Barclays shares slump to bottom of FTSE 100 as investors take fright at profit drop

Barclays shares tanked nearly eight per cent today, sending them to the bottom London’s FTSE 100 index, driven by investors fretting over the bank announcing today weaker than expected profits.

The firm’s profit in the three months to December last year fell eight per cent to £1.3bn despite a £800m revenue bump, taking the lender’s total 2022 profits to £7bn, a 14 per cent reduction.

What really attracted investors’ concern was the slim net interest margin – the difference between what a bank earns on loans and pays depositors – in the bank’s UK division.

Barclays UK’s net interest margin for the final three months of 2022 was 3.1 per cent, up from 2.49 per cent last year, but lower than market expectations.

On top of that, Barclays UK said the margin will not widen much this year.

UBS described the margin figures as “particularly disappointing” given the Bank of England’s 10 successive rate hikes, the most aggressive since the 1980s.

“Why is fourth quarter net interest margin momentum so low given double the BoE rate increase in that quarter versus the third quarter of 2022?,” the investment bank highlighted.

Analysts at Jefferies agreed, saying the underperformance “needs to be explained”.

The disappointing figures had a ricocheted through the market.

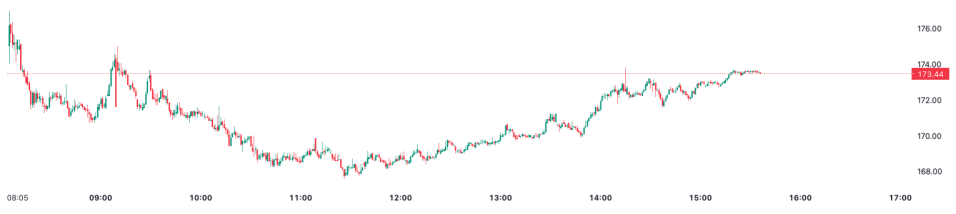

Barclays’s share price tumbled to the depths of the FTSE 100

Fellow FTSE 100-listed high street lenders NatWest and Lloyds 1.21 per cent and more than two per cent respectively.

Barclays’s results “suggests weakness in the housing market is starting to show up in a bigger way for the banks,” Sophie Lund-Yates, lead equity at Hargreaves Lansdown, said.

“Traditional products, like mortgages are a small part of Barclays’s business compared to more domestic-focussed NatWest and Lloyds. That means that net interest margin weakness would have a bigger impact on these businesses,” she added.

Analysts also raised concerns about Barclays’s £500m buyback programme given that its capital buffer – a measure of the strength of a bank’s balance sheet – hit 13.9 per cent. Analysts had expected Barclays to announce a £650m buyback.

Analysts from Jefferies said: “The £500m share buyback is not good enough in our view as [its] worth only 15 basis points of capital against CET1 ratio of 13.9 per cent.”

However, NatWest and Lloyds may escape a sell-off as they are less exposed to the slump in investment banking in 2022. Profits in that division at Barclays more than halved.

Its fixed income division – a traditional strength – failed to meet analyst estimates, leading to a two per cent fall in revenue.