnings will outgrow those of the US.”

Euro area firms grew earnings by 17 per cent in the second quarter, according to Barclays, compared to 0.9 per cent for S&P 500 firms and 0.1 per cent for UK firms listed in the Stoxx 600.

Estimates from the bank suggest Eurozone companies could see earnings rise by up to 26 per cent this year while it projects growth of just five per cent for America’s S&P 500.

A weaker euro – the currency has declined 16 per cent against the pound since the start of the year – and lower operating margins are also set to give Eurozone firms a stronger footing to accelerate growth.

“In Europe they’re getting a lot more impact from the falling currency which has been in place for the last year,” said Joseph Lupton, a senior economist at JP Morgan. “Importantly, the intensity of the turmoil within Greece has subsided a bit.”

While the magnitude of the euro area’s profit improvement may come as a surprise, profits are still far below the peak reached in 2011. The US may also get back on track during the second half of the year after its economic growth stalled since 1 January.

The People’s Bank of China pushed the yuan to its weakest level against the dollar for three years yesterday, while sterling hit a 10-month high against the currency.