Brits expecting strong year for house prices

HOMEOWNERS and prospective buyers are expecting elevated house price growth over the next 12 months.

It comes after a dip in expectations in February, which looked to be the beginning of a welcome slowdown in the market after a year of rapid growth and declining affordability.

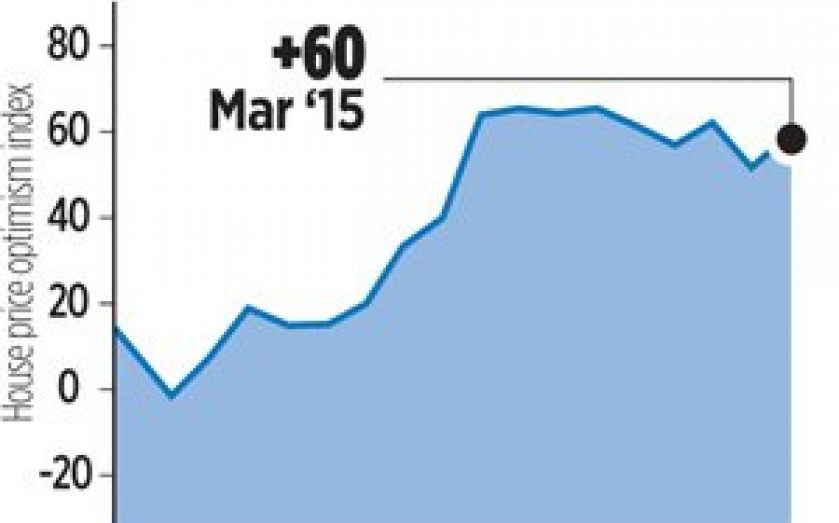

The Halifax house price optimism index released today rose to a score of 60 in March from 52 in February. The index regularly reached scores in the mid-60s last summer when year-on-year house price growth hit double-digits. Price growth expectations have been sky-high since the end of 2012 when the index scored just 20.

This echoes price surveys from Halifax and Nationwide, which show the house price boom losing some steam at the end of 2014, but prices remain at elevated levels. Part of the problem lies in the fact that not enough houses are being built.

“For sustainable long-term growth we need a period of stable growth and a more comprehensive housebuilding programme,” said Craig McKinlay, mortgages director at Halifax.

However, demand is also rising, helped by cheaper mortgages. Figures published by the British Bankers Association (BBA) yesterday showed mortgage approvals climbing to a five-month high of 37,305 in February. “We’re seeing stronger demand for mortgages as consumers take advantage of some of the very competitive deals currently available,” said Richard Woolhouse, chief economist at the BBA.