Bottom Line: This end is really the beginning

THE DEATH of Bitcoin’s most popular exchange couldn’t have come sooner. The “transaction malleability” bug that hit Mt Gox is a known problem with the crypto-currency, and exchanges failing to take the proper steps will find themselves vulnerable. By the time a fix came, “the damage had already been done”, a document leaked yesterday said.

For some, the news is devastating. But there’s a silver lining. Mt Gox was seen by many as a bad apple among Bitcoin exchanges – now failing to properly implement good protocols has seen it fail. While some will seek to jump on the failure as a sign that the cryptocurrency project as a whole is doomed, we can take a different lesson. In the case of Bitcoin, a vast financial institution has been able to fail, and to do so relatively safely.

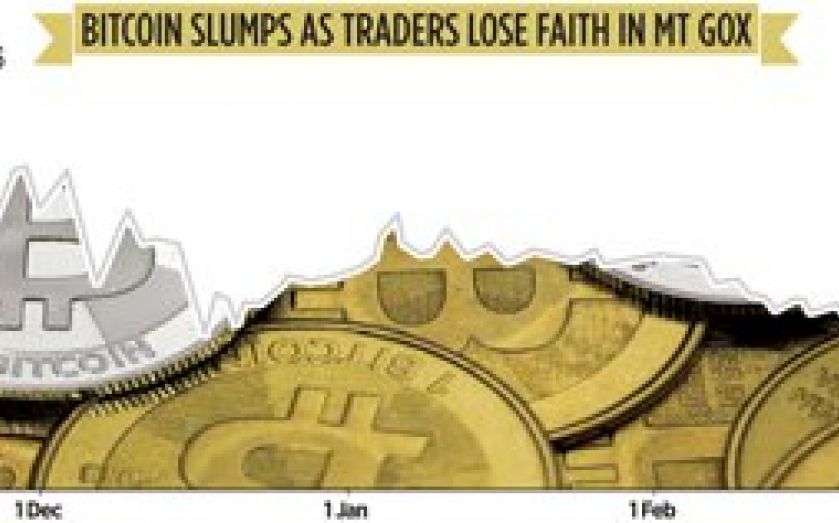

Yes, prices have taken a hit, but confidence in Bitcoin has not evaporated. Prices are up by over 9,200 per cent in the last two years alone, and are some 260 per cent up on just six months ago.

If anything, Bitcoin has shown remarkable resilience to the news. The cryptocurrency is still trading at more than $470, and it’s an alternative currency that still offers some distinct advantages over state-controlled fiat money. As long as there is demand for untraceable, untaxable currency, with faster transfers and lower transaction costs, there will be a demand for alternative currencies like Bitcoin.