BP rebounds as US court limits claims payouts

FTSE 100-listed oil major BP’s shares got a boost yesterday, after a US court tightened the standards in assessing claims relating to the Gulf of Mexico oil spill.

The appeals court in New Orleans ruled that a narrower injunction should be issued, to allow recoveries by claimants with “actual injury” from the spill, and not punish BP and its shareholders by allowing potentially “hundreds of millions of dollars of unrecoverable awards”.

BP had appealed the claim payouts on the grounds that terms of the compensation framework were being misinterpreted, resulting in what it claimed were fictitious submissions.

The claims emanating from the 2010 Deepwater Horizon disaster were initially forecast to cost around $7.8bn (£4.8bn), but estimates rose to $9.6bn in July. Around $3.69bn has been paid out so far.

“Today’s ruling affirms what BP has been saying since the beginning: claimants should not be paid for fictitious or wholly non-existent losses,” said the oil company in a statement.

“This is good news for BP,” Brenda Kelly, senior market strategist at IG, told City A.M. “The shares are still way below the price before the Gulf of Mexico oil spill but have bounced off with quite significant support. I expect we might see some more buyers too.”

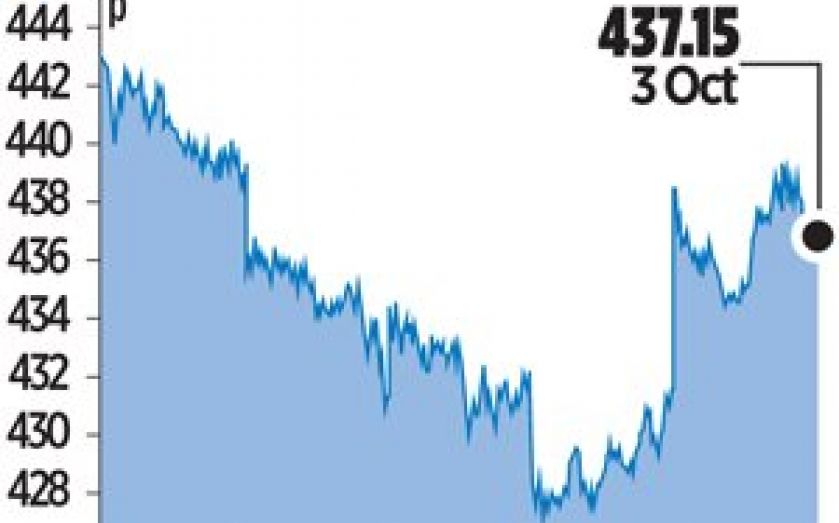

The oil spill legacy is not quite over for BP, however, as the second part of the civil trial began earlier this week, which will determine whether BP was grossly negligent. The outcome could cost BP up to $18bn, although the company says it expects the total will be closer to $3.5bn. Shares closed up 1.12 per cent at 437.15p.